How to diversify your portfolio

Avoid the mistake of many noobs, diversify!

If you read any investment how-to’s for beginners, you’d most often than not stumble upon the advice to diversify your portfolio and on how your money is eggs and your portfolio is some basket… Let’s admit it, many took note of it and still went on without any portfolio diversification. Why? Because as easy as it is to tell people to diversify, it’s actually pretty confusing — if you don’t know how.

What is portfolio diversification?

Screw the eggs and basket analogy (for now), let’s keep it real. It’s an investment strategy that tries to make sure the risk you’re facing is not too high.

How? Diversifying portfolio is when you buy multiple types of assets, and you did a mix-and-match of these assets to make sure that the assets in your portfolio have different risk characteristics than the others, so that if one company goes bad, your portfolio might be dented, but not broken.

Let’s say you pick companies that are identical, or you simply go goblin mode and buy just one stock with the huge chunk of money you have. If the industry booms (in a good or bad way) then your cash is going to be booming correspondingly.

It’s almost like the board game Battleship*, you don’t want to be gathering your ships for mass at only a corner of the board. Scatter it so that the enemy can’t wipe you clean.

*Battleship is a board game where two players will have to place different pieces of ships on their boards. They can’t see where the opponent’s ships are at. The players will then attempt to sink each other’s ships by guessing the coordinate of the ships on the board.

Why is it important?

If you’re thinking of investing in just one company and praying for it to either go big or go home, then your investment is just a nerd’s version of the lottery. Of course, you can be better equipped with research and readings, but that alone can’t guarantee your money.

In fact, nothing can guarantee you’re going to do well. Research and reading make up perhaps 60% of your chance for success, but the other 40% is going to be filled with things you can never expect, like, who would’ve thought two economic giants would clinch fists over a balloon and that apparently upset the forex market? (We just made up the number for dramatic effect, by the way).

So, after doing your research and readings, you need to look into your portfolio and make sure that you invest in a diverse portfolio, so that each of the assets in your portfolio is susceptible to different types of risks.

For example, Asset A can be susceptible to war, Asset B can be susceptible to bad weather, Asset C can be fragile when consumers’ purchasing powers are low, etc. The thing is, it’s rare that all horsemen of the apocalypse are going to gather in one period. Maybe at one point Asset A is taking the blow, but your portfolio won’t be as bad because Asset B and C might still be up and running.

It’s not like it’s impossible for a total apocalypse to happen, but if it happens then it’s better to hide your stash in many different places than to stash it all in one single hut.

How can you tell if an asset is risky?

An asset’s riskiness is measured through many lenses –

How risky is it in terms of asset classes?

First, you can look to diversify your portfolio by investing in assets of different classes. There are many types of assets out there, like stocks, bonds, cash, and more. How you can manage risk by asset classes is that you’ll have to look into the assets that you want to invest in based on their classes.

There are different types of assets available out there, and generally, they come with different level of risk. Bonds, for example, are considered as less risky compared to stocks.

Of course, there are some stocks that are safer than bonds, but generally you’d say bond is safer because there is a high likeliness of you getting your interest payment periodically, even if it’s relatively slower.

What you need to do in this context is that you can mix different types of asset classes in your portfolio based on their risk level. Perhaps you can have 40% of it from stocks, 20% bonds, 20% commodities, and 20% real estate.

How risky is it in relation to the market?

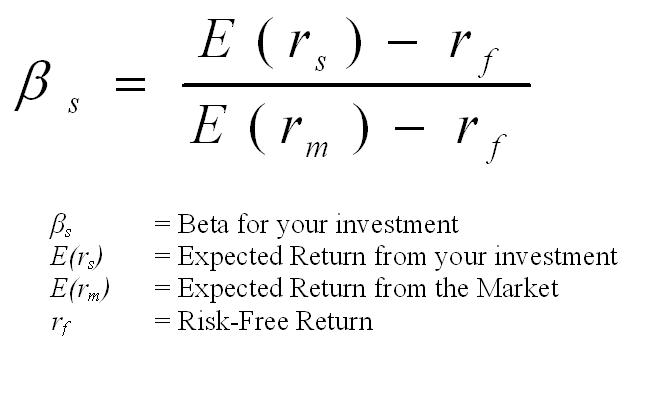

Another way of looking into risk is by looking how the asset moves according to the market. The most commonly used metrics for this is Beta (β). Beta is usually used in the context of investment to measure the risk that a stock has in relation to the market.

How? First, you’ll need to know how the market moves. In many cases, people will use market indices as their benchmark, and the commonly used index in the U.S. is the S&P 500 Index, since it gathers the 500 biggest companies in the U.S. What you need to do is that you’ll need to see how the graph moves for your benchmark.

Once you got that, now look at the asset that you want to invest in, how do they move. The Beta calculation will have a middle point of 1.0, which means that the stock moves together with the market.

A Beta reading of 1.0, simply, can be understood as how many steps the asset will move if the market moves by 1 step. So, if the Beta reading is 1.5, you can say that the stock is riskier or volatile, because when the market takes one step, the asset have already taken 1.5 step.

How do you get this Beta value? Our kind advice for beginner investors is to simply Google it and find which analysis they’d prefer, although they’re most likely nearly similar.

We do know, however, that some people have trust issues, so you can calculate it yourself by using the formula below:

Additional read: Your Beta (β)

How risky is it in relation to other companies?

Say, you’re investing in stocks, and your portfolio is all stocks. It’s fine, you can still diversify it. Apart from the methods above, you must also look at how closely interdependent one company is with another.

Don’t worry, we’ll illustrate it. Say, you want to invest in the IT sector. There are many companies out there, but you found Companies ABC & XYZ to be the most interesting ones so far.

However, as you look into it, you found that these stocks are closely interrelated. If ABC goes up, XYZ goes up if ABC goes down, XYZ follows suit. In this situation, it’s risky if you go for both ABC & XYZ, as they move nearly the same as each other, it’s almost like you’re just buying one single stock.

In the same way, these stocks can be closely interrelated in the opposite direction. If ABC goes up, XYZ goes down, and vice-versa. This is still not a good idea as they will cancel out each other and your portfolio is going to be very peaceful as it makes no move.

How do you measure this risk? There is a thing called covariance, which is a statistical method used to measure how one stock relates to another. It’s not hard, you can learn it in 5 minutes or so, but we will make sure to create a dedicated article explaining how to calculate it.

How to diversify?

There are many ways that you can try to diversify your portfolio. We’ll start with the general stuff first. The general rule about diversifying your portfolio is to diversify risk.

You could be asking by now, how should you allocate it, is there a golden rule on how many percent of assets of different risk levels should be?

The answer is no, there’s no golden rule. First, you can divide assets into high-risk, medium-risk, and low-risk. So, your portfolio can be a mixture of these assets, perhaps at the basic level of 40% high-risk, 30% medium-risk, and another 30% for low-risk.

What you can do is that the riskier you want to play, adjust it to — for example — 50% high-risk, 30% medium-risk, and 20% low-risk. It’s up to you to add and drop these assets according to your appetite for risk.

You can either diversify by choosing asset from different classes, like mixing stocks, bonds, real estate, and commodities into one portfolio; or you could also diversify by mixing assets from different industries, like stocks from IT company, along with stocks of consumer goods, tourism, or even construction companies. Another way is you can diversify by picking assets from the same industries, but based on different risk levels.

Those are the most common ways that people do it. Of course, you can find your own way if you wish to.

A few tips before we go

- Try to always allocate a certain portion of your investment to fixed-income asset (such as bonds or dividend stocks).

- You can just invest in Diversified Mutual Funds or Exchange Traded Funds (ETFs) if you’re feeling like all the thinking is a hassle.

- The more diversified the better, we are not talking 5, we’re talking 10, 20, or even 30 different assets, but make sure you can manage them well.

- Don’t keep them forever, your asset may change as time passes. A stock that was stable once may not be as stable a year later. Always monitor and rebalance your portfolio from time-to-time.

- If you think the whole country’s economy is dumpster fire, invest in assets of other countries!

- If asset prices are just too high for you to buy too many of them, consider buying fractional shares.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.