Fundamental Investing: Things to Look at When You Invest (Part 1)

What are the steps needed for you to select a good stock to buy?

Before this, we’ve spoken about the qualitative and quantitative methods of fundamental analysis. Within these two, we’ve learned a lot of indicators for you to gauge if a company is a good buy or not — especially the financial ratios. The question is, do you have to use all of them when you want to invest? Wouldn’t that take too much time?

The answer is it would, so you don’t have to use all of them, but make sure to look at the company from as many angles as possible. Now before we get to the crux of it, there are a few steps in the filtering process for you to pick your stocks.

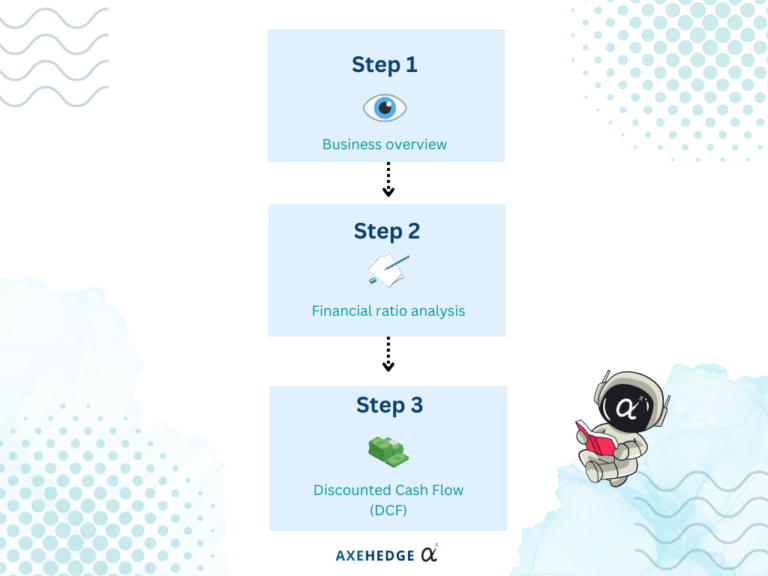

Steps to filter stocks

Based on the chart above, there are three main steps for you to vet whether the company is worth your time and money. The first step is to get a general overview of the business, such as what kind of business is the company operating, the background of its management team, the location it operates in, and more. This is necessary for you to get a grasp on the general nature of the company itself.

The next step is where you try to see how the business performs. A company can say that they sell the world’s only infinite-battery smartphone that can fly you to Mars for all we know, but the ones that will do the real talking are their financial statements and quarterly/annual reports.

The final step is called the Discounted Cash Flow (DCF) analysis, it is where you see if the price is worth the buy. Sometimes a company is good — but it may not be worth it. Imagine if someone sells the scrumptious dish below for like, $1000. It’s amazing, but is it worth it?

Much like the steps of getting to know someone, you’ll first have to get a general overview of the person — who they are, what they do for a living, and what sort of vibes they are giving you. As you move to the next step, you’ll start to see whether they live up to the initial expectations they presented to you, you’ll look into the details of the things they do — whether it matches the impression they initially gave you; and finally, you’ll see if this person is worth to be with for the long term.

“But I just want some quick fun!”

Then this is not for you. Fundamental analysis is for investing in the long term. Quick funs are for traders — but we got you covered on that as well *wink*.

Our articles on trading so far have talked about stock charts, volume, moving averages, relative strength index, and moving average convergence divergence, do have a look!

Getting to know the company

In the first stage of getting to invest in a company, it’s crucial for you to know the company. There are many angles from which you can look at it, such as:

The business that it operates

It is crucial for you to know the main money driver for a company. For example, you take a look at Tesla (TSLA). On the surface, you can say that it sells cars. If you do this, you’ll end up making the wrong assumption later on things like its competitive advantages, its market share, and many more.

Tesla doesn’t just sell any car, it sells electric vehicles (EVs), and on top of that, the techs that it introduces along with the EV. In that sense, you can compare apple to apple. When you look at Tesla’s competitors, you’ll now narrow it down to companies involved in EVs, and how its competitors are developing their EVs technology.

In that sense, you can tell where Tesla stands among its competitors. The reason for asking a company what makes them money is for you to see how good/sustainable their money stream in the future is.

The management team

Another thing that you’ll have to look through is the company’s management team. In many places around the world, many big companies are apparently very politically affiliated. As much as it means that they might get access to a lot of projects, it can also give an odor of corruption, and you might want to avoid these risks.

You should also see if the people handling the company have any issues such as fraud, criminal cases, or stock manipulation by looking them up online. You don’t have to go and do background checks on everyone though. Personally, I’ll usually just look at the board of directors, and anyone that may decide on the company’s trajectory.

Who are the competitors?

Quite like before, it is necessary for you to determine who the company’s competitors are. In this way, you can compare if the stock you’re buying is worth more than its competitors. The way that you can determine this is by defining what industry the company is involved in, the nature of its business, and its target market.

By doing so, you can identify its direct competitors who offer similar products or services, target the same customer base, and operate in the same geographical area. In brief, look for companies with a similar value proposition and business model.

You can also proceed to identify its Indirect competitors, who may offer different products or services but target the same customer needs or compete for the same resources. For example, a company selling luxury watches might have indirect competitors in the form of luxury handbag manufacturers.

The competitive advantage

One thing that separates good companies from impeccable ones is their competitive advantage, or what Warren Buffet famously called a “moat”. For example, NVIDIA (NVDA), as of June 2023 holds the biggest market share when it comes to AI-related hardware — at a time when AI is just about to bloom.

Logically, most companies who want to develop their AI programs will have to buy NVIDIA’s products, and what does that mean? Money! This is also why looking into the company’s business is important. It tells you what unique offerings are and how strong a company stands compared to its competitors.

Essentially, a company can have competitive advantages over a few factors, such as market control or offering something very unique. Some of them are also competitively better given their customer base, such as Starbucks which offers more lifestyle than the coffee itself.

Location of operation

Location of operation here refers to either the place where they sell their products/services, or even the place where they process them. Why is this important? For example, a US company sells most of its products abroad, say — in Sri Lanka. When Sri Lanka defaulted on its debt back in 2022, its currency came crashing down, it’s not just that the company may be selling less now, but whatever they made that they want to bring back to the US will value much less, because they get paid in Sri Lankan Rupees.

On another note, where they manufacture the products are also something you’ll need to be aware of, especially when it involves countries with big risks — say, China. It’s no secret that the US-China relationship has been souring over the past few years and the policies that ensue bite down on the companies that are doing business in both countries.

Apple (AAPL), for example, has been manufacturing its products in China for so long, but over recent years, the battle over semiconductors is making it riskier for Apple to stay. There are now talks on whether Apple will move away from China, and if it does, its financial statements will definitely shift — either for better or worse — from things like different costs of labor, currency, acquisition, and building of new plants, etc., all of these will play a role in its future growth.

The target market

You also need to know the company’s target market, as this will guide you in doing your research on whether the company’s business is capable of making a profit and growing. This will also determine the kind of competition the company is going to face, customer demands, trends, and most importantly — market size.

Market size here refers to the crowd to which the product is sold. Take luxury brands, for example, they have a predefined target of who are their customers, and they only cater to that. You don’t often see luxury items being advertised in tabloids, right? Try opening a finance magazine and you’ll see the bulk of expensive watches, handbags, cars, etc. being advertised there. Why? Because your target market will decide how you operate your business.

If you see that the company has no clear trajectory on its target market, then don’t even bother. Swimming without a direction will find you no shore (I’ll patent this quote).

Expansion plan

Companies can expand in various ways, they can either expand organically (internal expansion — such as expanding existing product lines, opening new branches or locations, increasing production capacity, or improving distribution channels).

They can also expand their market (targeting new customer segments or geographical markets); they can expand their products offerings; go through mergers & acquisitions (M&A); or even go for vertical expansion (expanding into different stages of the supply chain. Companies can also pursue backward integration by acquiring suppliers or forward integration by acquiring distribution channels or retailers).

All in all, it’s important to see if the company has any expansion plan in place. When you put your money, you want it to grow. How will it grow if the company remains dormant, right? However, it is also important for you to make sure that the growth plan is viable and not just some lip service.

Shareholders

A company is not just decided by its board of directors. Shareholders play a big role in deciding where the company will go as they’re able to vote on company decisions. That’s why it’s important for you to look at who are the major shareholders in the company. If you see some shady names or institutions, you might want to take a step back.

Bottom line

This is only the first step in researching a stock. Quite a lot, isn’t it? Well, that’s the price of trying to make money, you’ll have to spend some time researching, or else you won’t be looking at any gains (unless by luck). In all honesty, this list is not everything, but it’s a good place to start. If you find that the company doesn’t pass this filtration process, you might want to consider just dropping it and look for other companies. After this, we’ll proceed to the next two steps — heads up: they’re going to be more technical.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.