Stock Chart Trading: Dark Cloud Cover Candlestick

How do you trade when you see a Dark Cloud Cover pattern?

There are many things that two candlesticks can tell us — specifically on the current sentiment of the market. The essence of stock chart trading is to use the current sentiment in order to predict how the future sentiment may be.

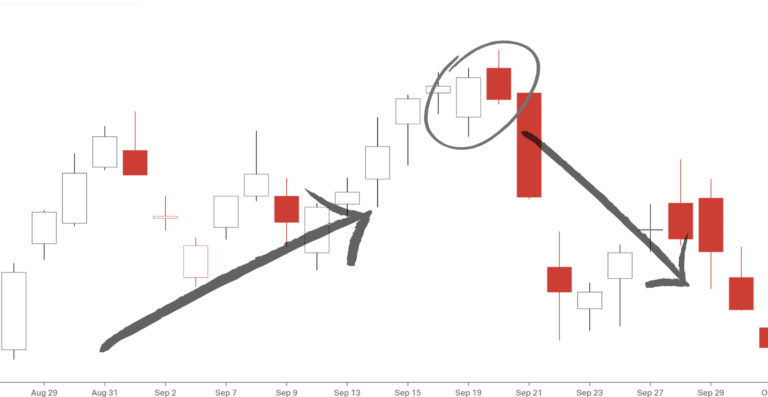

Dark cloud cover is a bearish pattern, which means that it usually is a sign that the price may go down after seeing the pattern. The looks of this pattern are almost like it’s an inverted version of the piercing candlestick pattern — or you can also say it very much looks like the bearish engulfing pattern.

Characteristics of The Dark Cloud Cover Candlestick

Here’s how to know if it’s a dark cloud candlestick pattern:

- It appears in an uptrend.

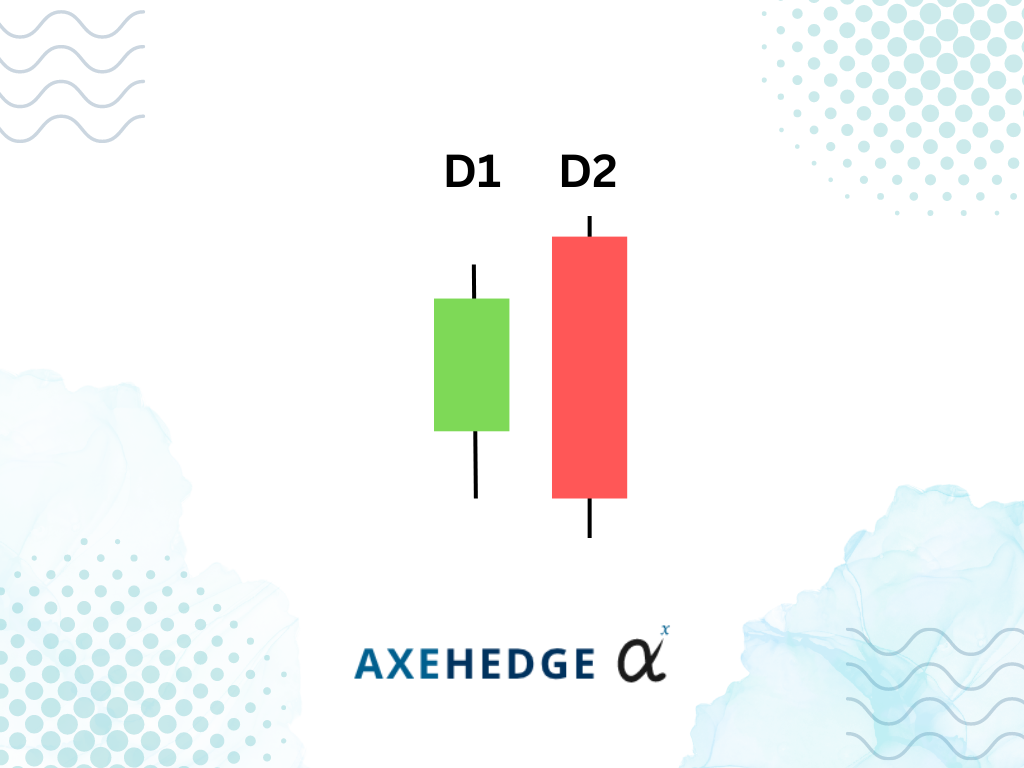

- The first day’s candle (D1) is a green candle which closes at a new high for the trend.

- The second day’s candle (D2) is a red candle that opens at a new high in the trend but closes very near to D1’s opening price.

- The D2 candle overshadows more than 50% of D1 candle, but not fully. So, if the range of the green candle body is 10, the green candle body must be somewhere between 5 to 9. You can also confirm the ratio just by looking at it (if it’s obvious).

What does the dark cloud candlestick tell you?

As the overly dramatic name suggests, the dark cloud may not be a good sign for the trend, but here’s what you can generally presume if the pattern appears:

- It appears in an uptrend, so the current mood of the market, before it appears, was a good one. People are buying and buying, pushing the price up.

- When D1 appeared, the buying sentiment was still strong as it pushed the price higher.

- During the opening price of D2, it sets another new high for the trend, showing that the market tried to push the price even higher.

- However, the mood in D2 wanes as people are starting to think the price couldn’t go any higher and sell — they sell, and sell, causing the price to drop significantly, almost as low as the opening price of D1.

- That showed the mood may have changed for the market and that the bearish sentiment may kick in soon.

How to trade?

There are generally two things that people would consider doing when they see the dark cloud appearing — short selling or selling whatever shares they have in the stock (also called “taking profit”). Two approaches are taken in doing these two things: playing it risky or being risk averse.

Risky

- If you’re short selling, you can start your trade on the same day as when the pattern appears. Just make sure that D1’s candlestick is green and that it sets a new high when it closes, and D2’s open is higher than D1’s close, but D2’s price when the market near closing time (the U.S. market closes at 4 pm) is lower than D1’s open.

- Short sellers’ stop loss can be put at whichever point is the highest price in D1 and D2.

- If you’re taking profit, you can sell near the closing time of the next day when you can confirm that the candle is indeed red. (if the second day’s candle is red, traders would usually consider it as a confirmation that the pattern is forming and working).

Risk Averse

- If you’re short selling, you can start trading near market closing the next day when you can confirm that the third day’s candle is red (as far as the price near market closing is concerned).

- Short sellers’ stop loss can be put at whichever point is the highest price in D1 and D2.

- If you’re taking profit, you can sell your position at the market closing time on the day that the pattern forms. This way, you can avoid selling for less when the price really falls the next day.

A general note:

Traders often use the patterns in conjunction with other technical analysis tools to confirm potential trading opportunities and make informed trading decisions. It is important to keep in mind that no single technical indicator or pattern is a guaranteed predictor of future price movements, and traders should always use risk management strategies to protect their capital.

Bottom line

- The dark cloud candlestick indicates a change in the market sentiment from bullish to bearish.

- The strong sell sentiment managed to drive the price down.

- The pattern will often occur within two consecutive periods (usually days) in the market.

- It’s identified by the first day which is a small green candlestick at the top of a downtrend followed by a massive red candlestick that opened higher than D1’s closing price but closed near to D1’s opening price.

- Slight variation in price is negligible but be sure that small really means small.

- A risk-taking trader would short sell on D2, meanwhile, a risk-averse trader would short sell on D3.

- Use other indicators and analysis as well to get a proper overview of what’s going on — it will help you make more informed decisions.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.