Market Update 23/1: Lunar New Year, Google & SBF

The market celebrates the year of the rabbit. Google’s massive layoff and SBF’s misfortunes

Yesterday marks a glorious moment in the Chinese Lunar calendar as the tiger made its way for the year of the rabbit. Chinese worldwide celebrates another tapestry in the Lunar Calendar.

As the crackles of fireworks and firecrackers accompany the festive, the humdrum of those at Google facing layoffs and Sam Bankman Fried (SBF) facing one after another legal turmoil made about the same noise in the market.

The Year of The Rabbit

Longevity, peace, and prosperity. These are the traits that the rabbit symbolizes. Perhaps it is not wrong to say that we are already seeing prosperity part in the market as the Lunar New Year emerges.

Transportation

The Lunar New year is not just a new year celebration for the Chinese. It is the time when families gather around for a grand meal, a celebration of not just the dawn of a new day — but rather the spirit of togetherness, love, and a moment to appreciate the blessings they have enjoyed throughout the year.

It is trite that families all around would return to their hometowns. Children to their parents, grandchildren to their grandparents, and spouses-to-be… well, to their relentless interrogations.

With China having ended its Zero-COVID Policy, traveling to and from China is now possible again. Expert estimates around 2 billion trips will be made over the 2023 Lunar New Year festive. To better understand the perspective of how huge 2 billion trips are (well, “billion” itself is large enough, we know), only 54.6 million travels were expected for 2022’s Thanksgiving festive.

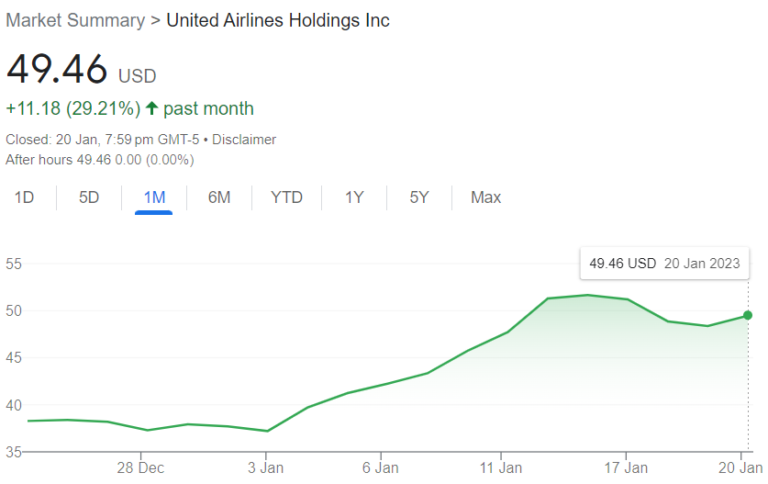

How the fortune which the Lunar New Year has brought is reflected in the US market can be seen in stocks that cover transportation to and from China, such as United Airlines (NASDAQ: UAL).

The rally coming up to Lunar New Year began as early as January 3rd, with the stock price moving up by 32.92%.

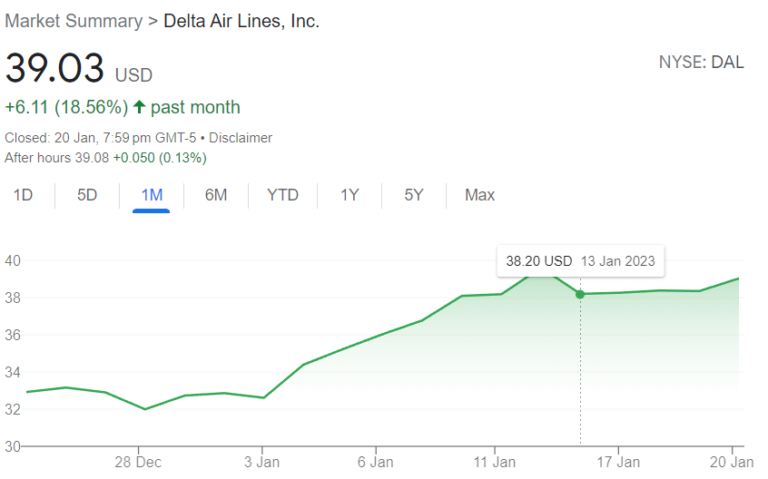

The same can be seen in Delta Air Lines (NYSE: DAL) stock:

The reason behind the early rally is not unknown — nobody books their festive-purposed flights a day or two before flying. It is wise to quote a Chinese proverb held on by many, “Bù shàn shǐ zhě bù shàn zhōng” (A bad beginning leads to a bad ending), which you can roughly understand as “bad planning will lead to bad results”.

Imports

Despite the constant bickering about who is set to be the prominent nation, the US and China still maintain a strong connection in terms of trade. In fact, China boasts a huge sum in terms of its export to the US, making it one of the biggest imports in the US market.

According to the data provided by the United States Census Bureau, the value of US imports from China in 2022 is at $499.45B. How a halt in Chinese business would be reflected can be seen from the companies seeking to receive from these imports.

Honeywell International Inc. (NASDAQ: HON), a technological manufacturing and service provider, saw its stock price taking a 1.08% dive from January 18th to January 20th. The company is known for its active production and R&D activities in China.

Honeywell saw its stock fall during the 2020 Lunar New Year season by 3.3% from January 17th to January 24th. However, the same trend did not persist during 2021’s Chinese New Year event (February 12th) where the stock saw a 0.32% between February 5th to February 12th, given the rapid news of plant reopenings in the US during that time period.

The year of the rabbit will surely be an interesting sight to the market, given how the previous tiger year scared the bull away in some heavyweight sectors. Let’s hope that it will bring longevity of bulls, prosperity to our trades, and peace to our minds.

Read More: Joy as inflation falls

Google Layoff

Through a memo, Google’s CEO, Sundar Pichai, announced that Google might be looking at a massive layoff of 12,000 employees (6% of the total workforce) to manage its way across the current economic landscape.

As we sifted through the words, the message was simple: we hired too many, and now is not the time to have too many employees on board.

Here’s a part of the said memo, should you be interested in its authentic literature:

"Over the past two years, we've seen periods of dramatic growth. To match and fuel that growth, we hired for a different economic reality than the one we face today."

This doesn’t come as a surprise, given how earnings per share for Google have tumbled down in 2022, with Q1’22 looking at $1.23, $0.30 lower than the previous quarter. The number continues to fall, down to $1.06 in Q3’22.

After the layoff announcement, the stock price for Alphabet Inc. (NASDAQ: GOOGL) is looking at an upward momentum in the past week, a trend which could be driven by rising investors’ interest in the possibility that Google will now spend less to run their business.

Now that we are speaking of spending, the employees (at least in the US) that are looking to receive their pink slip may also be looking at:

- Payment during the full notification period.

- Severance package of 16 weeks, with additional two weeks’ pay for every year, said employees worked at Google.

- Bonuses for 2022 and remaining vacation time pay.

- 6 months period of healthcare, job placement services, and immigration support.

As for the employees that are not within the US, the reimbursements will be in accordance with their respective countries’ local practices.

Read More: Layoffs Hitting Finance & Tech

Sam Bankman Fried Grilled by the Law

FTX’s CEO, Sam Bankman Fried (SBF) is now more than fried by the law as the scandal that saw the crypto market crashing down surfaced in November last year.

He is now looking at the possibility of $700 million worth of assets being seized by the US government if he was found guilty of defrauding investors.

The Securities Exchange Commission (SEC) accused SBF of fraud involving at least $1 billion of FTX’s customers’ money.

The basis of said charge is that SBF has been promoting FTX as a safe and responsible trading platform, while in reality there have been a few discrepancies lurking in the shadow:

- Undisclosed diversion of customers’ funds.

- Undisclosed special treatment to Alameda Research, including exemption from a certain level of risk measure.

- Undisclosed risk from exposure to Alameda’s holdings of overvalued and illiquid assets.

What’s next for him?

Well, $700 million is the least of the worries that SBF may have in mind. If he is ever found guilty of all his eight counts, he may find himself incarcerated for a period not shorter than 100 years.

On the other hand, SBF’s shortcomings may be a piece of good-bad news for the crypto market, whereby regulations will definitely grow tighter. It’s a double-edged sword situation where tighter regulation will mean a tougher way of doing business, but it also means that the market will grow in confidence over the security of their investments.

Key takeaways:

- Lunar New Year marks a short-term period of opportunities and challenges to corporate revenue.

- Transportation peaked during the Lunar New Year festive while industries that rely on China’s imports saw a temporary halt in supply.

- Google laid off 12,000 workers to navigate slower growth, putting investors’ confidence in the company’s ability to generate better profit.

- SBF may see $700 million of its asset gone while the crypto market is set for tighter regulations.

The key-takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.