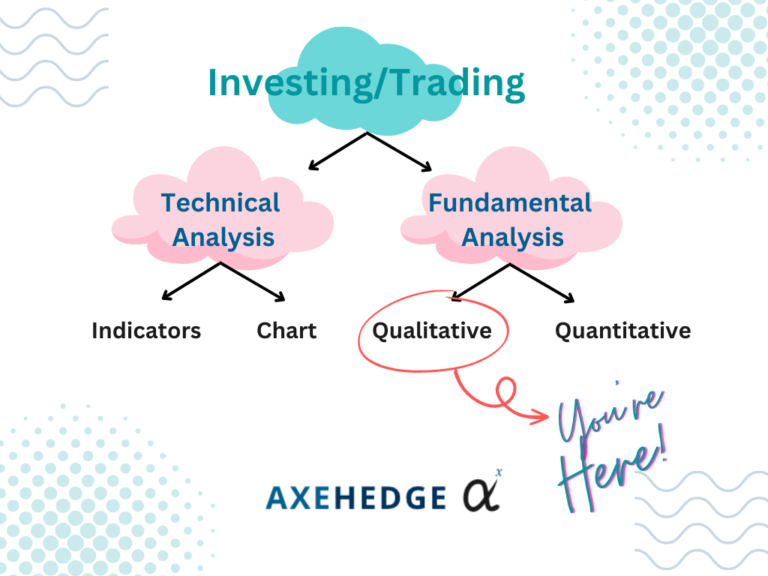

Fundamental Analysis: Qualitative Approach

Here are the things you need to look at when doing your investment analysis.

In investment, there are generally two main approaches taken in deciding when and what to invest in — fundamental analysis and technical analysis. Under the fundamental analysis method, there are two angles that you must look at: qualitative and quantitative.

In this write-up, we are going to move in a bit deeper and elaborate further on the qualitative aspect of fundamental analysis. Let’s go!

Want a more general overview of Fundamental & Technical Analysis?

Read below:

Qualitative Investment Analysis

1. Business model:

When looking at a business model of a company, you’re essentially looking at how they generate their revenue. For example, a cinema’s main activity is playing movies for its audiences, but that only generates a part, if not a bit, of its revenue.

Their main money-making business is their snacks and beverages stand. So, when you’re thinking of investing in any company that runs cinemas, apart from seeing how good the movie experience is, you should also have a dip at their popcorn and see if it tastes like money or not.

One way that you can look into whether a company’s business model is good or not is by looking at its gross profit, cash flow, or net income.

Essentially, what you want to be looking at here is a company that actually makes a profit, regardless of how grand the company represents itself.

However, if the company is fairly new, it is normal for them to spend more before actually generating income — what you need to look at is the cash flow, whether their spending can justify the prospect for future growth or are they excessively spending for things that brings no impact to their growth.

2. Competitive advantage:

Another thing that you may want to look at is how the company stands among its peers. Do they have a competitive advantage in the industry? For example, you’re thinking of going for Artificial Intelligence (AI) stocks. There are many startups, and many existing players as well that are actively developing their AI technologies.

In this bustling industry, you can perhaps evaluate which company holds a better competitive position than its peer — and it can be subjective. Some companies may dominate in terms of capital, but some other small firms may have the expertise — say, Company ABC is a big tech firm with billions in market capital, but they may be less positioned in expertise as Company DEF, a small tech firm, which employs a mad-genius AI expert.

As for this, it is quite hard to tell who is actually holding what card up their sleeves, as it’s a poker table where many are putting up a bluff, what you need to do is too sift through the noises and marketing campaign to see how well these companies are put.

3. Management’s background:

It is important for an investor to look into the management’s background. The executive officers, board of directors, and managers. At this point, you’ll have to ask questions. Who are these people? Do they have the expertise to handle whatever it is that they are positioned for? Do they have the experience to be sitting in that position? Were they involved in any scandals, allegations of crimes, or wrongdoings?

You certainly don’t want to have your money in a company led by ravening wolves.

4. Business ethics:

Next, you will also have a look into the business ethics of a company. Are they involved in any unethical practices such as unfair business practices, unfair business terms, or even down to illegal practices like bribery?

Sometimes a business can be doing legal practices, but it can be unethical. Say, an airline company puts in its terms and conditions that they have the right to reschedule their flights without any compensation to the passengers — it is fine when the rescheduling is not too often and is done for technical reasons, but imagine if they make it their business model to overbook a flight, and the rest of the passengers will be ‘rescheduled’ for the next flight, they’ll be making more angry customers than money!

5. Corporate governance:

The next thing that you might want to look at is how the corporate governance structure is at the company. How were the directors appointed? Is it through favoritism or is it based on merits? Is the organization structure well established or is it haywire? How transparent is the company to its investors?

All this information is not very much out there, since no company would go out and shout “we are doing some shady things here!”, your best bet is to do some digging online to see if there’s any information on undesirable practices.

One of the places you can go is to the websites that provide a platform for employees to review their employers like Glassdoor (this is not a paid promotion) or any other website of the like.

6. Industry:

In terms of industry, what you need to evaluate is how big is the market base, how would the consumer base look like, how big is the company’s market share, how well can the industry grow over time, etc.

This is important because you need to know the ‘playing field’ that the company is in. For example, you’re going to invest in a mining company, but the one you’re going for is a new company that looks to mine coals.

With all the ESG movements and concern for the environmental effects coal can bring, the company may not be your best bet yet — even if coal is going to last, there are many other big companies with better facilities and utilities that can bury this new company.

“If you know the enemy and know yourself, your victory will not stand in doubt; if you know Heaven and know Earth, you may make your victory complete.”

7. Minority shareholders:

Another thing that you may want to look at is how the company treats its minority shareholders. After all, unless you have a pot of gold under your bed, you’re most likely to be a minor investor.

You need to see if the corporate decision considers the opinions of minor shareholders or if are they simply following what the majority shareholder demands. This can be known by attending shareholders’ meetings, but you’ll have to acquire at least a share first before you can attend the meetings. However, you can do your research by joining online forums and the like to ask how the company makes its decisions.

8. Share transactions:

This is quite important for you to look at since you don’t want to be involved in a company that is involved in shares fraud, or at least deceptive shares transactions. Some companies deceive their shareholders by having their shares sold or bought in unethical ways through promoter groups.

The way it is done is that the promoter group will try to inflate the price of the shares by buying and selling them at a high price when it shouldn’t be as such. Unaware investors would then think that the stock is a good buy when actually the price is artificially inflated.

9. Related party transactions:

You might also want to be sure that the company doesn’t engage in any transactions to and from the company-related parties that aren’t properly justified, such as transferring money or company asset to a company executive’s family members, etc.

10. Salaries paid to promoters:

How much a company pays its promoter is also something for you to be concerned about. Too much of it and it may be not viable, and too little of it then you might be looking at a sour prospect in terms of growth — unless the company is well-known, or well-established enough that they don’t have to occupy themselves with shares promotions.

11. Operator activity in stocks:

This is almost like point 5 abovementioned, but it’s more on looking at the end product, i.e., the price movement of the stock. So, what you need to do is monitor the price movement of the asset, especially when there’s any transaction done by company insiders and its promoters.

What you’re looking for is any significant changes, be it in trading activities or the price movement, which is unjustifiable (not a normal outcome of any event). For example, when the price suddenly rise at a significant level or vice-versa.

12. Shareholders:

You need to be aware of who are the key players and decision-makers in the company. As with the management team, company directions are also decided by its shareholders. So, you need to know who is involved in the decision-making process of the company. Even if the company is made up of credible executives, if the key shareholders are a pain in the bums, you might want to think twice.

13. Political affiliation:

This is also a thing that you should be concerned about. Being well-connected can put you up on a certain pedestal, there’s no denying that. However, being too intertwined with political affiliations may expose the company to political risk.

Corporate lobbying is not illegal, in fact, it is allowed in the U.S., it’s just that you have to disclose the number of your lobbying efforts. Apart from that, companies with higher lobbying expenditures have been showing impressive returns.

Nonetheless, make sure that the company that you’re investing in is not intertwined with politics — lobbying is fine, and it’s different from being intertwined. Getting some special treatment just because the CEO is close with a certain politician is not cool, if the politician falls, the company might follow suit, given that its lifeline is cut.

14. Company Personnel/Promoter lifestyle

Another thing that you may want to consider is the way that the higher-ups of the company or the stock promoters represent themselves. Many of them are lavish, and that is understandable, given the nature of the job. However, there would come a point where you would ask yourself if this particular person is actually in the position to live THAT lavishly. If you’re starting to ask such questions, perhaps it’s good to dig further or keep your distance.

Bottom line

- There are two things to look at when you’re doing your fundamental analysis, the qualitative and quantitative aspects of the company.

- This qualitative list is not comprehensive, but it touches on the main concerns that one should raise when analyzing a company.

- It is imperative for you to also do your quantitative analysis to get the best out of your investment decisions.

- In fact, it is better if you can use both fundamental and technical analysis methods in your investment, i.e., by using technical analysis to make a short-term investment decision and fundamental analysis for long-term decisions.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.