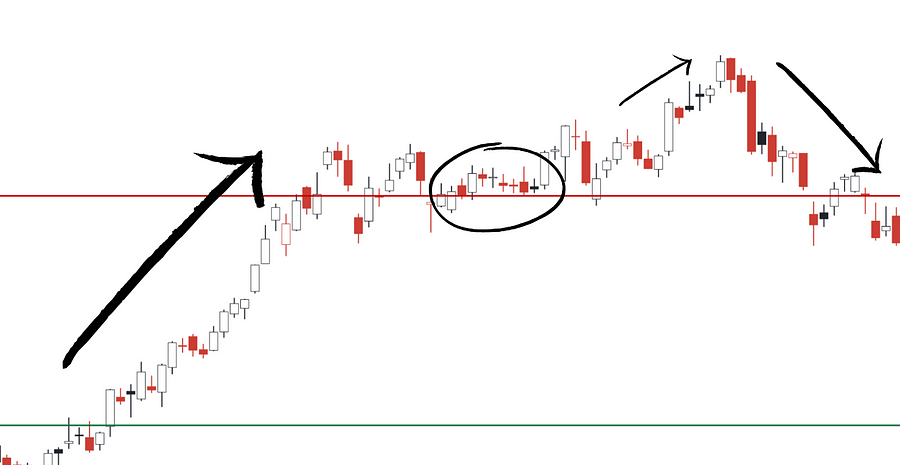

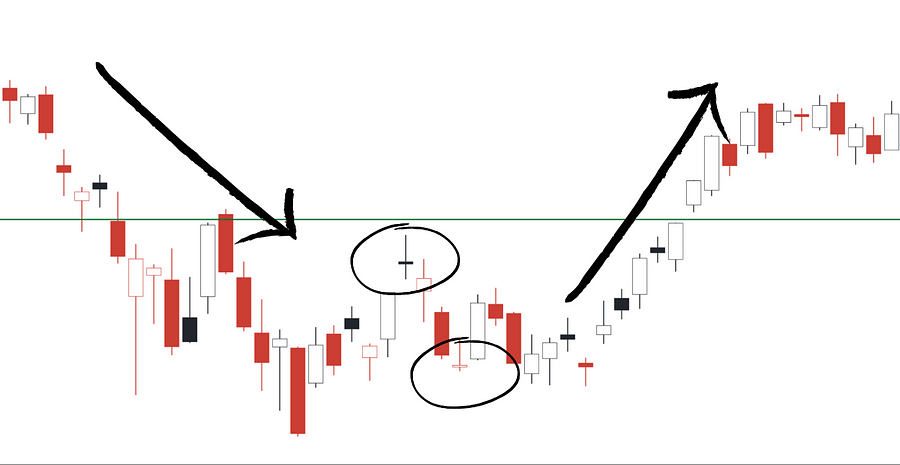

“Doji” is Japanese for “the same thing”. The reason that the pattern we are about to discuss is called Doji is that the price on the candlestick chart when it opens is pretty much the same as when it closes.

Now, if you have no idea about the different charts available when trading and what each of them indicates, this article will clear things out: