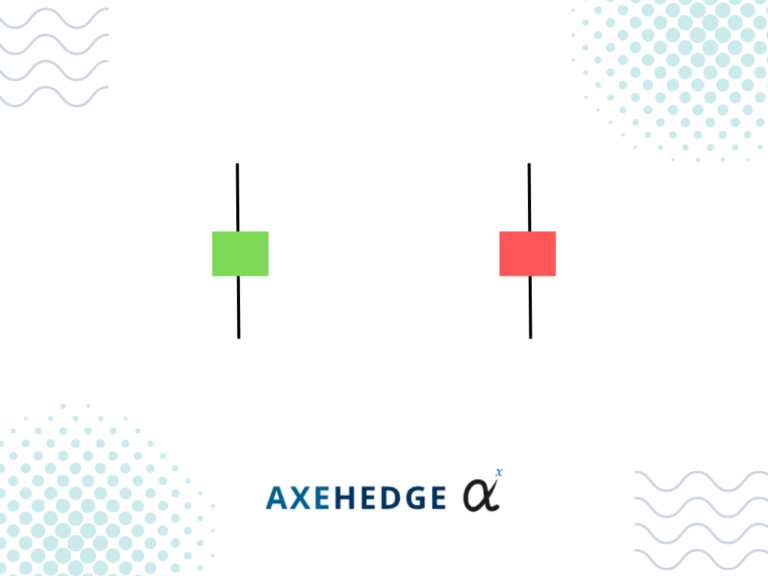

The picture above shows what a spinning top candlestick looks like. What are the most notable features of the two charts above?

Short Body in the middle

If you look at a spinning top chart, one thing that you’ll most likely note is that the body of it is short and stout relative to its tail. What does this mean?

We’ll look at it from two perspectives — if the chart is green or when it’s red. If it’s green, it means that the price closes higher than it opens, and if it’s red, it closes lower. The notable part about this is not if it closes lower or higher, but the fact that the distance between the two prices is very near to each other.

What this means is that the price moves very little for the day. By now you would’ve sighed “thank you, captain obvious”, but wait until we get to the tails and then we’ll get the full picture of what’s going on.

Before we get there, we would also like to point out how this stout body is in the middle between the tails (in real life, it doesn’t have to be exactly in the middle. A little disproportion is acceptable.

Long tails on both ends

This is where a spinning top chart tells you what you need to know. If you look at the chart, you can see that both it tails at the top and at the bottom are long. The tail at the top tells you that the price has moved up to that point for the day, and the one at the bottom tells you that it fell by that much for the day — all of these movements happen until the price goes to its closing price.

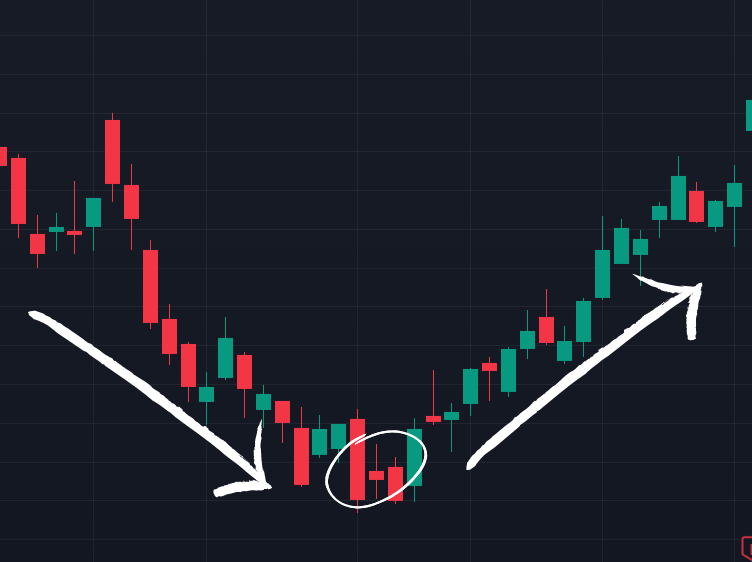

Okay, what does it mean? We will look at it in a green–red chart situation.

If it’s green: what it means is that the price moved up so high for the day, which means that people tried to push the price way higher, but it wasn’t successful, and the price only closed a bit higher than when it opened. The price also fell way lower, which means that the bearish market sentiment also tried to take over the chart, but they too failed as the price closed a bit higher than when it opened.

If it’s red: the price moved up high, which shows that bullish market sentiment tried to take the price higher, but failed as the price closed a bit lower than when it opened. The bearish sentiment has also tried to drag the price way lower, but they too, failed as the price closed only a bit lower than when it opened.

So, what does it all eventually mean? It means that the market is indecisive. Both bull and bear were playing tug-of-war and ended at an impasse — the middle ground.