The second triangle: the Descending Triangle

Read MoreRisk management: Correlation Matrix

How to get the Correlation Matrix for your portfolio?

Before this, we’ve spoken about how to look for variance and covariance matrix as part of the steps needed to see how risky your portfolio is. Moving forward now, the correlation matrix will be the ‘gauge’ of sorts that will let you see how closely related the stocks in your portfolio are.

What do you want from this?

Long story short, a correlation matrix can be between 0 to 1. The closer it is to 1 means that they are closely related. What you want to have in your portfolio are stocks that are not too closely related so that you can diversify your risk. Is that everything you need to know? Not really. After finding the correlation matrix, we will have to look at the Portfolio Variance to get an overall ‘score’ of your portfolio.

If all these are too tedious…

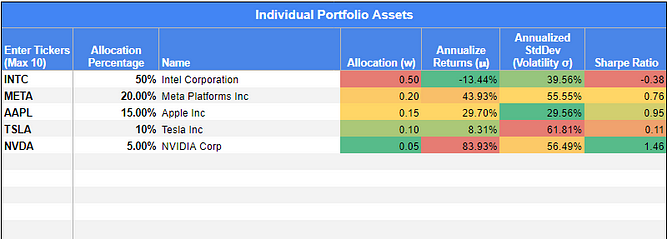

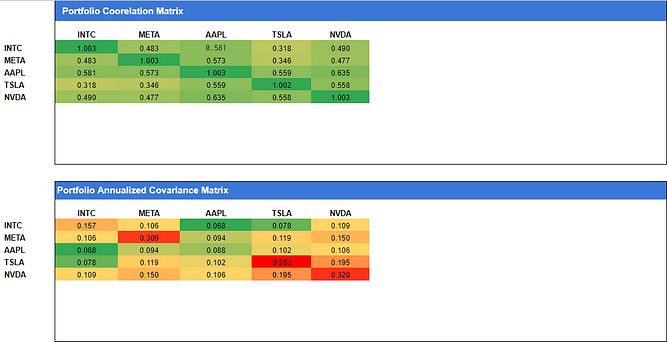

You can skip all of these lessons and head straight to this Google sheet file. All you need to do is fill in the ticker name for the stocks that you have and their weight. All credit for the sheet file goes to John Mihalik who published it on his Medium page.

By the way, the weight is how many percent of your portfolio the stock constitutes. For example, the total money you allocated to invest is $1,000. Out of that $1,000, $100 is invested in Stock A. So, Stock A’s weight is 10% ($100 out of $1000 is 10%).

These are some of the things that are included in the Google sheet file:

It’s super helpful! You can see from the example above how different stocks in your portfolio correlate to one another, like how INTC and META have 0.483 in correlations.

The key to risk management is to make sure your stocks are diversified so that some stocks shouldn’t be strongly correlated to another. If a few of them are, it’s okay, but make sure not too many of them are strongly correlated — that would mean that your portfolio is not diversified well.

If getting to it is all you need, the stuff above is already enough for your needs. If you want to know how to do it, or you want to have more than just 5 stocks in the matrix, then stick around!

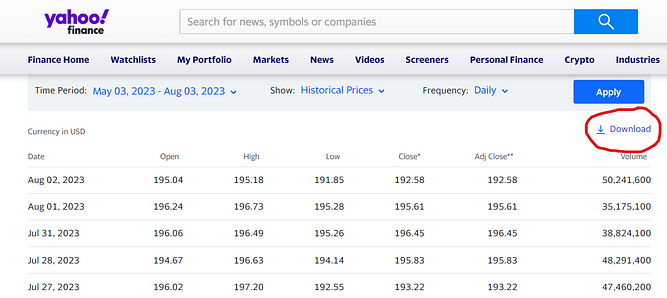

Step 1: Get the data that you need.

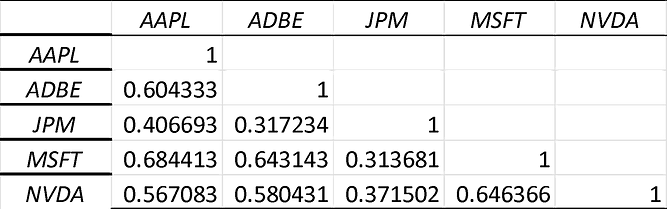

By data, we would usually use the closing price for each stock. In this example, we are using the closing price for five stocks: Apple (AAPL), Adobe (ADBE), JPMorgan (JPM), Microsoft (MSFT), and Nvidia (NVDA).

You can get this anywhere, but the easiest way is to head to Yahoo! Finance. You can download the historical price sheet for free. As for this example. We will use the data from September 7th, 2022 to September 7th, 2023.

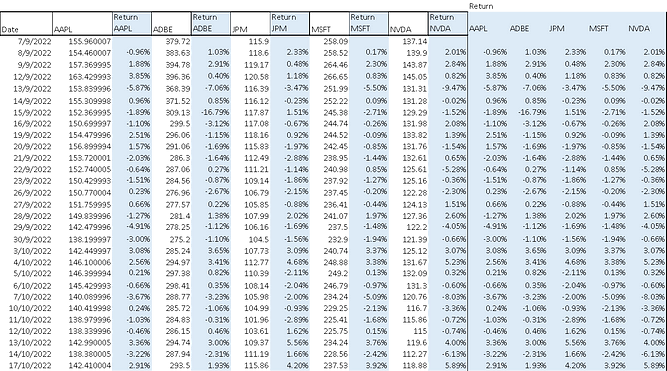

Step 2: Calculate the daily returns.

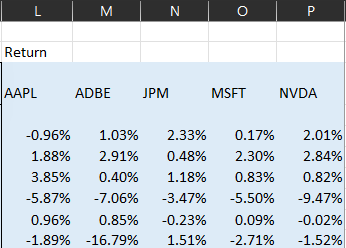

Below you can see how we did it (of course, you can do it your own way). The price extends until September 7th, 2023, but we don’t have enough space for that, but the ones below would do the trick hopefully.

To calculate daily returns, just use the formula below:

Return = (Day 2 Price — Day 1 Price)/Day 1

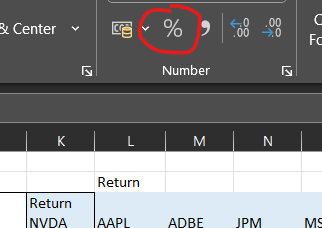

Once you get the return, change it into a percentage by using the function below (we are using MS Excel by the way).

Do note how we arrange all the returns on the right side of the table. This will make it easier for us to do the Excel stuff later on.

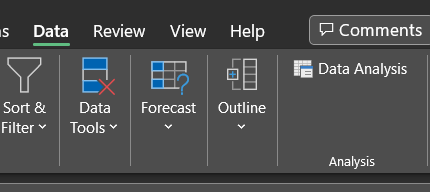

Step 3: Enable the 'Data Analysis' Add-Ins on your Excel (if you haven't already)

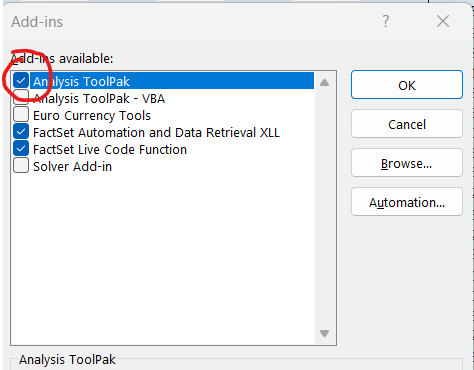

Now, in your MS Excel, look at the “Data” tab, and look for the “Data Analysis” function per above. If you can’t find it there, then enable it using the simple steps below:

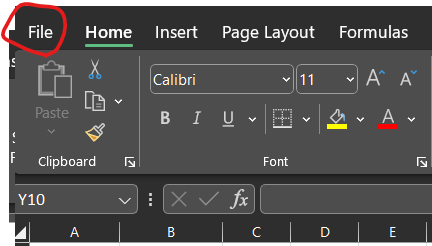

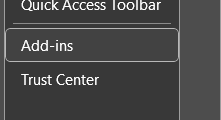

Go to the “File” tab

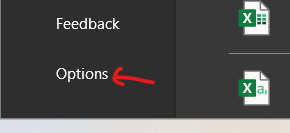

Head over to “Options”

Go to “Add-Ins” tab

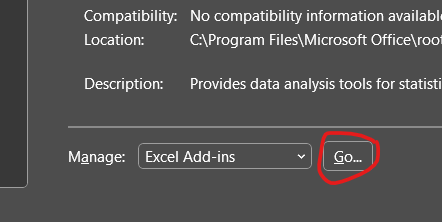

Then head over to “Excel Add-ins”

Check this box and press “OK”

You will now have the Add-ins enabled. (Don’t ask me why they don’t automatically enable it the moment you install the software).

Step 4: Get the correlation matrix

To do this, follow these simple steps:

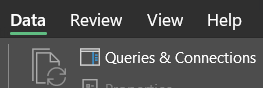

Head to the “Data” tab

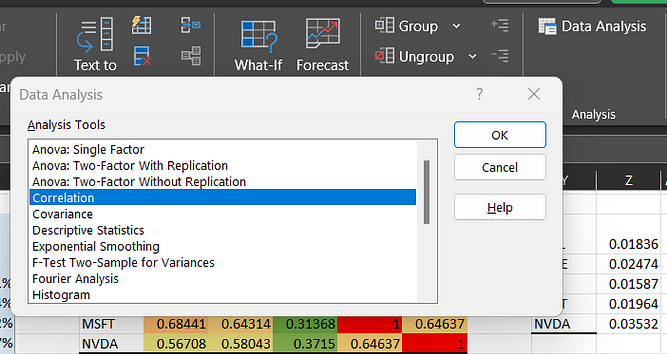

Click on the “Data Analysis” function and then click on the “Correlation” option. Press “OK”.

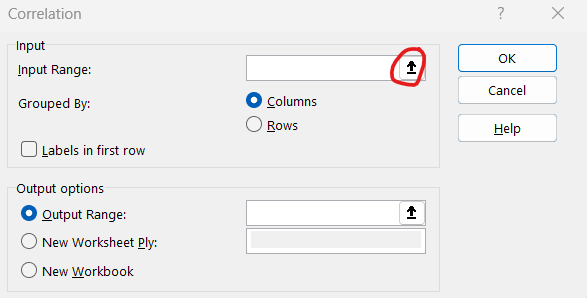

You will see this tab. Click on the ‘arrow’ looking button to select your input range.

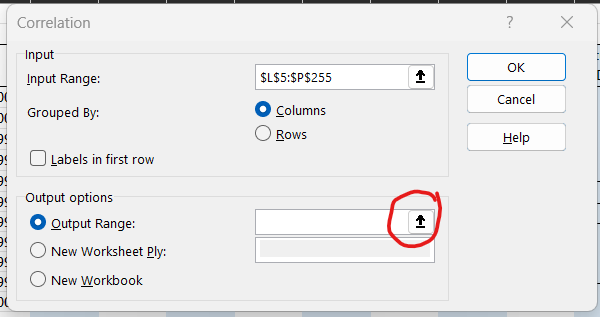

Now, select all of the returns value that we have arranged beforehand. (we just show 6-days value but actually select all of them, all 1-year worth of data).

Also, you can also select the stock name if you want (the “AAPL”, “ADBE”, etc.), just make sure to select the “Labels in first row” checkbox if you do.

Next, select an output range. This is where you’d want to have the matrix presented. Make sure you allocate enough space. (For 5 stocks it would be around 6 by 6 cells including the label, I think).

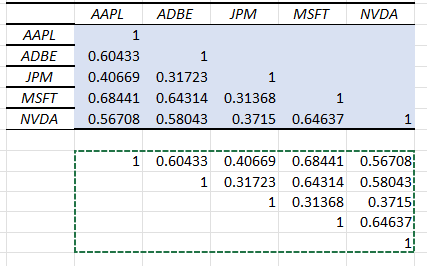

You will then get this:

Are we done? Yes, but there would be a little bit more step to make it a proper matrix table for our next use, which is when we want to calculate the whole portfolio variance, the final step to see how well diversified your portfolio is.

Step 5: Make the matrix table more proper

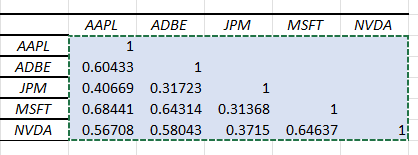

What you want to do is select all the values in the correlation matrix table, and press “Copy”.

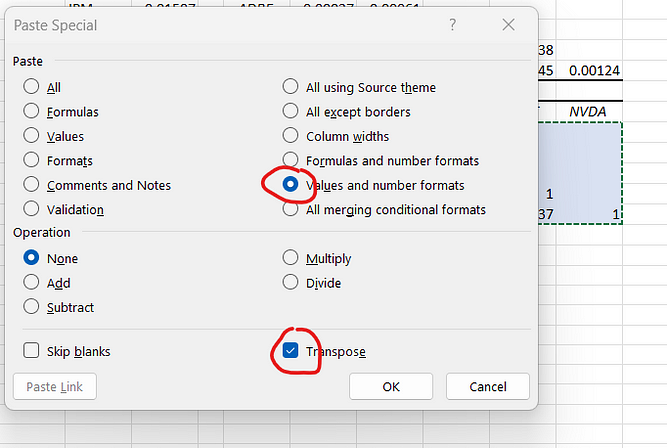

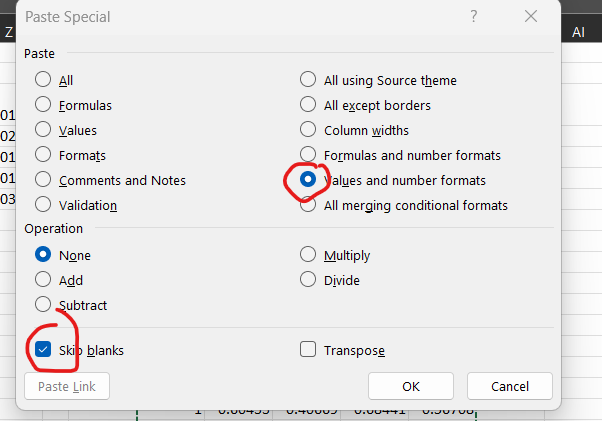

Next, select another blank area and right-click. Select “Paste Special”. Then tick on the “Values and number formats” and “Transpose”.

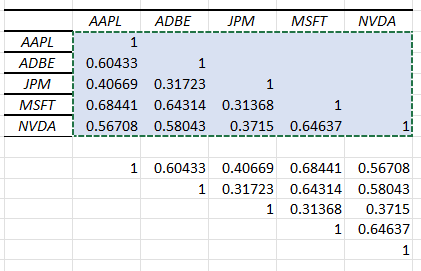

You will now have this:

Note: if you look carefully, they are the same number but in an inverted form.

Then, select the new numbers that you have produced (in our example above, they’re the inverted version at the bottom), and click “Copy”.

Now, click on the first cell in your matrix table (in our example, it is AAPL-AAPL, the one with value “1”), right-click, and press “Paste special”. In the Paste Special menu, check the “Values and number formats” and “Skip blanks” checkbox like shown below. Then click “OK”.

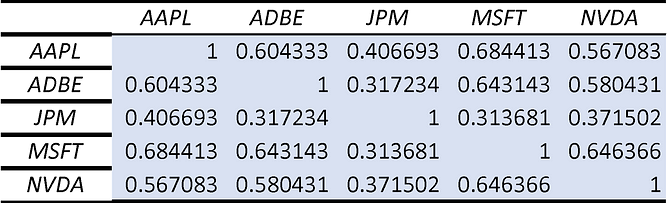

Ta-da! You will now get this:

This is the proper correlation matrix table that you will need for the final step, which is to look for the Portfolio Variance value. We will get to that in our next article. Hehe.

Oh, and here’s a link to our Excel file if you want to play around with it.

Step 6: Stand up and stretch

Yes, get up from that chair, or bed, or whatever you’re on (if you can). Stretch your body a bit. It ought to be a bit tiring, get a snack or something. Oh, and give yourself a pat on the back. It might not be much, but it’s never wrong to appreciate yourself for learning new things, as little as it can be. An achievement is an achievement. You deserve love from yourselves, more than anything.

Bottom Line

- The correlation matrix is used to see how closely related the stocks in your portfolio are.

- What you want to have in your portfolio are stocks that are not too closely related so that you can diversify your risk from price fluctuations.

- A correlation matrix can be between 0 to 1. The closer it is to 1 means that they are closely related.

- A correlation matrix is only useful if you want to see how two stocks in your portfolio correlate with each other.

- After getting the correlation matrix, you can find the Portfolio Variance value, which is like an ‘overall score’ of your portfolio diversification.

- The Portfolio Variance will give the overall diversification score for your portfolio.

- We will teach you how to get the Portfolio Variance value in our next article. (This one is already too long! Cowwy).

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More