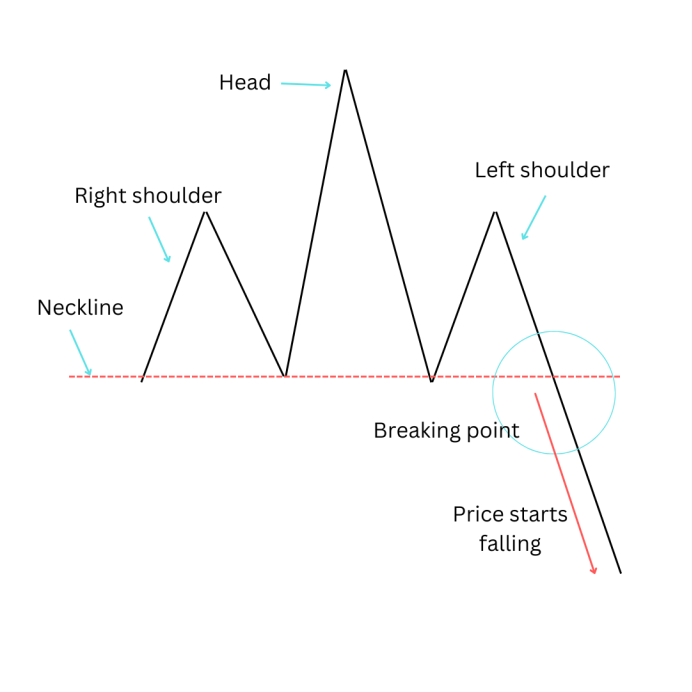

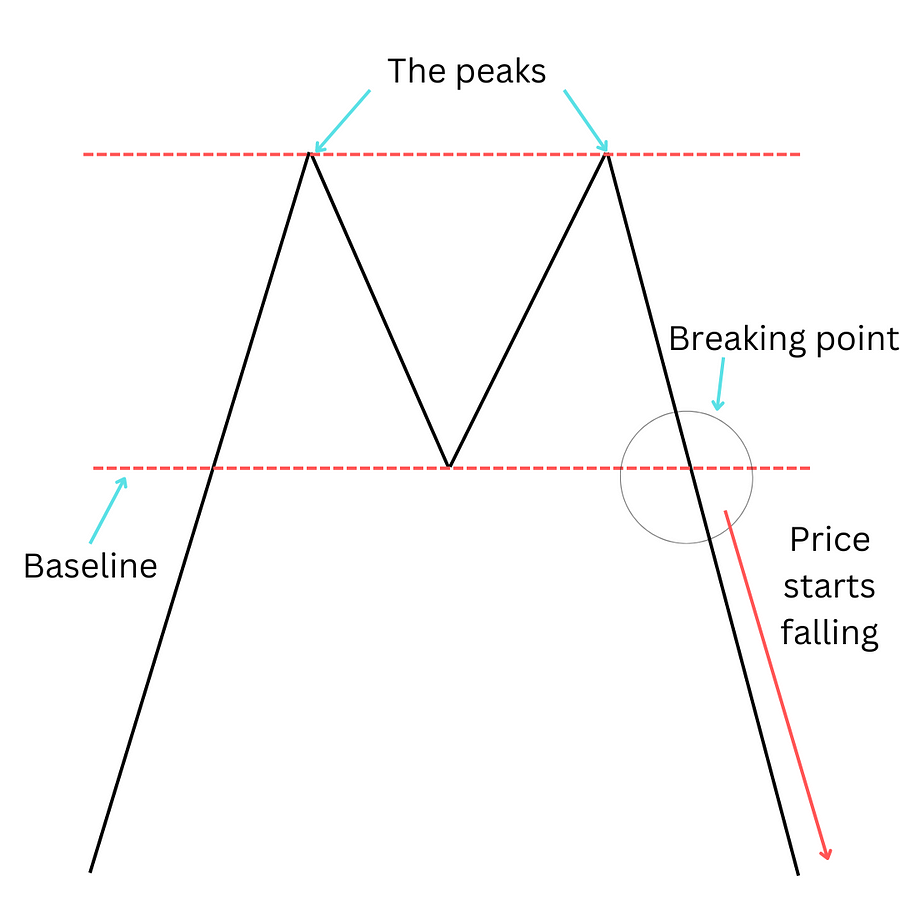

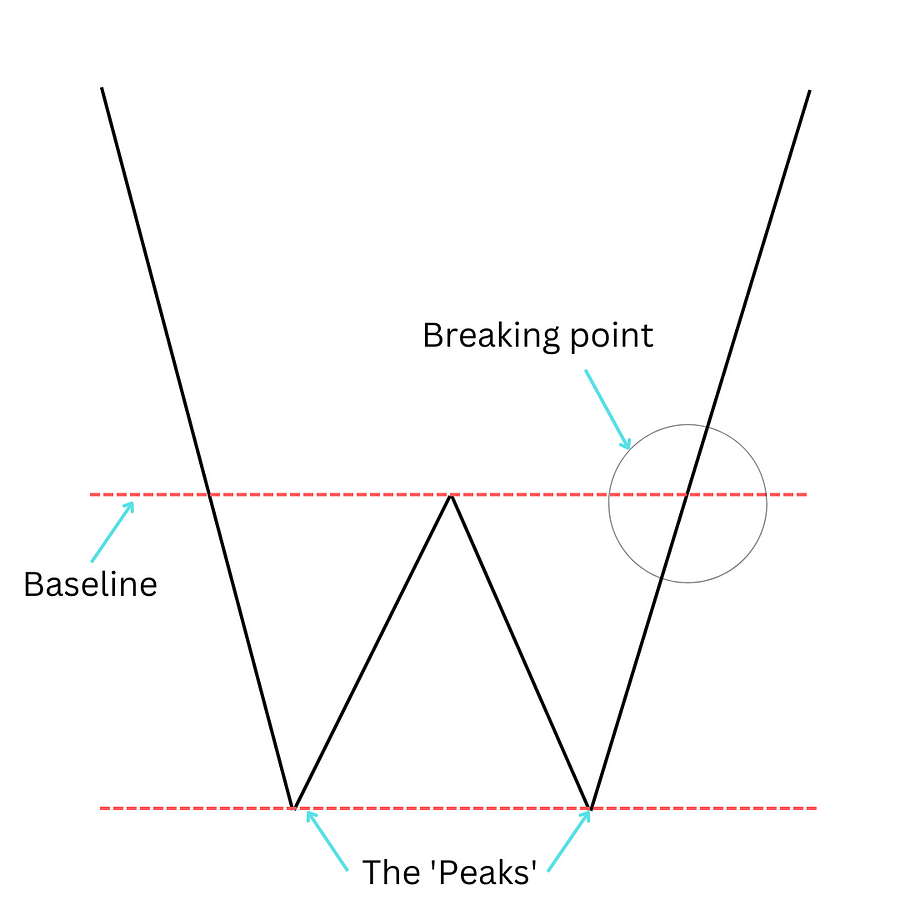

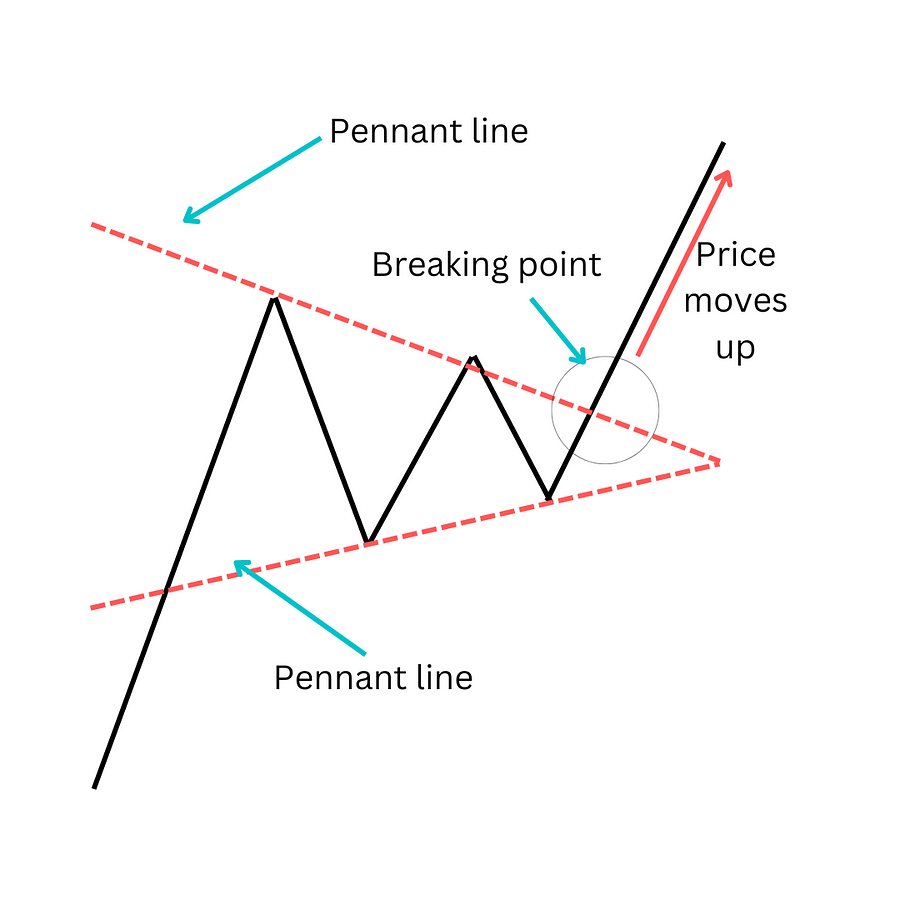

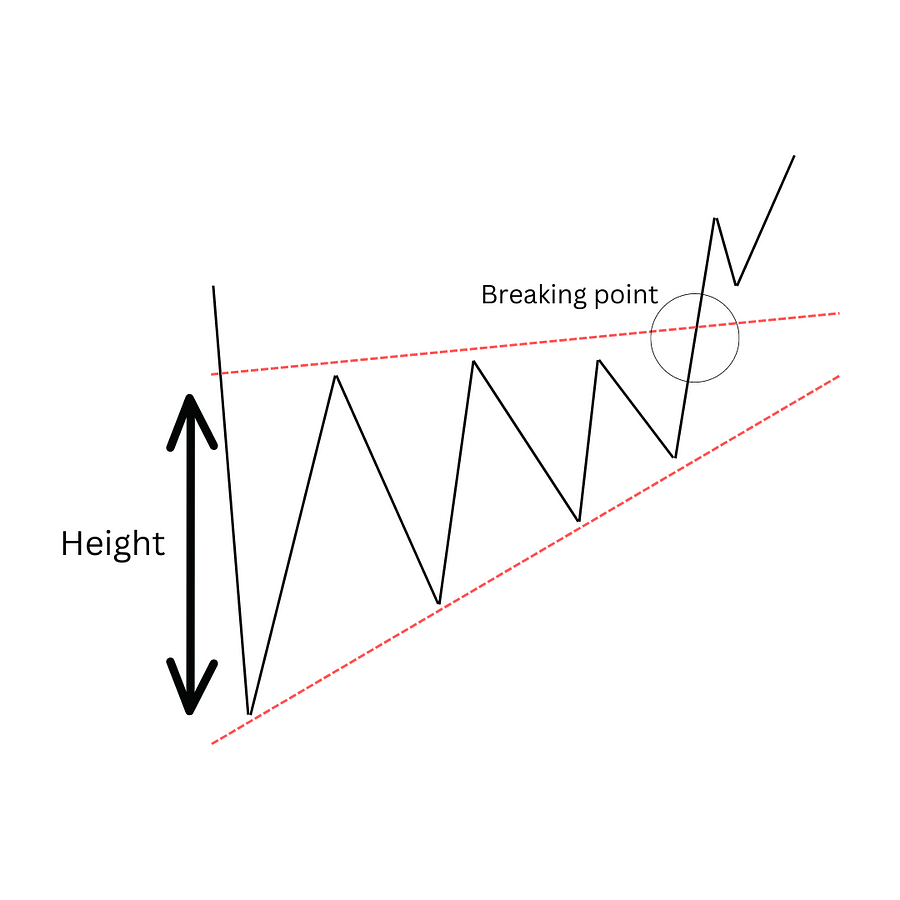

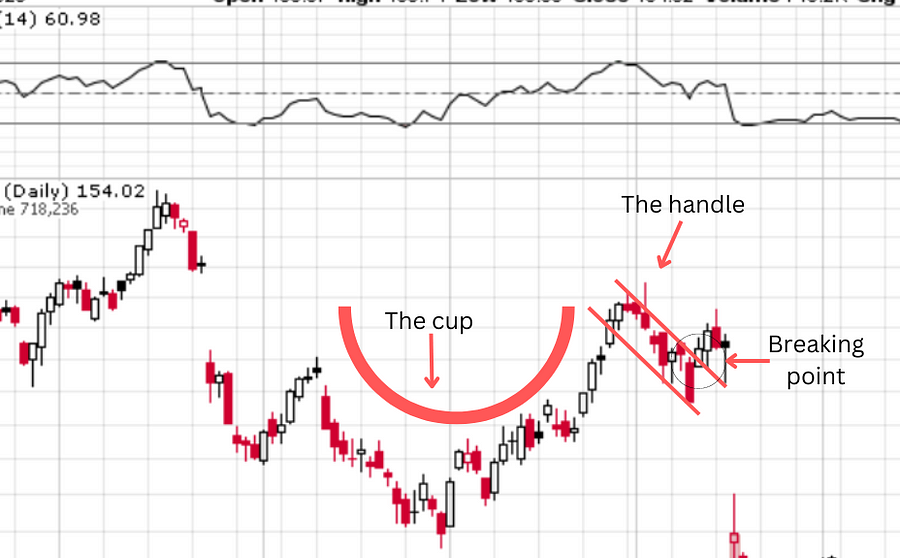

Reversal refers to a chart pattern that indicates the possibility of the chart going the other way. For example, if the chart is currently going up, upon reversal, it may go down in the future, and if it is currently going down, the price might go up.

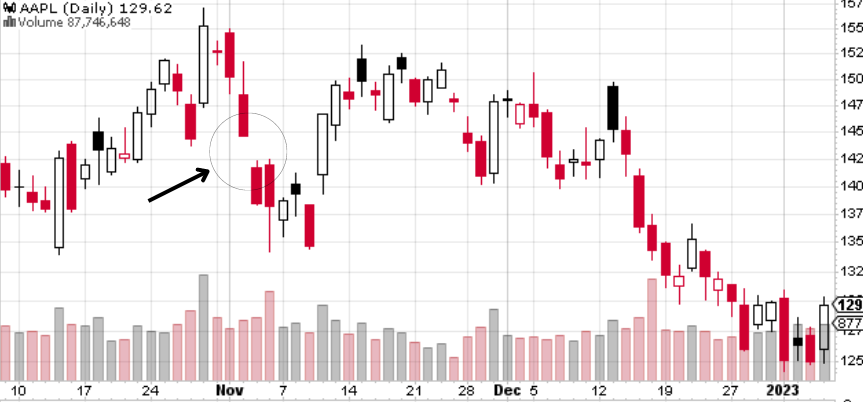

The picture above shows how Apple’s stock reversed from going down to moving up again. If you can master the skill of reading charts, you might be able to predict when the price might go up or down, so that you can place your trade at the most opportunistic time.

However, keep in mind that nothing is assured, it’s just that the market usually moves in a certain pattern which is usually predictable.