How to identify a "good" crypto project?

It had been a whole roller coaster ride for every crypto trader this few weeks. Crypto prices going up and down. Some investor sees this as an opportunity to buy at discounted price while others suffer from egregious price fall. Thus, it is very crucial to perform your diligence research before investing in any crypto. Do not invest in something just for seasonal hype or in something you are unsure about.

Cryptocurrency, NFT, Metaverse Where to begin?

Crypto used to be just about bitcoins and now the crypto world had evolve far beyond that. It comes across Blockchain, DeFi, NFT, Metaverse and many more to come.

So, let’s break them into subsections –

- Cryptocurrency is a digital currency in which transactions are verified and records maintained by a decentralized system using cryptography, rather than by a centralized authority.

- NFT is a non-fungible token (NFT) that is a type of cryptographic asset. It is used to produce and authenticate ownership of digital goods. It represents Internet collectables like art, music, and games with an authentic certificate created by blockchain technology.

- Metaverse is a digital reality that combines aspects of social media, online gaming, augmented reality (AR), virtual reality (VR), and cryptocurrencies to allow users to interact virtually.

Here are some of the elements to check while doing your research.

History of the coin/ crypto project.

It is important to understand the reason behind a crypto project. What motivates the founders and developers team to come up with the project. What are the problems that arise in the market that they try to solve?

For example, Solana creation is to reduce transaction fees as currently, Ethereum is conducted with very high gas (wei) costs. Thus, The project’s mission is to ensure that not only can it be accessible to everyone, cheap, has short processing times but also be scalable enough to support real-world demand.

NFT is another take to solve the problem behind art ownership. When minting an NFT on the Mintable platform such as OpenSea, creators are given the option to transfer and specify copyright permissions in the item’s metadata. Not only that, an NFT creator can decide if they want to receive royalty as well as the royalties percentage for their work. It gives absolute freedom to the art creator.

The Team.

This is another vital element but often being overlooked. Check the team behind the coin—the founders and developers’ credibility as well as their past projects. The sole purpose is to check their presence to ensure that the team is legit and now just a mere set-up. They are usually available either on Discord, Twitter or Linkedin. Do extension check on any reports about scams involving team members or past projects? Are there any advisors on the project and what do they bring to the table? A good crypto project usually will also be audited thoroughly.

Coin’s characteristic.

Research on the coin’s creation purposes, its associated technology, used cases, and future projects. The pieces of information are primarily available on their whitepaper and tokenomics.

Before purchasing coins/tokens, answer this question – “is the coin/token method significantly better than the centralized traditional approach? Are they really needed for this?

Always researching how is a coin differs from another. What makes Matic and EOS different from PolkaDot and Ethereum? Is KSM different from XRP? Is AAVE the same as MKR? Understanding what can the project’s vision can help understand the future that the coin will unfold as well as the future of your investment.

Tokenomics.

As an investor, it is important to understand what is the value to the coins’ stakeholders. Does it reward their early adopters? Being an early adopter of a coin gives the project capital to visualise its mission. In another word, early adopters are like investors in the crowdfunding of startups.

Roadmap / community adoption

Transparency is the key to the crypto ecosystem. Understanding the roadmap (public document showing what the leaders plan to do with the money raised from a project) contains clear direction and a realistic strategy to proceed with the project. Always reflect on how well the team respond to their roadmap so far. Is the project ahead or falling behind. With this, it can help you narrow down your list of crypto to buy.

Crypto Community

Crypto coin’s success is heavily dependent on their community. Crypto communities are places where people hang out and discuss the latest cryptocurrency news, market conditions, tech, and ideas with others. The most active platform of crypto users is bitcoin talk, Twitter, Reddit, discord and telegram. The community have the power to move the demand for certain coins.

However, you will definitely meet with a ‘to-the-moon’ crypto enthusiast who is 100% sure the price of his coin of choice is going to the moon! Do not listen to them! Always DYOR (do-your-own-research).

How to detect a scam crypto investment?

Coin’s Activities

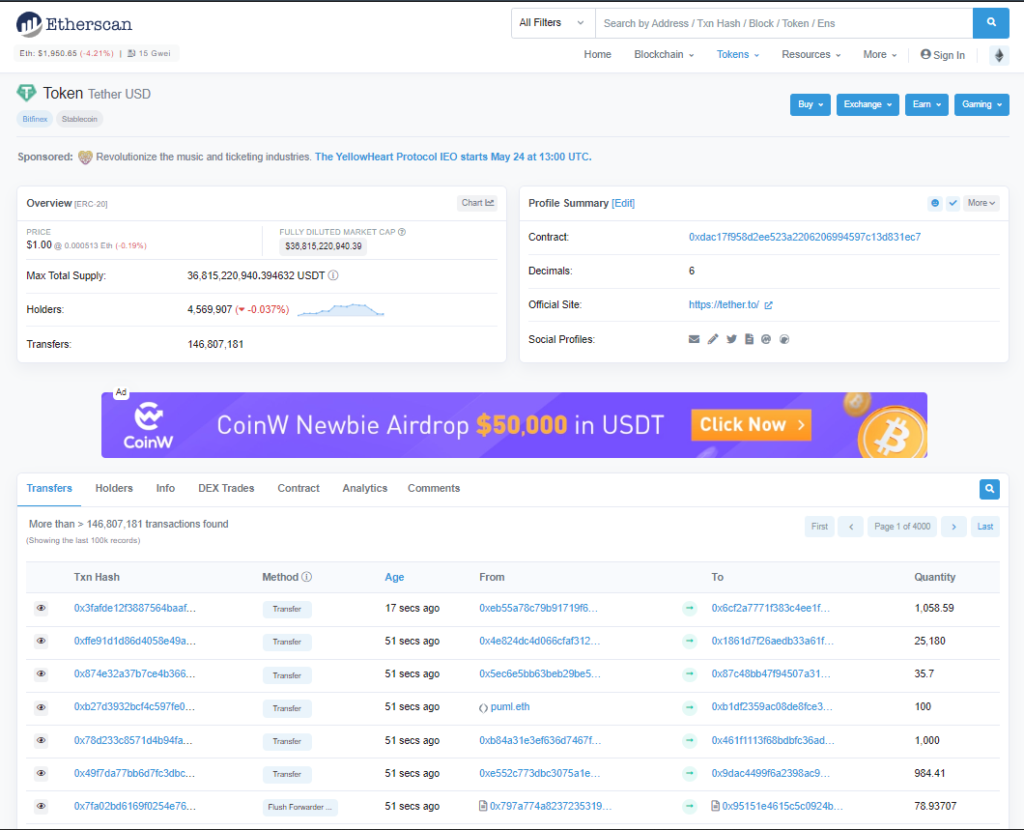

Always counter-check your research with the explorer link for validation. Explorer link provides you with token analytics, hash rate, price, block height, available exchanges, token contract, transaction and more. It helps users understand the network activity, how active the network is, and the network liquidity. Network liquidity indirectly indicates others’ trust in the coins. The higher the liquidity, the more demand for that specific coin.

Explorer links listed the tokens of their ecosystem. ERC tokens are analytically provided by etherscan, BEP-20 and ERC-721 tokens provided by bscscan, while explorer.solana and subscan DOT provides analytics for each project of their ecosystems.

Beware of Cryptocurrencies Scam.

Crypto success stories might blind your reasoning with the thought that jumping into a good crypto project is like falling into a gold mine. The greediness trait is the driving force of major cryptocurrency scams out there.

Crypto Pyramid Scam

There are many crypto pyramid scams present, where they usually promote the nature of high return for every referral sponsored. The promises of low initial investment can be multiplied with ridiculously high returns by the number of members signing up using designated referral links. Long gone, thousands of victims have fallen for the trick.

Ponzi Scam

Ponzi scam is a scam method where they lure investors and pay profit to early investors using later investors’ money. They usually come with promises of unrealistic high returns.

Last 2016, Bitconnet launched as a Bitcoin lending solution promising monthly returns of 40%. They even have their own BCC token. To obtain returns, investors had to purchase BCC tokens, lock them on the platform and wait while trading bots used their locked funds to trade. After being forced to halt its operation in 2018, BCC crashed by 90% and caused investors to lose over $3.5B.

Fake Token/Project

It is essential to check token legitness. There are a lot of fake tokens available on the market. Scammers took advantage of investors’ naiveness with very low budgets with a promise of great crypto projection.

In 2019, Amit Lakhanpal, the proprietor of MTC (Money Trade Coin) is associated with a fake ICO scam. The exchange used in the scam has never existed yet it didn’t hold investors from using their money. This could only happen as investors lack literacy and the cherry on the cake, – the alluring profits! With just a promise, he managed to get away with $71.6 M.

Another famous scam occurred in 2019, PlusToken where they promised users of high yield if they bought their token, $Plus, using Bitcoin or Ethereum. They later exited the scheme and ran away with over $3B.

A fake token red flag is when a new project promises unrealistic listing prices with extremely low pre-sale token prices. For example, a project projected their coin with a presale price of $0.0000001 will be listed at $1 upon listing.

Mining Scam

Mining scam offers mining hardware or cloud mining package where you purchased the contract and they will reward you with a certain amount of BTC. Famous mining scams are GateBitcoin, Mining Max and Bitclub Network. They only use up to 30% of the amount to purchase mining hardware and the exited the market with the rest of the crypto after certain times.

Scammers can only pledge their game if investors are lack crypto education. The best way to do extensive research, identify red flags and ensure you don’t fall prey to their tactics.

Always invest wisely

In a nutshell, always remember crypto investment should be treated as an investment and not as a fast money solution. Plus, only invest the amount you can lose. Do not put in your entire saving with the mindset of higher capital, and higher return.

We hoped you’ve enjoyed this piece and appreciate the time you spent reading. We love making and sharing content which are insightful and actionable. Stay tuned for more exciting content, coverage and latest news about the world of finance. Visit AxeHedge.com to learn more about what we do and how can we help you in your investment journey.