The second triangle: the Descending Triangle

Read MoreFundamental: Discounted Cash Flow (Part 2)

The second component: Free Cash Flow

This is part of a long-running series on AxeHub where we discuss how investors would use the fundamental analysis technique to see which companies are worth buying and which are not. There are generally three main steps for you to do it (of course, this varies according to your preference, but this is how we generally do it).

The first step, look at the business overview to get a first glance at how the business is doing generally. If they pass the test, move to the next step and apply financial ratio analysis on these stocks to see if it supports your initial findings. If this step is passed, move on to the last step which is to look at Discounted Cash Flow (DCF) to see if the price that you’ll buy it at is worth it or not.

We are now at the last step. However, mind you there are a few core concepts that we’ll need to master before we can actually jump into the DCF evaluation. In this article, we will learn the second concept which is the free cash flow.

From what we've learned before…

Previously, we’ve spoken about the future & present value, and we’ve touched along the way on the concept of Net Present Value, which is to see how much something is worth today when you factor in the growth that it can bring. If we remember correctly, the example we used was of a vending machine that can generate a steady annual income.

To see how much you should pay for the machine, we use the present value to see how much the money it will make is actually worth today, and from there we sum the present value to get the net present value. If you want to read more on that, you can head to the article below:

Fundamental: Discounted Cash Flow (Part 1)

That is if we are speaking of vending machines. In this case, we want to buy stocks, not vending machines. If we’re speaking of vending machines, we can look at the future cash flow it can generate, but what about stocks? For stocks, we use the free cash flow!

Free Cash Flow?

Free cash flow is simply the money that the company makes from its business, minus all the expenses. In a more structured way of saying it, it’s the company’s cash generated by operating activities minus its capital expenditures.

Capital expenditures here refer to any spending the company had incurred to operate, as well as its purchase of plant, equipment, and properties.

The formula for that is:

Free cash flow = Cash generated by operating activities — capital expenditures

Let's see how it's calculated!

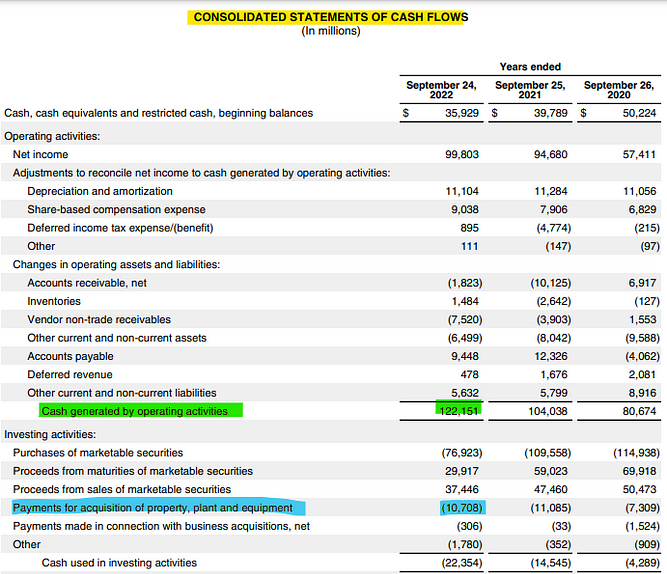

For this, we will look into Apple’s 2022 Annual Report. In its consolidated statement of cash flows, you can find the two values needed, the cash from operating activities (highlighted in green) and the capital expenditures (highlighted in blue).

Question: Why do we just take the blue value, what about other expenses Apple incurred? The answer is that these expenses are already factored in when they calculate what now results to the green value.

Without further ado, we’ll get to the calculations now.

Free cash flow = Cash generated by operating activities — capital expenditures

Free cash flow = 121,151–10,708

Free cash flow = $110.443 billion

So, what do you do with that?

Let’s remind ourselves why we’re here. We’re here to see how to calculate a reasonable price to purchase a stock. What have we identified so far is how to calculate future & present value, and how to calculate free cash flow. Where do you go after finding the free cash flow?

Step 1: Look for the average free cash flow growth rate

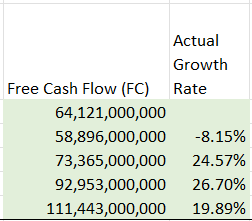

First, look into how the free cash flow has grown over the past 3 to 5 years, and find the average growth rate. The way to calculate the growth rate is not that hard, how it’s done is:

Growth rate = free cash flow year 2 — free cash flow year 1 / free cash flow year 1 * 100

Here’s what we calculated and tabulated in Excel (you can see the formula we use is really simple):

From this, we can get the average growth rate over the last 5 years, which is 15.75%.

Step 2: ‘Iron out the creases’ from the latest free cash flow

As of the time this article is written, the latest annual free cash flow we have of Apple is its 2022 free cash flow. We want to project the price forward, right? This means what we want to do is we want to see how the price will grow from 2022 to 2023, 2024, 2025, and so on.

Why do we need to iron out the crease? Why not just use the free cash flow value we get from 2022? Now, what if Apple’s 2022 sales sucks? What if its cash flow is negative in 2022, but in the past 3 to 4 years prior it made gazillions of dollars? It wouldn’t be fair to start your projection at a negative value when the company has been doing so well over the past few years.

Hence, we’ll have to calculate the average free cash flow over the past 3 to 5 years.

From the above, the average free cash flow is $80.16 billion.

Step 3: Estimate future cash flow

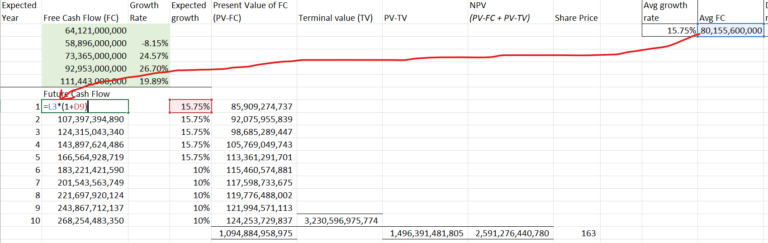

What we’re going to do now is we can try to estimate the future cash flow of Apple by adding in the growth rate for each year. However, mind you the growth rate might not be the same after it has been growing for like 5 years. After all, most companies will stabilize, and their growth rate may be reduced over time.

Right now, we are using Apple, which is a tech company. Tech companies are a bit unique in terms of their growth, and some of them can maintain rapid growth over time. However, just for the sake of it, we’ll still reduce it after 5 years from 15.75% to 10% (we just made the number up).

So, here’s what it’s going to look like:

TA-DA! Now you can calculate the prediction for future cash flow of a stock!

What can you do with this? In our next few articles, we will show you how the value that you have found here and the ones that you found previously can be used to calculate the best-estimated price for the stock.

Bottom line

- The free cash flow tells you how much a company makes from its operation minus its capital expenditure.

- You can use historical free cash flow to calculate its rate of growth.

- Using that rate of growth, you can presume the future free cash flow of a stock.

- Based on the value that you will get from the future free cash flow, coupled with a few steps that we’ll explain in future articles, you can estimate the fair value of a share.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More