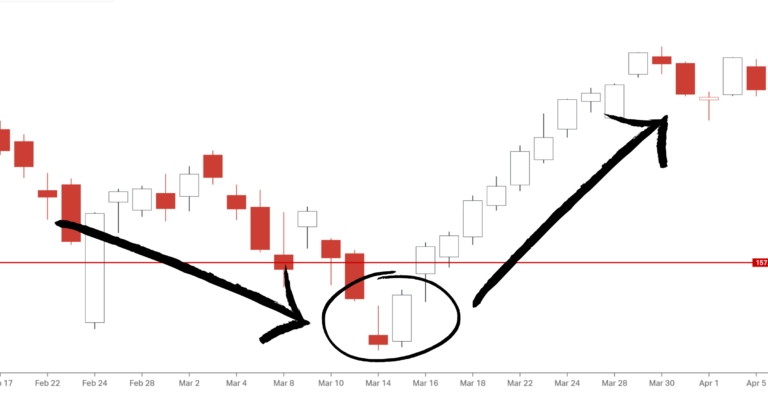

The shooting star is another red flag for traders. As with a shooting star, the price will usually go down when this pattern appears. Thus, this pattern is what we can call a bearish pattern. The Shooting Star pattern is a technical chart pattern that occurs when the price of an asset (like a stock, currency, or commodity) opens high, then trades much lower throughout the day, but closes near its opening price.

Traders and investors may use the Shooting Star pattern as a signal to sell or take profits on their long positions or to potentially enter short positions. However, it’s important to note that the Shooting Star pattern should not be relied upon solely, and other technical and fundamental analyses should be considered before making any trading decisions.