Stock Chart Indicator: Relative Strength Index

How to trade using the Relative Strength Index indicator.

The Relative Strength Index (RSI) is a popular momentum oscillator used by traders to assess whether a financial instrument is overbought or oversold. Imagine it like a meter that tells you when an asset (for example, stock) is being sold too much that people might start to think “wait a minute, what the…“ and the trend might reverse and people will start buying — causing the price to rise, or the other way around where a stock is bought too much that the trend might reverse, and people will start selling.

Simply, it tells you when a stock is bought or sold up to a point that it’s too much and a reversal might happen. The RSI is measured from 0–100, where a point between 0–30 would usually indicate that it’s oversold, and a point between 70–100 tells you that the stock might be overbought. This, however, is the general rule. There are instances where it might differ a bit, and we will look into these special circumstances in a while.

How is RSI calculated?

Mind you, this is not necessary as you can always look it up online, but we’ll let you get a general grasp of the concept, nonetheless. The formula is:

RSI = 100 — [ 100 / (1 + RS)]

Where,

RS = Average Gain / Average Loss

How do they look for Average Gain and Average Loss? Let’s use the price movements below as an example:

Note: assume that on the day before January 1st, the price is at $3.

How it’s calculated is, you look at the price movements each day, for example, the price on January 2nd rose by $2 right? So, you mark it — January 2nd, price is up by $2. Now, take January 3rd, when the price fell by $3 from $6 to $3, you mark it — on January 3rd, the price falls by $3.

Mind you, there is no negative value, so if the price fell for that day — say, by $1, what you’ll have to do is write in the “price down” section the number “1”, but since the price for the day fell, it means that if anyone asks you “how much the price rose today?” The answer is none, right? Because the price didn’t rise. So how much is “none”? — yep, 0, now write that 0 on the “price up” section.

Why is this important? To calculate the Average Gain and Average Loss!

Back to the calculation.

Average Gain = Total gain in the period / Period number (days/weeks/months, etc.)

Average Loss = Total loss in the period / Period number (days/weeks/months, etc.)

Now from the table above, here is how the calculation will look like:

Average Gain = 4 / 5

Average Gain = 0.8

Average Loss = 5/5

Average Loss = 1

RS = Average Gain / Average Loss

Thus,

RS = 0.8 / 1

RS = 0.8

Back to calculating the RSI,

RSI = 100 — [ 100 / (1 + RS)]

RSI = 100 — [ 100 / (1 + 0.8)]

RSI = 44.44

Based on the scale, we can tell that the stock’s selling sentiment is stronger because it’s closer to the 30 range, but it’s not yet up to the point that it’s sold too much, and a reversal might happen.

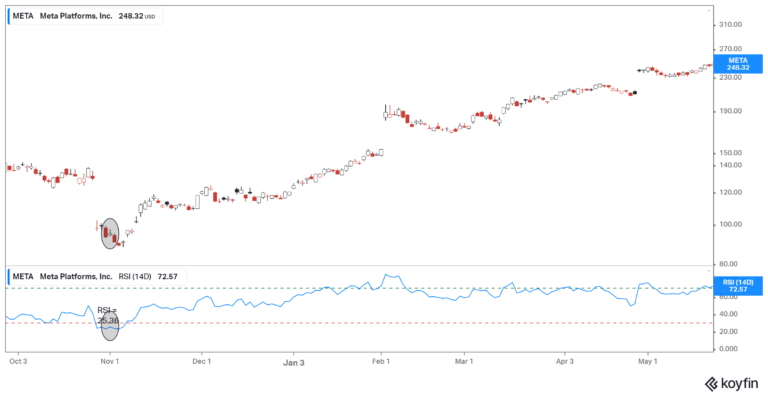

Here’s how it will look if you look for RSI in a charting software app. See the blue line at the bottom? That is the RSI value of the stock (in this case we use 14-day RSI). The green dotted line tells you when the RSI reaches the point of being overbought and the red dotted line tells you when it reaches the point of being oversold.

Look at November 1st, where the RSI is 26.36 which is below 30, which also means that the stock is oversold at that point, a few days after that, the trend reversed, and the price goes up again. Yay! Simple right? Now, let’s look at the less simple situation.

Special cases

Sometimes, a stock can be so superb that the price can (generally) rise for months, or even exceed a year. With these stocks, the RSI will always be stuck at the “overbought” area, and if you’re not careful, you might get tricked into thinking that the price might fall, so you go short-selling and create a dent in your pocket.

There are also times when the stock is being an absolute crap that the price keeps on falling and gets stuck in the oversold region. The same thing, if you’re not careful and only rely on RSI for your trade, you might buy hoping that the trend might reverse, but instead, you end up buying worthless stock.

At this point, it is also helpful for you to look at the news and see why the stock is performing that way, there should be a reason why.

How to trade?

In a normal situation, the decision is pretty simple, you buy when the RSI is at oversold, and you sell when the price is at the overbought region — of course, look at other indicators as well, such as if there is any pattern that forms, or if the price is moving closer to its support or resistance level, etc. to confirm your decision.

In the special case, you can place your buy if the RSI is at a prolonged overbought level, and start selling or short-selling when the price is at a prolonged oversold — simply, try to ride the trend, but it can be risky as you can’t really gauge if the trend is going to persist or not — again, don’t forget to look at other indicators as well when doing this.

Another way which is much safer is by waiting to see if there is any sudden change in the RSI value, i.e., if it moves away from its trend (if it’s overbought, then the RSI suddenly falls — if oversold, RSI suddenly rises), and look to place your trade once that happens, there are more likeliness that the prolonged trend might be reaching its end. Again, look at other indicators as well.

Bottom line

- tells you when a stock is bought or sold up to a point that it’s too much and a reversal might happen.

- The RSI is measured from 0–100.

- A higher RSI value indicates that the stock is being bought more.

- A point between 0–30 would usually indicate that it’s oversold.

- A point between 70–100 tells you that the stock might be overbought.

- When the RSI value is in a prolonged high or low, common sense will be highly helpful in deciding the fate of your trade; don’t place your trade like you’re in a normal situation.

- Use other indicators as well to increase your chances of success.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.