Understanding stocks for beginners

A brief guide to stocks, the stock market, and many more!

What are stocks?

The definition of stocks, simply put, is part of a company’s ownership. Imagine a company is like a whole cake you find at your local bakery and each slice is sold separately, the bigger part of the cake you want, the more slice you will have to buy.

Taking that example to the context of stocks, ownership over a company is usually represented in the stocks that it issues. The more stocks you have, the more ownership and (usually) power you have over the company, and of course — if the company is doing good, so is your wallet.

In a simple way — you could say that these companies slice themselves into some pieces and sell them to whoever is interested in owning them.

Why would a company want to sell ownership over itself to the public? Wouldn’t that jeopardize their growth?

On the contrary! When companies issue stocks and investors buy those stocks, the company will then use the money they get from selling those stocks to expand their businesses.

If thing goes well and the company grows, so will the value of the company, and if the value of the company grows, the price of stocks that were sold will also increase. It’s a win-win situation.

For example, Company A sells 1 million stocks at $1 each. The company then uses the $1 million it gets to invest in machinery. A year later, the company’s production grew much bigger and made more profit. That $1 stock may now double to $2. If an investor bought $1000 worth of stocks before, he/she will now have $2,000 worth of stocks.

The investors can either choose to hold on to the stocks if they think that the company can grow bigger or sell it for profit.

“Investors have ‘power’ over the company, right? Won’t that hamper down the company’s ability to grow, being tied to investors and all?”

It is true that investors will have a say on how the company would run, but they don’t have that much power.

The day-to-day operation of the company will be handled by its staff and executives. That’s why in some TV dramas you can find scenes of some big-shot CEO being in hot water when it comes to meeting with shareholders — because these executives are the ones who are responsible for making sure that the company is profitable.

How many types of stocks are there?

That will actually depend on what kind of investment method you’re looking at, but generally speaking, there are many different types of stocks — almost 20 kinds of them. There are, however, two main types of stocks that are usually discussed: common stocks and preferred stocks.

Common stocks represent ownership in a company and usually come with voting rights at shareholder meetings. Preferred stocks usually don’t include voting rights, but they may be given higher priority in terms of dividends and claims on assets if the company goes bankrupt.

Here are other types of stocks:

- Large-cap stocks: Stocks in which market capitalization is considered large (in most cases exceeds $10 billion).

- Mid-cap stocks: Stocks in which market capitalization is considered intermediate (in most cases around $2 billion — $10 billion).

- Small-cap stocks: Stocks in which market capitalization is considered small (in most cases below $2 billion).

- Domestic stock: stocks from the country you’re located in.

- International stocks: stocks from outside the country you’re located in.

- Growth stocks: Stocks that may grow quickly, but usually are riskier.

- Value stocks: Stocks that are more stable and less risky, despite slower prospects for growth.

- IPO stocks: Stocks of a company that is recently listed publicly through an initial public offering (IPO).

- Dividend stocks: Stocks that are profitable through their dividends.

- Non-dividend stocks: Stocks that are profitable through the growth of their stock price, and not necessarily from dividend payments.

- Income stocks: These could refer to dividend stocks but could also refer to a matured company that is slower in growth but less risky.

- Cyclical stocks: Stocks that tend to follow economic movements.

- Non-cyclical stocks: Stocks that don’t really follow economic movements.

- Safe stocks: Less risky stocks.

- ESG stocks: Stocks where that focus on companies that perform well in terms of Environment, Social, and Governance (ESG) evaluations — not necessarily on profits.

- Blue chip stocks: focus on industry leaders, companies with stability and a reputation of ‘staying up top’.

- Penny stocks: stocks whose price is lower than a certain limit. These limits may differ according to each country.

Stocks vs Shares

Stock is the actual asset that you invest in, while shares refer to the unit measurement of how much of the company you own, and yes — we are in that “same, but not same, but same” situation.

If you say, “I own 1,000 stocks in Google (NASDAQ: GOOGL),” it can also mean that you own 1,000 shares in Google. But, normally when people talk, they refer to shares as your ownership over a specific company, while stock is a more general term referring to the company itself. Don’t worry, we’ll give you examples.

If tell your broker or agent:

“I want to buy 100 shares,”

They would then ask you “100 shares in which company?”

However, if you tell them:

“I want to buy 100 stocks,”

They would then look for 100 different companies to invest your money in.

Simply, it’s more of a language issue (or ‘lingo’) rather than a technical one. People are accustomed to associating stocks with companies in general, while shares are associated with a certain amount of ownership owned by a specific company.

What is Stock Exchange?

A stock exchange is a platform or marketplace where people buy and sell stocks. Selling and purchasing stocks can be done through a variety of channels, including stock exchanges, over-the-counter markets, and online brokers.

What is Stock Market?

The fish market sells fish, the farmer market sells farmers (just kidding), and the stock market sells — yes, you got it right — stocks! Only usually, the stock market refers to the whole ecosystem of stock trading.

Simply, it is a collection of many stock exchanges. Just imagine the stock market as an umbrella that covers many stock exchanges under it. Again, this is more of a ‘lingo’ thing among traders.

“What does it mean when people say the stock market is down?”

It refers to the performance of stocks in general, not that the trading system is down or under maintenance. For example, when the global pandemic hits, stocks are down because companies cannot perform due to restrictions and lockdowns.

What determines stock prices?

A lot of things, but it all goes back to one thing: supply and demand. If there are more buyers than sellers, the price will go up. If there are more sellers than buyers, the price will go down.

For example, when Argentina secured their way to the 2022 Soccer World Cup final, everyone suddenly jumped on to be a die-hard fan of the Argentina football team. The stock price for Adidas (ETR:ADS), which is the official sponsor of Argentinian kits then increased along with the hype due to the increase in demand for Argentina’s jersey. They then went on and won the world cup, with the main man, Lionel Messi, announcing his retirement from international soccer — a complete jersey-buying frenzy!

Lionel Messi's Argentina jerseys are sold out worldwide | CNN Business

Fans of Lionel Messi looking to scoop up his official Argentina jersey following the soccer star's first-ever FIFA World Cup win may be out of luck.

On the other hand, when news got out on December 15th, 2022 that Elon Musk dumped $3.6 billion worth of Tesla (NASDAQ:TSLA) stock, investors got scared and shy away from buying Tesla stock. The market then saw Tesla’s price decline over time.

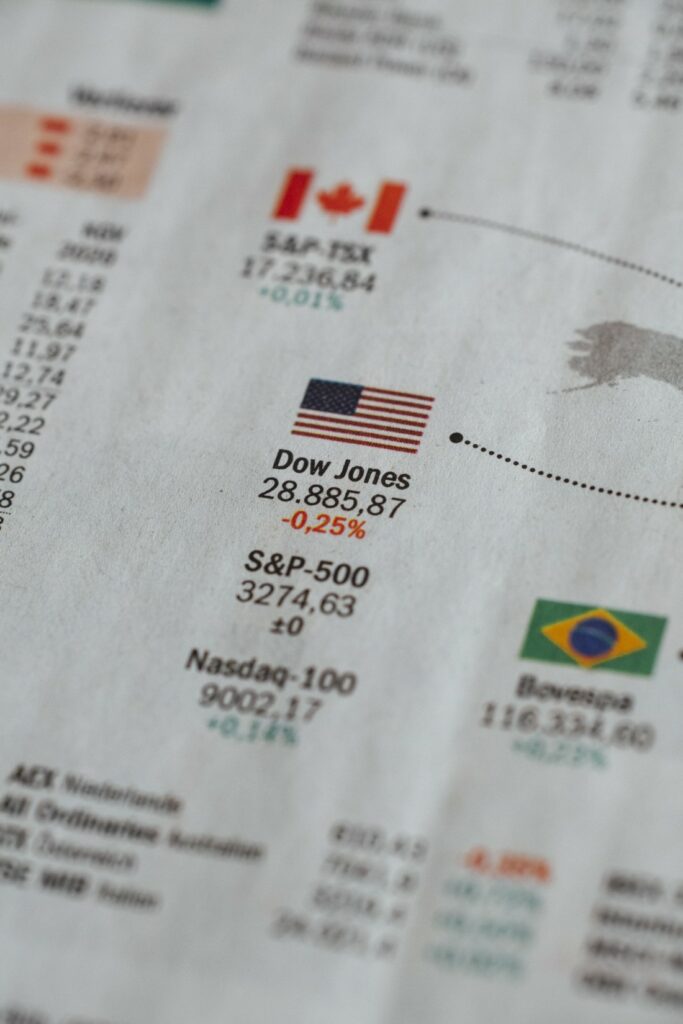

What is a stock index?

A stock index is a statistical measure used to measure the performance of the market, and it’s measured in many different categories. For example, the S&P 500 measures the top 500 US-listed companies, Dow Jones Index (INDEXDJX:.DJI) on the other hand measures 30 large American companies that are listed on Nasdaq and New York Stock Exchange (NYSE).

To understand it simply, imagine you’re an owner of a soccer club and you’re looking to buy new players into the club. You can look at many ‘indexes’ such as “top 100 strikers globally”, “top 100 Asian strikers”, or “top 50 best players globally”. All of these will list down different names — but you’ll most likely get what you’re looking for if you know what you want.

Where to buy stocks?

To start investing in stocks, you can’t simply call the stock exchange and place your order. You’ll need to deal with a stockbroker, be it a person, an organization, or an online platform. The easiest and the most common way nowadays is to simply use online platforms — it’s almost like you’re doing it yourself without the intervention of third parties. Although keep in mind, there are certain fees you need to account for when purchasing stocks.

Conclusion

Buying stocks, shares, and equities generally refers to the same thing, i.e., buying a certain part of ownership over a company. It’s not always an easy task, but it’s not that hard either (depending on what you’re aiming for).

However, do keep in mind that you may want to do your own research into the companies you’re interested in. Just don’t blindly listen to these financial gurus you find online. Yes, those Lamborghinis are tempting, but if it’s that easy, thousands of people who join this kind of class would have had it by now, no?

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.