Market Update 30/1 - Storm After The Calm in the US?

Will the US market face danger that still looms?

The United States (US) has been seeing some positive growth in the market recently. Driven by falling gas prices, the consumer price index (CPI) saw a -0.1% decrease In the January 12th CPI report. Upon anticipating that the 6.5% inflation estimate is in sight again, the market leapt with joy.

Question is, does danger still loom?

How it was so far:

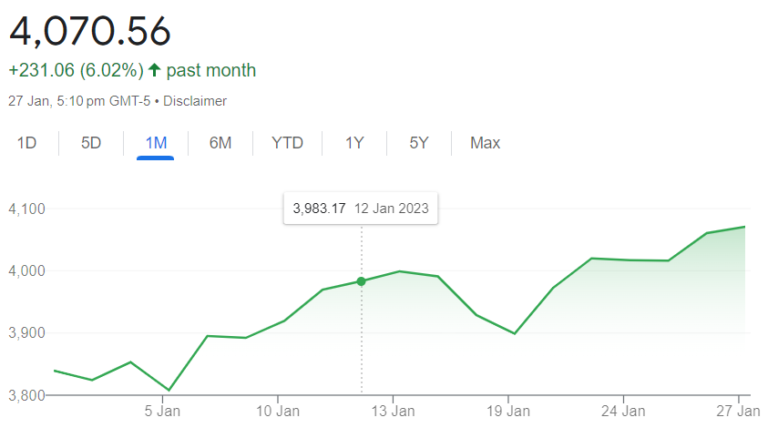

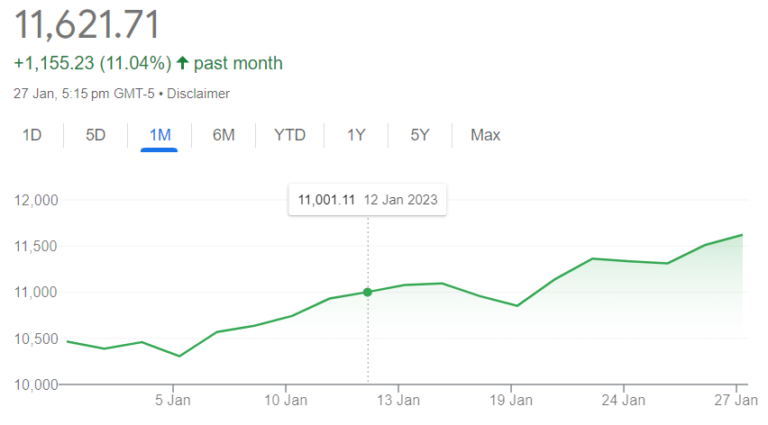

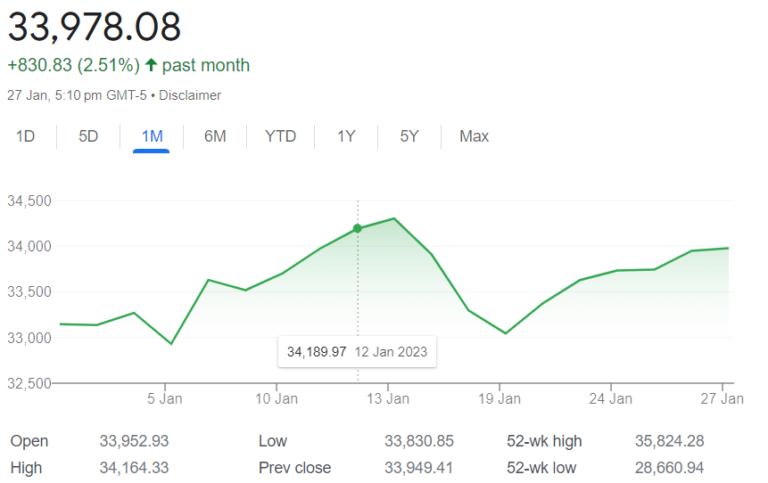

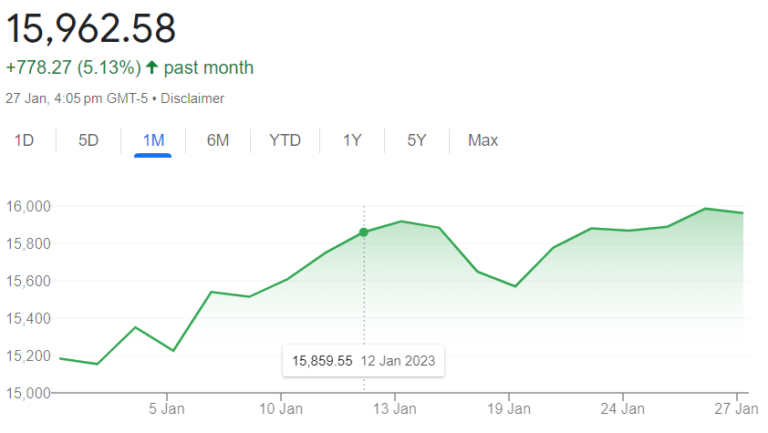

Upon the 12th January announcement on falling CPI, many indices rose as investors rallied on optimism. The rally is still ongoing given the strong labor market data. Here is how major indices perform since the announcement.

The S&P 500 saw its price rally up by 0.20% in the week of the announcement prior to a 2.31% dip since its January 17th peak. However, the rally continued to make it a total of 2.19% hike from January 12th to January 27th.

The Nasdaq Composite Index saw a rally of 0.85% in the week of the announcement, followed by a total rally of 5.64% from the time of the announcement up to the point that the market closed on January 27th.

The Dow Jones Industrial Average (DJIA), however, took a slightly different path, whereby the price rose by 0.33% a day after the announcement, before falling by 1.14% for the week.

The fall continued to reach its January 19th bottom price, a 3.67% fall from January 13th, before stabilizing up to make the price difference from the January CPI announcement up to January 27th a slight 0.62% fall.

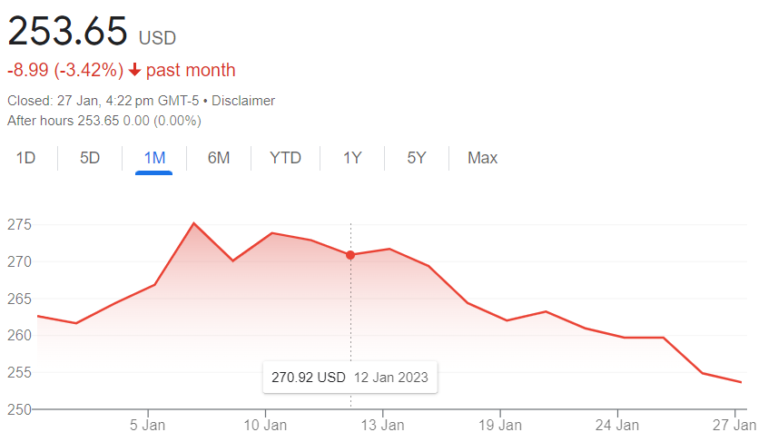

This can be explained given that among the top 10 stocks (in terms of price) under the DJIA, only McDonald’s Corp (NYSE: MCD), Caterpillar Inc. (NYSE: CAT), Microsoft Corp (NASDAQ: MSFT), and Visa Inc (NYSE: V) saw a rise from January 12th to January 27th.

On top of that, the rise in these few stocks is relatively smaller than the fall in many. Amgen Inc. (NASDAQ: AMGN) for example, saw a 6.37% dive from the January 12th CPI announcement day. Compare that to the 4.05% contributed by the highest gainer (among the top 10) since January 12th, Microsoft Corp (NASDAQ: MSFT).

The NYSE Composite index saw a total 0.65% rise from January 12th to January 27th, a relatively smaller rise than the other indices mentioned above.

How it is currently going

The news that has been going on surely is not a melody to the ears. Is it a sign of a storm that is to come? Or is it simply a warning breezing by? That is for the future to tell.

What we can tell so far is that the Bank of America (BofA) forecast that the US will face a loss of 175,000 jobs a month – wait, we had to read it again – yes, in a month. That is approximately 2.1 million total job losses in a year.

Compare it with the total employment in the year of 2022 estimates (158.28 million), which is a total loss of around 1.33% of the US workforce. Of course, it is too early to assume the scenario, but given the circumstances, it’s not a far-fetched guess to think that it is a part of the cyclical unemployment phenomena.

“Cyclical unemployment is a lack of employment as a result of changes to an economy's business cycle. Cyclical employment is caused by job losses during downturns or contractions in an economy.”

As any cycle goes, we can expect that even if BofA’s forecast is to come true, the labor market will look to soothe its sore as many will be reabsorbed, but we may not be seeing that anytime soon.

On another hand, a still-not-so-good hand, somewhere around January 27th, Treasury Secretary Janet Yellen mentioned to Bloomberg her belief that the economy is at risk of recession, based on the data available to her.

Yellen points out that a high interest rate is her main concern in deciding that perhaps recession is still looming in the shadows.

Take said concern and pair it with the Personal Consumption Expenditure (PCE) Price Index released by the Bureau of Economic Analysis (BEA) recently, we can see that consumption has slowed down in Q4’22 compared to Q3’22. From said data, we can see how the PCE Price Index rose by only 3.2% in Q4’22, while it rose by 4.7% in Q3’22.

Well, if we are to avert our gaze to the bright side, the mannerism in which the opinion was delivered suggested that the possibility of recession remains a possibility – at least for now.

“I’m reasonably satisfied by the data that I’ve seen so far, but I don’t want to minimize the risk of recession,”

According to analyst estimates by the end of 2022, there was a 65% chance of a recession from Q2’23 to Q3’23. However, this will depend on how the labor market will go, and of course, how you define a recession. The general indicator is on shrinking GDP (the recent report shows an increase), increased unemployment and shrinking income (the recent labor report shows that it is still going strong).

Nonetheless, as many of the recent layoffs point their fingers at the economic landscape that we are currently in, investors should be cautious about further shrinks in employment and income – and if paired with relentlessly high interest rates by the feds, a recession is almost inevitable.

How will it go?

Based on the current 2023 trends, big tech companies, along with real estate, investment banks, and manufacturing companies are looking to a rough start. Meanwhile, between June 2021 to June 2022, the professional and business services sector saw 2.12M layoffs; trade, transportation and utilities saw 1.46M layoffs; while leisure and hospitality saw 1.05M layoffs.

If, and we repeat, if – we are looking to see reductions in employees based on who has the most employees, you should turn your focus on these companies:

Tech

- Amazon (NASDAQ: AMZN) – 1.54M employees.

- IBM (NYSE: IBM) – 282,100 employees.

- Microsoft (NASDAQ: MSFT) – 221,000 employees.

- Alphabet (NASDAQ: GOOGL) – 186,779

- Apple (NASDAQ: AAPL) – 164,000

So far, apart from Apple, all of the companies above went through layoffs circa 2022-2023.

(Source: CompaniesMarketCap)

Real Estate

- CBRE (NYSE: CBRE) – 105,000 employees.

- Rocket Companies (NYSE: RKT) – 26,000 employees

- Geo Group (NYSE: GEO) – 18,000 employees.

- Americold (NYSE: COLD) – 16,275 employees.

- Equinix (NASDAQ: EQIX) – 11,451 employees.

CBRE and Rocket Companies went through layoffs recently.

(Source: CompaniesMarketCap)

Investment Banks

- JPMorgan Chase (NYSE: JPM) – 250,000 employees.

- Morgan Stanley (NYSE: MS) – 73,000 employees.

- Goldman Sachs (NYSE: GS) – 40,900 employees.

Morgan Stanley had layoffs by the end of 2022, and Goldman Sachs had theirs only recently.

(Source: Vault, as of 2022)

Manufacturing

- Schneider Electric (OTCMKTS: SBGSF) – 136,727 employees.

- Stryker (NYSE: SYK) – 38,410 employees.

- Trane Technologies (NYSE: TT) – 35,400 employees.

- Dow Inc (NYSE: DOW) – 34,933 employees.

- Nucor Corp (NYSE: NUE) – 27,000 employees.

Dow reportedly is planning for job cuts to save $1B.

(Source: Fortune, as of 2022)

However, job cuts can either be good or bad news. If the job cuts are done because the company is unstable, or is performing poorly – then the price will most likely fall. If the layoff was done to cut down on unnecessary expenditures, or as a part of a new strategic business approach, then the price will most likely rise

What if a recession happens?

Let’s cut to the chase, recession will definitely affect the stock market in general. Moving a bit specifically, here are the sectors that may be implicated if a recession occurs:

1. Retail

A bad economy with people having less to spend will definitely affect the retail sector, which sadly relies heavily on people’s ability to spend. However, moving a bit deeper into the retail sectors, there are many sub-sectors under retail which one can separate into necessities and luxuries (“luxuries” here refers to anything that is beyond necessities).

Retail companies like Amazon (NASDAQ: AMZN) may be seeing a reduction in spending within the app, but given the wide range of items sold, including necessities, the business will likely go on as usual – affected, but alive.

2. Travels

Another sector which may take the blow if a recession is to occur in the US is that many will cut their travelling expenses, especially for leisure purposes like tourism. Travel can be in two ways, domestic travel and overseas travel.

In terms of travel, airline companies are the ones who are most likely to be susceptible to recession. Take Delta Air Lines (NYSE: DAL), which saw its stock plunging down by around 40% during the 2007-2009 recession, and around 30% during the 2019-2022 COVID recession.

3. Real Estate

Real estate companies may be affected if a recession is happening. With unemployment soaring and income plunging, real estate companies may find it harder to sell their existing properties to unable buyers.

Existing house buyers will also find it harder to settle off their mortgage payments if a recession happens.

This can be seen in companies involved in properties like Simon Property Group (NYSE: SPG) which saw its price plunges during the 2007-2009 recession, and the recent COVID recession.

However, considering the 2007-2009 recession in this context is still questionable, given that the recession specifically revolves around the housing market. It is inevitable that the shrapnel pierced through (almost) every real estate stocks out there.

The recession that may happen in 2023 will most likely revolve around the issue of inflation, supply-side disruptions, and high interest rates. There is a chance that the real estate sector may be affected by the recession, but it may not be as hard as it was circa 2007-2009.

What about tech?

Well, it’s not that we don’t want to include tech companies in the “what-if-recession-happens” segment, but it’s quite hard to pinpoint what is tech and what isn’t nowadays. At some point, many companies can be considered as tech in their own spectrum. Say, we mentioned Amazon under retails above, but Amazon is also a tech company, right?

So, when speaking of techs, it’s important to have it spoken under the sub-sector in which these techs are. Travel apps are tech companies but in the travel sector. Hosting apps like Airbnb is a tech company but under the real estate/travel sector.

Key Takeaways

- The economy and market are looking good so far, but it doesn’t mean that danger is not around.

- Treasury Secretary Janet Yellen mentions that recession may still happen, while BofA predicts 175,000 layoffs per month in 2023.

- Tech, real estate, investment banks, and manufacturing companies are leading the 2023 layoff headlines.

- If a recession happens, retail, travel, and real estate companies may be taking the hit.

- Note: most of the companies mentioned above serve only as a sample from their respective sectors, it is in no way a suggestion to buy/sell said companies’ stocks.

The key-takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.