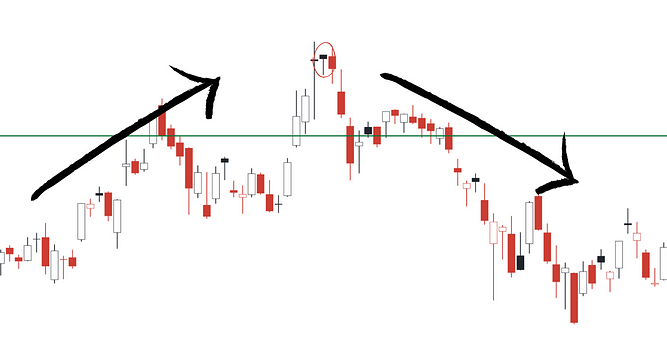

The Hanging Man pattern is a red flag to many traders. It refers to a candlestick chart pattern that typically indicates a potential reversal of an uptrend, which essentially means that the bull rally might be coming to an end. It forms when a small-bodied candlestick with a long lower shadow (wick) appears after a sustained uptrend, resembling a hanging man with outstretched arms.

So, whenever you see a hanging man during an uptrend, you might want to be careful with the positions that you still have, or it could also signal an opportunity for you to start short-selling.