The second triangle: the Descending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings group

We have talked about the many different types of equity funds, and now we are at the part where it’s grouped according to value or growth. Before we go anywhere, let’s zoom out a bit and look at the whole context of this topic:

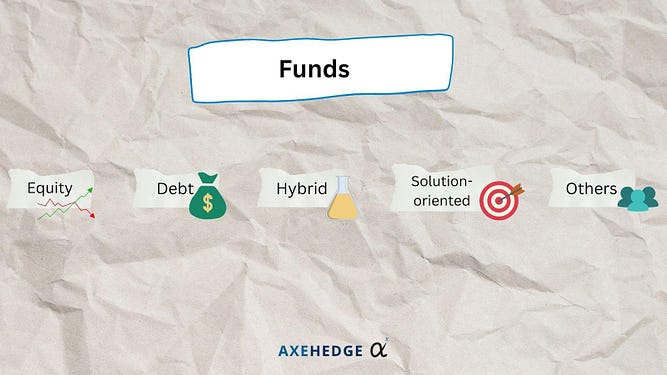

There are many major types of funds, which are divided as follows:

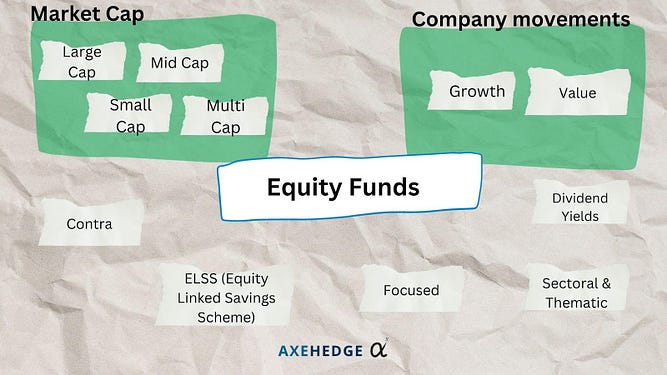

Under the branch of Equity funds itself, there are many ‘sub-types’ of funds which are:

We did explain generally what each of the above sub-branches of equity funds stands for, you can read it here.

Company's movement

This method of grouping looks at the company’s movements — or should I say how the companies’ earnings grow. So, if we’re talking about a company’s movements, there are usually two main categories — value and growth. It can be small-cap, micro-cap, or whatever, but as long as the earnings are of “value” in nature, the fund would consider it.

“Growth” and “value” are two distinct investment styles that investors use to categorize and analyze stocks based on their characteristics, potential for future performance, and underlying financial metrics.

So, if you’re talking about investing in growth or value equity funds, it means that you’re looking at the earnings patterns of these companies instead of other factors like the market cap.

What’s the difference between “growth” and “value”?

Growth Stocks:

Earnings Growth: Growth stocks are associated with companies that are expected to experience above-average growth in earnings and revenue. These companies often reinvest their earnings back into the business for further expansion.

High Valuations: Growth stocks tend to have higher price-to-earnings (P/E) ratios compared to the broader market. Investors are willing to pay a premium for the expectation of future earnings growth.

Limited or No Dividends: Many growth companies, especially in technology and other innovative sectors, may not pay dividends. Instead, they focus on reinvesting profits to fuel expansion.

Volatility: Growth stocks can be more volatile than the broader market. The potential for high returns comes with an increased level of risk.

Innovative Sectors: Growth stocks are often found in sectors with high innovation, such as technology, biotech, and other emerging industries.

Value Stocks:

Undervalued: Value stocks are often considered undervalued by the market. Their stock prices may be lower relative to fundamental indicators such as earnings, book value, or dividends.

Stable Dividends: Value companies may be more likely to pay dividends, providing a steady income stream for investors. These companies may have a history of distributing profits to shareholders.

Lower P/E Ratios: Value stocks typically have lower price-to-earnings (P/E) ratios compared to the broader market. Investors are looking for bargains and are less concerned about high growth expectations.

Established Companies: Value stocks are often associated with more mature and established companies in traditional industries like utilities, financials, or consumer goods.

Lower Volatility: While not immune to market fluctuations, value stocks may exhibit lower volatility compared to growth stocks.

Which fund is better for me?

Between growth and value, which one is your pick? That depends on your strategy, but here are the general pros and cons of both:

Growth:

Pros:

High Potential Returns: Growth equity funds invest in companies expected to experience above-average earnings and revenue growth. If these companies perform well, investors may benefit from high returns.

Innovation and Future Potential: Growth funds often focus on innovative sectors and companies at the forefront of technological advancements. This can provide exposure to industries with significant growth potential.

Diversification: Growth funds typically invest across various sectors, offering a level of diversification within the portfolio. This can help spread risk across different industries.

Cons:

Volatility: Growth stocks can be more volatile than value stocks. The potential for high returns comes with a higher level of risk and price fluctuations.

High Valuations: Many growth stocks trade at relatively high price-to-earnings ratios, reflecting the market’s anticipation of future growth. This means investors might pay a premium for these stocks.

Limited Dividend Income: Growth companies often reinvest their earnings for further expansion, and as a result, they may not pay regular dividends. This can be a drawback for investors seeking income.

Value:

Pros:

Undervalued Opportunities: Value equity funds focus on stocks that are perceived to be undervalued by the market. If the market recognizes and corrects this undervaluation, investors may benefit from capital appreciation.

Stable Dividend Income: Many value stocks pay regular dividends, providing investors with a steady income stream. This can be attractive for income-focused investors.

Lower Volatility: Value stocks tend to be more stable than growth stocks. While they are not immune to market fluctuations, they may offer a more conservative investment approach.

Cons:

Potential for Slower Growth: Value stocks are often associated with more mature and established companies. While they may offer stability, they may not have the same growth potential as some high-flying growth stocks.

Cyclical Sensitivity: Value stocks can be sensitive to economic cycles. During economic downturns, these stocks may underperform compared to growth stocks.

Market Recognition Time: It may take time for the market to recognize the true value of a company. Investors in value funds may need patience as the investment thesis unfolds.

Which one should I choose?

Growth Funds:

Suitable for: Investors seeking higher returns and willing to accept higher risk.

Why: Growth funds focus on companies expected to experience above-average earnings and revenue growth. They are suitable for those looking for the potential of significant capital appreciation, even if it comes with higher volatility.

Value Funds:

Suitable for: Investors prioritizing stability, regular income, and a more conservative approach.

Why: Value funds invest in undervalued stocks, often from more established companies. They are suitable for those who prefer stable dividends, lower price-to-earnings ratios, and a focus on companies with a perceived intrinsic value.

Bottom line

- Investors categorize stocks into two main groups based on company movements: value and growth.

- The distinction lies in analyzing earnings patterns.

- Growth Pros: High potential returns, innovation exposure, diversification.

- Growth Cons: Volatility, high valuations, limited dividend income.

- Value Pros: Undervalued opportunities, stable dividend income, lower volatility.

- Value Cons: Potential for slower growth, cyclical sensitivity, and market recognition time.

- Growth Suitable for: Investors seeking higher returns and willing to accept higher risk.

- Why Growth: Focused on companies with above-average earnings and revenue growth, appealing to those seeking significant capital appreciation despite increased volatility.

- Value Suitable for: Investors prioritizing stability, regular income, and a more conservative approach.

- Why Value: Invests in undervalued stocks from established companies, suitable for those valuing stable dividends and lower volatility.

The choice between growth and value funds depends on individual preferences and risk tolerance. Growth funds are for those seeking higher returns with higher risk tolerance, while value funds are for investors prioritizing stability and regular income with a more conservative approach.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More