Fractional Shares

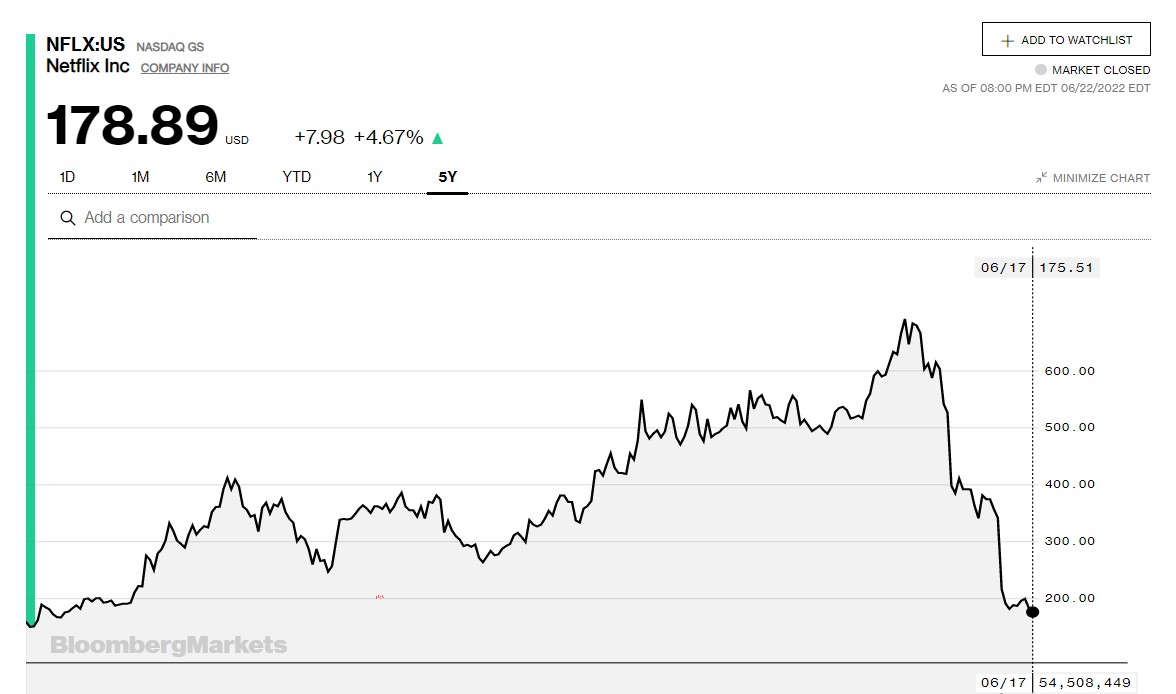

Netflix (NFLX:US) shares had reached their 16 years old birthday last May. Its first traded share was listed at $15 as its IPO and closed its first trading day price at $16.75 or $1.20 per present-day share after adjusting with a stock split with a 7:1 ratio that took place on July 14, 2015.

As for the last trading day from the time of writing, the investment of $1000 investment in Netflix stock split-adjusted closing price of $1.20 per share over the following 16 years, that investment would be worth about $149,079, which is a great investment return taking into account of the bear market condition. If the investor chooses to exit the market during the pandemic (October 2021), the investment worth almost $575000.

So back to the main concern, is $178.89 per share affordable for every investor to start jumping into stock investing? This is where fractional shares come into play.

What are fractional shares?

A fractional share is a slice of stocks that had been broken down. A fractional share is any amount less than one full share. It can result from stock splits, mergers and acquisitions, dividend reinvestment plans, and other corporate actions. Imagine the act of buying a slice of cake from a portion of a whole cake. The same goes for buying fractional shares. With fractional shares, owning a variety of assets is more accessible than ever. It allows an investor to diversify their portfolios and invests in assets with high share prices.

Do bear in mind, that through fractional shares investors do not trade on the stock market directly. The facility option re available through brokerage/ investment firms that allow an investor to have particle ownership of varieties high-value stocks.

To understand how partial shares work, imagine you want to invest in Google (GOOG:US) whose current share price is $2240.68. You only want to invest $500, so you use the money to buy almost one-quarter of a share. Allocating a specific number of dollars you want to invest and purchasing shares according to the exact amount is called dollar-based investing. It allows you to budget and plan your investment accordingly.

Before investing, make sure the brokerage offers commission-free trading so there will be no hidden transaction fee for every partial share.

The truth of fractional shares

Let’s dig into the basic need to know before buying fractional shares. Like with every other investment medium. They come precaution to be highlighted before investing.

- They are not available everywhere– Not every brokerage provides the facilities of fractional shares. Even though fractional shares have become popular in the US markets, it is still foreign to the international market.

- Stock splits impact fractional shares. In the event of a 10-for-1 split, investors who hold less than one share ahead of the split will get ten additional fractional share equivalents. If an investor holds half a share before the split, he/she’ll end up holding five shares after the split. An investor holding a quarter of a pre-split share will end up with two and a half shares afterwards.

- Fees accumulation- Not every brokerage provides commission fees. Thus, with no time, investors might be piled up with transaction fees.

- Do fractional shares add up to whole shares? – Yes, it is possible to buy enough fractional shares of one stock to equal a whole share. For example, if a stock was available to purchase as 0.25 fractional shares, buying four of those fractional shares would equal a whole share. (0.25 x 4 = 1).

Why you should invest in fractional shares?

Investing in fractional shares comes with several benefits. Here are a few major advantages:

- Portfolio diversification at a lower cost. Especially the novice investor, don’t have to wait for their saving to reach the desirable share price (as the price might had rose by the time come). Whether with $100, $1,000 or $10,000 to invest – an investor can purchase a variety of assets. This means, that rather than lumping together large chunks of money to purchase one share, it can aid in portfolio diversification.

- The capital allocation plan stays on track. With dollar-cost investing and fractional shares, it allows an investor to keep track of their capital allocation. It ensures the investor to not unintentionally overweight in one asset and throws their portfolio out of balance.

- Get the most out of every dollar. Fractional shares let stock investment become affordable and accessible. Thus, it let every dollar available for investment and makes the full benefit out of it. Especially for long-term investors who regularly contribute to an investment account. It might not seem like a major deal, but it can impact overall wealth in the long run.

- Invest in stocks that match your interests and strategy. Every investor has their own favourite strategies. Thus, the access to fractional shares, allows an investor to invest in more expensive stocks.

- Partial Dividend. Depending on the stocks and brokerage, If the security pays dividends, fractional shareholders receive a proportional share. For example, if Stock A paid a dividend of $10 per share and you owned a 0.25 share, the dividend payment would be $2.50. ($10 * 0.25 = $2.50).

Conclusion

Fractional shares had change the way of equity investing, it let investors invest with an amount that fits their budget. Whether fractional shares beneficial to invest in? that’s a question every investor must answer for themselves. Fractional shares are a good fit if you’re new to investing, or want more diversification in your portfolio without investing a lot more money.

If you’ve ever wished you could get in on an exciting stock like NVR Inc (NVR:US), Apple (AAPL:US), Seaboard Corp (SEB:US) or Amazon (AMZN:US) but found the share price too high, hence fractional shares might be a great option. Investing can be accessible when you take it one slice at a time.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

We hoped you’ve enjoyed this piece and appreciate the time you spent reading. We love making and sharing content which is insightful and actionable. Stay tuned for more exciting content, coverage and the latest news about the world of finance. Visit AxeHedge.com to learn more about what we do and how can we help you in your investment journey.