1. Things concerning profits and revenues.

Net sales (or net revenue):

This refers to the amount of sales made by a company. From the example above (it’s Apple’s 2021 Report), we can see that the sales are divided into products and services. Usually, companies would lay down their business activities here.

Apple (from above) made it clear that their two core businesses are in products and services (they did detail out what are the products and businesses in another part of the report). From this, you can generally see three things:

- Which part of their business makes the most money.

- How much are they making for the year.

- Is the amount of money they’re making this year better than the years before?

Operating income:

Operating income is simply how much they are making when they actually take into account the cost of producing their products/services and the cost of operating their business.

The formula of operating income is –

Operating income = Total revenue — Cost of goods sold — Operating expenses

From this, you’ll see the actual money that the company is making for the year, and you can compare it to the amounts from the years before.

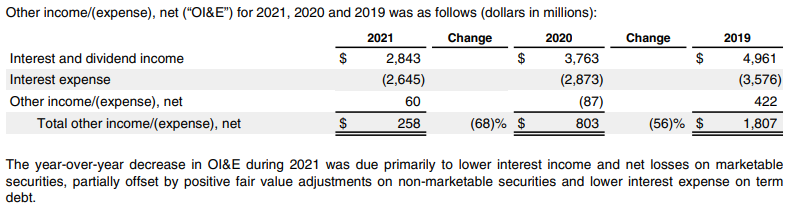

Another thing that you get from the table above is “Income before the provision of Income tax”, or what is also known as Profit Before Tax (PBT).

PBT is calculated by the following formula:

PBT = Total revenue — operating expenses

PBT is important because it is the basis to calculate Profit After Tax (PAT) which gives you a glimpse into how much you will have to operate in the next term. PAT’s formula is as follows:

PAT = PBT — All taxes

Let’s shake off all these fancy terms to make it more understandable. It’s pretty straightforward and logical. If a company makes money in a year, what will it use the money for (after paying for expenses, taxes, etc.)?

No, not charity, of course! They’ll use it to run their business the very next year. So, with how much they make that year, you can roughly tell how much they will have to spend the next year (without taking into account next year’s income).

Anyway, some reports may include a slot for an “exceptional item” or whatever the company decides to label it as — it stands for expenses that are accrued for the year, but it will most likely not happen again the next year.

Let’s take an example, Company ABC operates a few of its factories in Country XYZ. In the year 2020, Country XYZ was hit by an earthquake that damaged Company ABC’s factories and equipment. So, these expenses are considered special expenses that may not be incurred again in the near future.