The second triangle: the Descending Triangle

Read MoreFundamental: Discounted Cash Flow (Part 3)

The concept of Terminal Value

This article is a part of our series on how to choose your stocks for investment using fundamental analysis. Terminal value is a component under the third stage of the analysis, which is known as Discounted Cash Flow (DCF). As a quick recap, there are three stages to fundamental analysis (generally speaking).

The first step is to look at the business overview to get a first glance at how the business is doing generally. If they pass the test, move to the next step and apply financial ratio analysis on these stocks to see if it supports your initial findings. If this step is passed, move on to the last step, which is to look at Discounted Cash Flow (DCF) to see if the price that you’ll buy it at is worth it or not.

We are now at the last step. However, mind you there are a few core concepts that we’ll need to master before we can actually jump into the DCF evaluation. In this article, we will learn the third concept which is the terminal value.

What have we learned about DCF so far?

Before this, we’ve learned about:

Future & Present Value tells you how much the money that you can get from your investment later might be worth now (or how much the money you have now could be worth later); while Free Cash Flow tells you how much a company makes from its operation minus its capital expenditure.

These concepts, if paired with the concept of Terminal Value that we are going to discuss now, and a few other concepts that we will discuss later, can be used to estimate the fair value of a share. Simply, it can tell you if the price of the stock that you want to buy is a good price or not.

So, Terminal Value.

In stock investment analysis, you often make projections of a company’s future cash flows, typically over a finite period, such as 5 or 10 years. These cash flows can include revenues, expenses, and profits. Just like what we did when we discussed Future & Present Value and Free Cash Flow.

The problem is that most businesses are expected to continue operating beyond the projection period. They don’t just disappear just because your projection doesn’t account for it.

“If a company makes a profit but there is no one to witness it, did it really happen?”

Jokes aside, Terminal Value helps us account for this by estimating the value of all the cash flows that occur beyond the last projected year. There are two common approaches to calculating Terminal Value in the context of stock investment:

Perpetuity Growth Model (Gordon Growth Model):

This method assumes that cash flows will continue to grow at a constant rate indefinitely. The formula for this is:

Terminal Value = Final Year Cash Flow × (1 + Terminal Growth Rate) / (Discount Rate — Terminal Growth Rate)

This is the model that we will use in this series.

Exit Multiple Method:

This method assumes that the company will be sold or valued based on a multiple of a financial metric (like earnings or EBITDA) in the terminal year. The formula is:

Terminal Value = Final Year Metric (e.g., EBITDA) * Selected Multiple

Where,

Final Year Metric: The financial metric in the last projected year.

Selected Multiple: A chosen industry multiple used for valuation.

However, we will not be using this for our article.

“Terminal Growth Rate?”

If you look into the first method, which is the one that we will use, you can see the term “terminal growth rate” in its formula. So, what does it mean?

Terminal Growth Rate, in the context of stock investment, refers to the rate at which a company’s cash flows are expected to grow indefinitely into the future after a specified projection period. Simply, it is a rate at which the company will grow forever (the “forever” here is just theoretical, nothing lasts forever. You’d understand this better than I do).

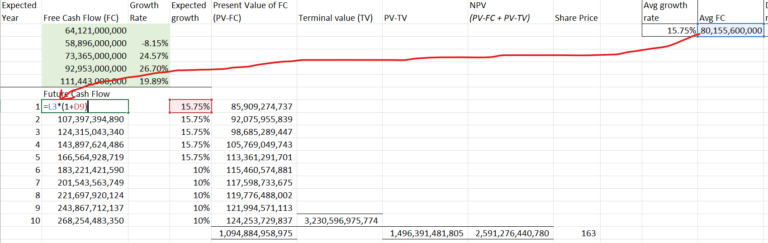

After reaching a certain ‘age’ the company’s growth would usually slow down a bit, in which previously we put a company’s growth rate for the first 5 years of the projection to be at 15.75% and 10% for year 6th to year 10th (we made the 10% up, but the number is usually not far from that).

After the 10th year, when the company (presumedly) goes into old age, its growth would usually decline further. We will put it at 4% for the sake of this example. (There’s no particular reason for this, but you can play it by the ears and experience. If the company seems to be growing at a bigger pace, you can move the projection to be a bit higher, and vice versa).

Let’s see how the calculation works in the wild, shall we?

Let's get to it

For this example, we will take the data we already had from our previous article. You can find it below:

The second component: Free Cash Flow

For this, we will use Apple’s 2022 Annual Report. The value that we obtained is as mentioned below, and if you want to see how we came up with it feel free to read the article above.

Back to our formula:

Terminal Value = Final Year Cash Flow × (1 + Terminal Growth Rate) / (Discount Rate — Terminal Growth Rate)

In this case, the final year cash flow refers to the final year that we projected, i.e., the 10th year (2027), where the expected future cash flow is $81.16 billion.

The Terminal Growth Rate is as we decided above, which is at 4%. The discount rate that we came up with is 8%. Why 8%? In short, that includes the risk-free (4.21%) rate of investment plus a few more percent assuming that there’s a better investment than the safest one. If you want to know more, head to this article and go to the “Present Value” paragraph.

Now that we have all the values needed. All we need to do is start calculating.

Terminal Value = Final Year Cash Flow × (1 + Terminal Growth Rate) / (Discount Rate — Terminal Growth Rate)

Terminal Value = 81.16 × (1 + 4%) / (8% — 4%)

Terminal Value = 3,230,596,975,774 or 3.23 trillion

So, the (projected) sum of all of Apple’s future free cash flow for its terminal years (based on our rough estimate) above is around $3.23 trillion.

Is this final? Of course not. Many things can happen over the course of your investment, but this is just a rough estimate.

How is this useful? This number will be needed when we proceed further into the Discounted Cash Flow rabbit hole. The Terminal Value is especially important when you want to calculate the Net Present Value, which will be our next topic to cover. Ciao!

Bottom line

- Terminal Value represents the estimated value of a stock at the end of a specific projection period.

- This is typically when you’re trying to calculate the present value of all future cash flows generated by the investment.

- Terminal Value = Final Year Cash Flow × (1 + Terminal Growth Rate) / (Discount Rate — Terminal Growth Rate)

- Terminal Growth Rate in the formula refers to the rate at which a company’s cash flows are expected to grow indefinitely into the future after a specified projection period.

- The Terminal Value is especially important when you want to calculate the Net Present Value.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More