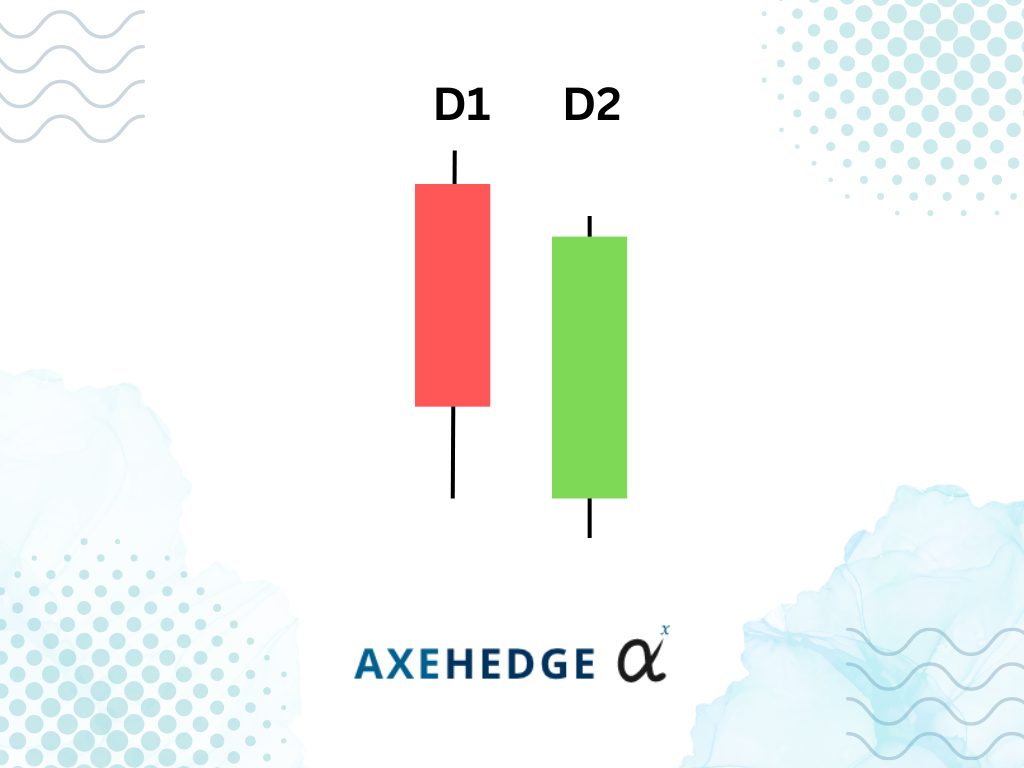

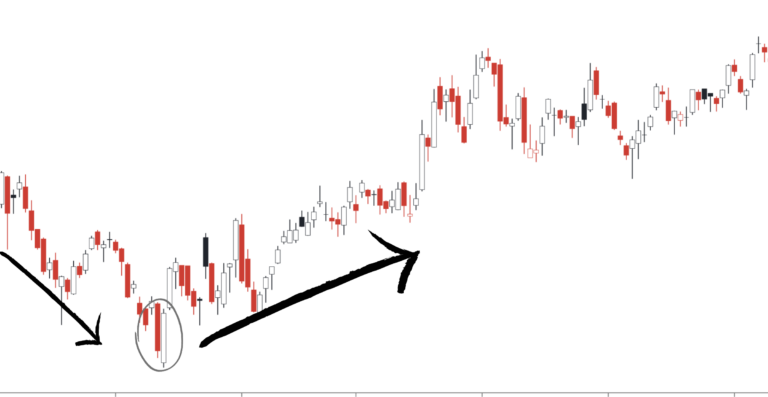

The piercing candlestick is pretty much just like the Bullish Engulfing Candlestick, whereby for you to trade, you’ll need to see the pattern forms within two trading days. It is also nearly similar to the Bullish engulfing candlestick in the sense that the massive size of the candlestick on the second trading day (D2) sort of ‘swallowed’ the candlestick on the first day (D1) — but for piercing, it doesn’t swallow it whole.

Just in case you haven’t yet mastered the different types of price charts available, check out our article below!