The second triangle: the Descending Triangle

Read MoreTrading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

One of the most common patterns under the Dow Theory is the Triangle Pattern. The whole reason why this theory is considered under the Dow Theory is because it follows the rules under the Dow theory which are as follows:

Types of Triangle Patterns

There are three types of triangle patterns: Ascending, Descending, and Symmetrical. In this writeup, we will just look into the Ascending Triangle. However, here are all three of them just so that you are familiar with how they look like.

Ascending

Descending:

Symmetrical:

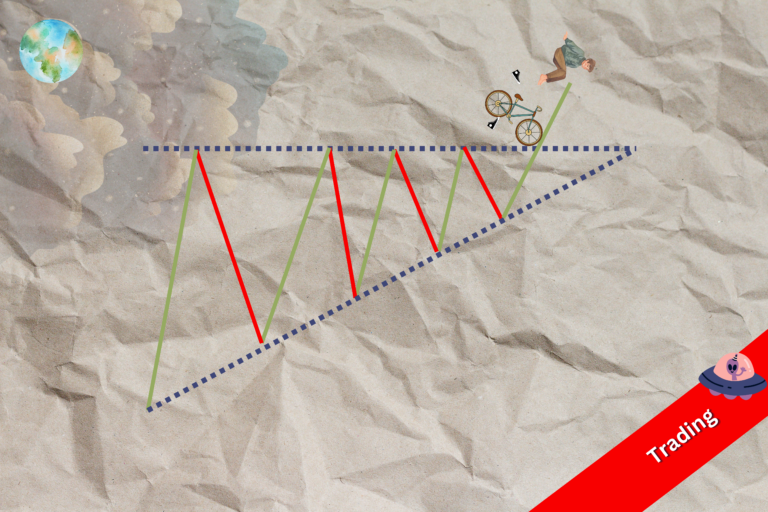

Ascending Triangle Pattern

Well, an ascending triangle is a formation where the triangle points upwards, and it is a sign that perhaps the price may go up soon, once it breaks through the “breakout point” or as we like to call it: break point/breaking point.

To identify this pattern, the upper trend line (resistance) is usually horizontal while the lower trend line (support) is moving upwards.

With an ascending triangle, the price would have to break through the upper trend line for you to know that the game is on.

The ascending triangle pattern is generally considered a continuation pattern rather than a reversal pattern. Continuation patterns suggest that the existing trend is likely to continue after a period of consolidation. In the case of an ascending triangle:

Existing Uptrend: The ascending triangle typically forms during an uptrend, with higher lows indicating ongoing buying interest.

Consolidation Phase: The pattern represents a period of consolidation where the price encounters resistance at a horizontal level while forming higher lows. This suggests a temporary balance between buyers and sellers.

Breakout Confirmation: The pattern is confirmed when the price breaks out above the horizontal resistance line. This breakout is seen as a signal that the buying pressure has overcome the selling pressure, and the uptrend is likely to resume.

P/S: In the example we’re going to show below, it isn’t really in a downtrend, but it just serves to show you the shape and general idea of it.

Key characteristics:

Horizontal Resistance Line: There is a straight, horizontal line connecting multiple highs, where the price struggles to move beyond. This represents a level where selling pressure is encountered.

Ascending Trendline: The pattern also features an upward-sloping trendline connecting higher lows. This trendline represents a level of increasing buying interest and higher lows being established.

Consolidation: The price action between the horizontal resistance line and the ascending trendline creates a triangular shape, forming the ascending triangle. This consolidation phase typically signals a temporary balance between buyers and sellers.

How many ‘mountains’: If you consider a pair of peak and through as a ‘mountain’, then you should wait for at least 2 to 3 mountains to appear as part of the patterns before proceeding to your next step.

Formation period: There is no specific minimum or maximum. Generally, the whole pattern would usually form in between a lower limit of 7–10 weeks and could go at an upper limit of a few months.

What happens during an ascending triangle formation?

The ascending triangle indicates a stronger buy sentiment which pushed the support line upwards. However, the decisive moment would be along the end of the triangle where the size of the ‘mountains’ shrink.

This is almost like that moment when a game of Simon says are getting more intense — everyone’s extra careful in anticipation of what the market will look like.

The breaking point is where the price moves beyond the pattern line, which shows that the price has now defied the pattern, and the trend may be looking at a change — for good or for bad.

Do note, that sometimes it can go the other way around when the price breaks through the bottom trend line.

How to trade?

Entry Point:

Consider entering a long (buy) position after the breakout is confirmed.

Some traders prefer to wait for a pullback or a retest of the breakout level before entering to ensure the breakout is valid.

Stop-Loss Placement:

Set a stop-loss order to manage risk. This is often placed just below the ascending trendline or the breakout point. In the graph we showed above, it should be somewhere around the red line here:

Eventually, you should put your stop-loss level based on your risk tolerance and the volatility of the stock put it a bit higher if you’re more risk averse, put it lower if you’re taking more risk.

Target Price:

Determine a target price for taking profits. One common approach is to measure the height of the triangle and project it upward from the breakout point.

So, how you do it is measure the height (the percentage of price difference) on the left side of the triangle — in the example below it’s around 18%.

After you’ve got the number, expect an 18% increase from the breakout point (in the example above the breakout point is at ~$254, so 18% from that is 299.72.

If you’re wary of risk, then you can put it lower. As you can see from the example above, we barely make it above 18% before the number starts falling again as people are taking profit.

Bottom line

Do note that identifying these patterns in the wild wouldn’t be as easy, and even if you do, there will always be a chance that the pattern doesn’t turn out as you thought it should be. These patterns are essentially a collection of experiences of many traders which stumbled upon a usual trend. Try to look for more indicators to confirm your deductions.

To minimize your risk, you can also try to master your pattern identifying skills while keeping your head abreast on value investing method.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More