Say, you started working your first job right at the beginning of the 1980s. The average starting salary back then is around $1,600 per month (not yet adjusted for inflation), so that’s what you’re getting. As for the cost of living, having just graduated, we’d strike away cars, new houses, and gasoline from your expenses.

So, what would your spending look like? For food, let’s just say here’s your monthly grocery (note: you’re single and just landed a job):

Milk: 1 gallon at $1.59/gallon = $1.59

Apple: 12 pounds at $0.35/pound = $4.20

Corn: 24 pieces at $1.18 for 12 = $2.36

Sliced bread: 4 loaves at $0.50/loaf = $2

Pork and beans: 20 at $0.40 each = $8

Pork chop: 7 pounds at $2.49/pound = $17.43

Potatoes: 10 pounds at $0.20/pound = $2

Tomatoes: 5 pounds at $0.39/pound = $1.95

Turkey: 17 pounds at $0.55/pound = $9.35

Cheese: 36 pieces at $1.47 for 12 = $4.41

So, for the basic food, you spend around $53.28, let’s round it off to around $80 — $100 considering other things that may not be listed.

For rent, you spend around $250 a month. For public transportation, you spend around $20 for the monthly pass. Now we’ve covered food, shelter, and transportation. It all sums up to around $370 for the basic necessities. It’s the 80s though, so let’s throw a few more dollars into the cauldron just to make it up for other things, and round it off to $500.

You’re now left with $1,100 from your salary. Everyone wants a dream car and a dream house, right? At least in the 80s. You save some of those for new house deposits Let’s just estimate the price at $97,204 for when you want to place your deposit of 10%.

Say, you want to place your deposit after 5 years of working, that’d be $9720.4 in 5 years, so you save around $162 a month. For your car, let’s put the price at $10,822, and again, you want it to be done in 5 years, so that’s around $180.40 a month.

In total, you’ll spend around $842.4 in a month, on food, rental, transportation, savings for houses and car — all of it. That will now leave you with another $757, cut it down more for miscellaneous things like fluffy wigs, and let’s just leave with $500.

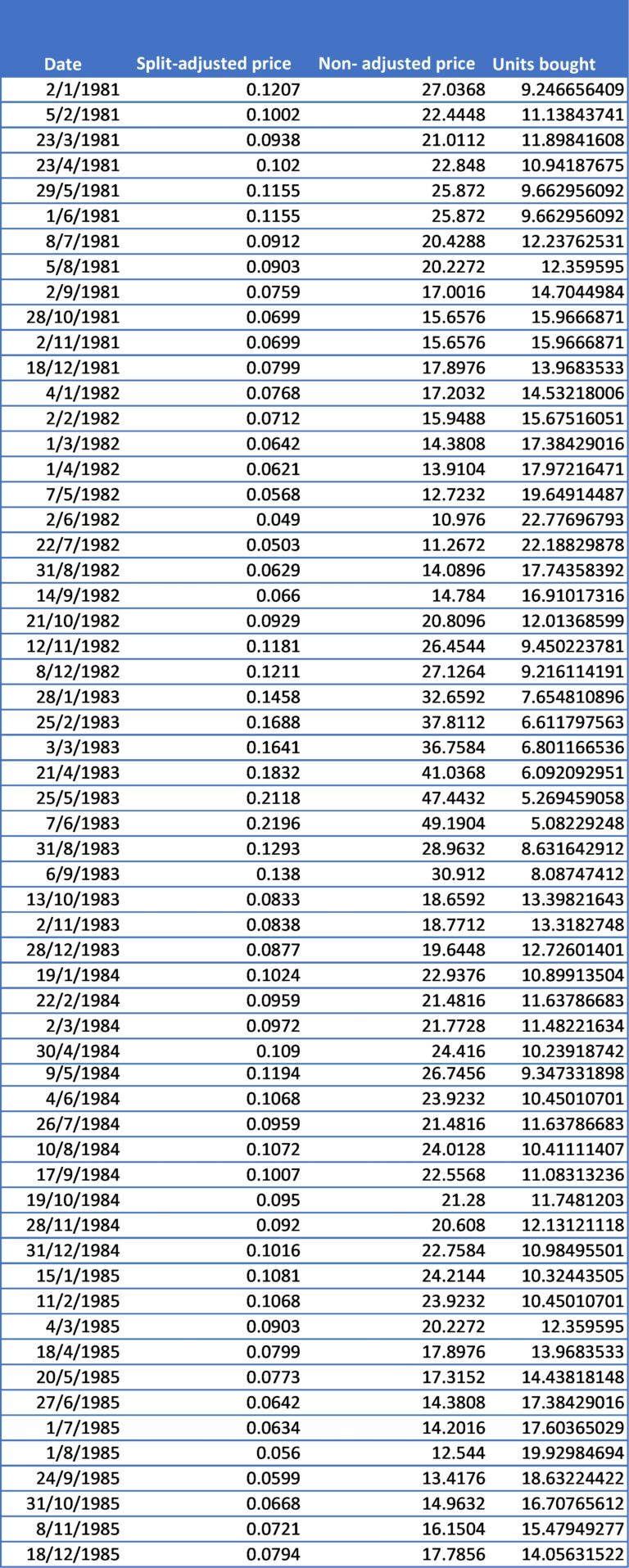

With the remaining $500, take half of it for your just-in-case savings, and now you’ll have $250 to invest, and let’s just say you only want to invest for five years, because after that you’ll be getting a house and a car to pay installments for.