Hello, and welcome to an article that is a part of our series on fundamental analysis. Just to get you up to speed, here’s what we are up to:

When considering investments or trades, there are generally two approaches used by people (or AI, we don’t discriminate) to analyze their prospects. These approaches are known as technical analysis and fundamental analysis.

Each approach utilizes different methods to evaluate the worthiness of companies for investment. In this case, we will focus on the fundamental investors, also known as value investors, and their way of evaluating investments.

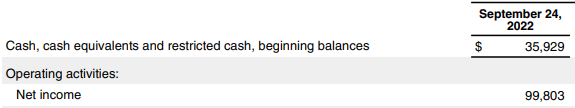

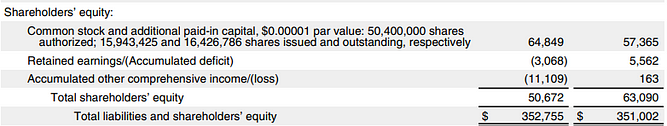

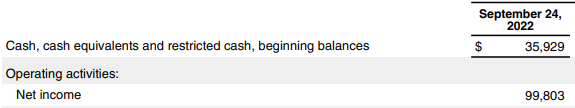

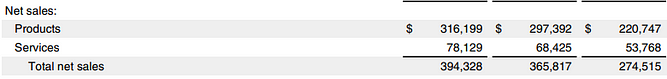

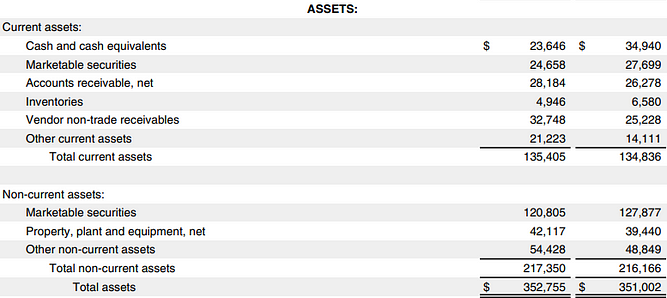

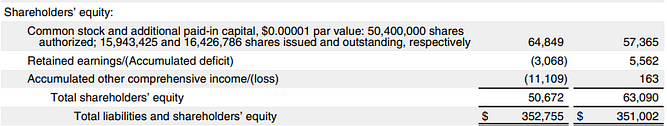

Fundamental investors seek to identify the intrinsic value of a company. They do this by examining the financial statements of the company, including the Profit & Loss Statement, Balance Sheet, and Cash Flow Statement. For a comprehensive guide on how to read these statements, you can click on the hyperlinks provided.

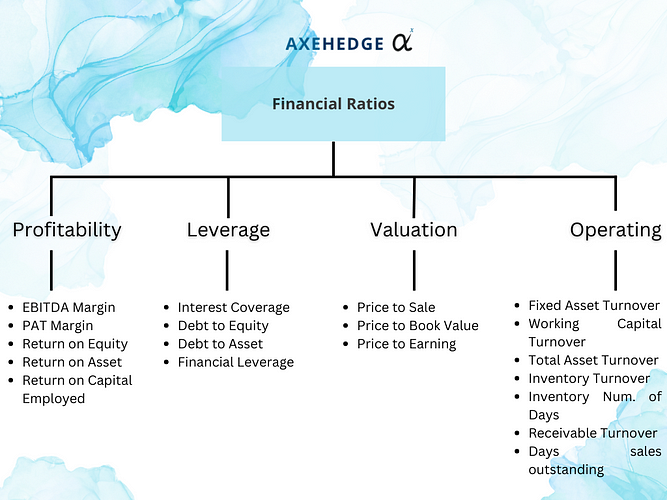

How do they examine all the financial statements above? By using financial ratios! If you want a general overview of how financial ratios work, check out this article — Fundamental: Introduction to Financial Ratios.

If you missed the first part of our article on Profitability Ratio which covers EBITDA Margin and PAT Margin, do check it out here: Financial Ratio: Profitability Ratios (Part 1).

Please also look at the chart below to get a full picture of where we are.

So, we are on the “Profitability Ratio” category while the types of ratios that we are going to discuss for now is Return on Equity (ROE).