Cyclical & Non-Cyclical Stocks Beginner's Guide

Looking to take it slow or are you a little adventurous? Find out with us!

If you want to categorize stocks, there are many — and we mean it, there’s like A LOT of groups that you can make out of the same thing. You can categorize stocks according to whether they pay dividends or not, which moral spectrum each company is standing at, this, that, and more.

Nonetheless, one of the most common attributions of stocks is based on whether they move based on how the market moves, or they don’t really bat an eye on the market as a whole.

What are Cyclical and Non-Cyclical Stocks?

Cyclical stocks: Cyclical stocks refer to stocks whose prices are dependent, or at least interconnected with the market. That is to say, the stock price will usually move in accordance with the market. For example, if the market goes down, the stock will go down along with the market.

In the same way, you can also say that the stock is cyclical if it moves in opposite directions of the market. For example, if the market is bad, the stock would perform well, and if the market is good, the stock may go down.

So long as they move in response to the market, you can say it’s cyclical.

There are many types of businesses that are reliant on the market. Take luxury fashion, as an example. During tough times, people can pass on buying luxury goods to make way for necessities. So, you could say that when the economy goes under, stocks of companies dealing with luxury goods are more likely to fall along.

Non-Cyclical stocks: It is also known as defensive stocks, which refer to stocks whose values are not dependent on the stock market. This is usually for companies that deal with necessities like food, healthcare, and so on.

Put it this way, when times are tough, people would still need to eat, right? So, these companies that sell food items are likely not to be affected that much.

Cyclical vs Seasonal

There is often a little confusion on cyclical and seasonal stocks. As much as the term seems interchangeable, you can put it like this:

Cyclical stocks refer to stocks that move alongside the market, but you can’t really predict how the market is going to go.

All you can say is that — if the market is crashing, these cyclical stocks that you are holding might crash as well.

Seasonal stocks, on the other hand, refer to stocks that move seasonally. Take businesses in the tourism industry, for example.

In the West, people would usually take a break during the summer. schools are usually on holiday, workers taking a few days off, and those without much worry in life seek oriental enlightenment by visiting Asia.

So, you can usually predict that as summer is around the corner, stocks for tourism-related companies are likely to rise.

How to look for Cyclical and Non-Cyclical Stocks

There are a few ways for you to identify the cyclicality of stocks:

How volatile is the price?

One of the most common identifiers of whether a stock is cyclical or not is how volatile is the price. So, you look at the stock chart and the price is moving like crazy, it went up and down so rapidly that you went into an unwarranted headbanging trying to keep up — that’s it, right? Not really.

Many stocks are volatile, but their volatility might not have anything to do with the market. How you measure it by looking at the stock chart and comparing it with a benchmark for the market. Most investors use the S&P 5000 Index (for the U.S. market) as it tracks the performance of the 500 largest companies in the U.S.

Look at the chart below as we try to compare Apple (NASDAQ: AAPL) with the S&P 500 Index (the orange line):

See how closely similar the movements are? They might not be picture-perfect, but you could almost sense a pattern with them.

How sensitive they are to economic conditions?

Another way to do it is by generally trying to understand the nature of affairs which the company is dwelling in. By knowing the products that the company is offering, the target market, and the issues that may affect the company’s revenues, you can sort of tell whether the company is more likely to be susceptible to changing economic conditions or not.

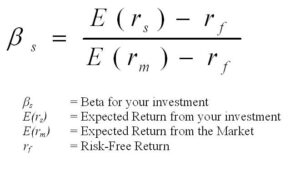

Beta (β)

Beta is a term used in finance to describe how tangible is an asset to the market. So, it’s measured with a baseline of 1.0, which means that the company mostly moves according to the market.

Put it like this, Beta 1.0 means that, if the market takes 1 step forward, the company will also take 1 step forward. If the Beta is 1.5, if the market moves 1 step, the company will already have moved 1.5 steps — more than the market.

If the Beta is low (below 1.0), it means that any moves in the market don’t really affect the company’s movement.

In short, high Beta = more cyclical, and low beta = less cyclical.

How do you get this Beta value? You can just Google it up and look for the value which analysts have already come up with. If you don’t really believe in other people’s works, you can count it yourself, the formula is:

Additional read: Your Beta (β)

High-risk, Low-risk

Some cyclical companies are considered to be high-risk assets since financiers are not yet aware of how well the company can perform. However, this is most often for companies that are just getting started. If you’re looking at companies that have already been out there, simply vibing with the market, this pedagogy isn’t much relevant.

Non-cyclical stocks, on the other hand, are usually less risky, because their stock prices would usually be stable, as it hovers around. Again, be reminded that this is only the usual case, there can always be companies that are non-cyclical but are considered high-risk.

Again, when speaking of risk, the rule of thumb is high risk=high return. The question is whether you can afford to put as much on the line or not.

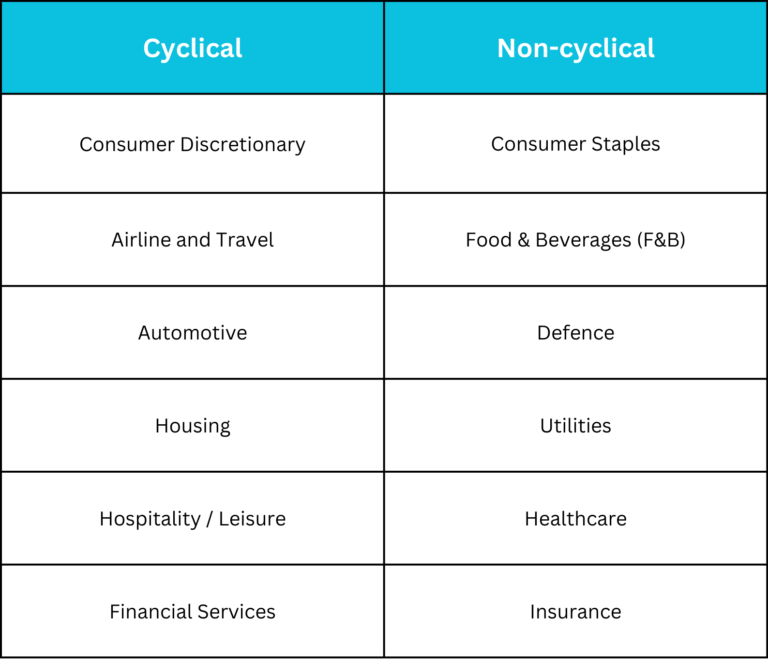

Sectors based on the cyclicality

Here are the sectors based on their (usual) cyclicality:

Things to consider:

Risk-to-return

Before deciding whether you want to go for cyclical or non-cyclical stocks, it is best if you ask yourself first how much risk you can bear, and the most important of all is — how much can you make if you take this risk.

Some stocks may seem appealing, but you’ll have to look if the risk is worth it. Sometimes there are stocks that are less risky but may pose the same prospect of returns.

All in all, before you even decide to go for cyclical or non-cyclical stocks, make sure that you have done your research to see if there are any better options than the ones you’re aiming for.

Economic health

To go for cyclical stocks or not is up to each individual, but it would be pretty weird if you decide to go with cyclical stocks at a point where the economy is looking grim. The whole point of cyclical stock is that it moves with the economy.

It’s like going into a white van when the clown promised you candy. You may have the chance to actually get that candy, but the question is whether you’ll come out unscathed.

If you’re not well-versed with the economy then… sadly, you’ll have to make yourself familiar with it. You can’t expect to make money out of luck, that’s one thing.

We’d suggest that you make yourself familiar with the economics surrounding your targeted companies first. Then expand your knowledge from there. Don’t be afraid to lose money (but don’t go all in). Learn from your mistakes and make better investments.

Predictability

One good thing about cyclicality is predictability. Cyclical stocks tend to be more predictable than the ones that are not. If you see that the market may be going south, then you’d get yourself prepared with the cushion.

On the other hand, some hate predictability and go for risk-taking, and that’s totally fine. In finance, the higher the risk is, the higher the reward would be.

Keep in mind that there is no surety in finance. You can be 99% sure but keep yourself prepared with the 1%. The market is never too efficient, humans are as predictable as the lottery, especially with the internet. Many would think that the Internet would make the market more efficient, on the contrary, there are more unthinkable things that are going on given how information is spread.

Well, isn’t finance fun?

Bottom Line

- Cyclical stocks are stocks that move alongside the market, while non-cyclical ones don’t.

- The most common identifiers of cyclicality are stock volatility, sensitivity, Beta value, and risk.

- Stocks that are based on necessity items are less likely to be cyclical.

- One must consider their risk tolerance, the market’s situation, and the factor of predictability when thinking of cyclicality.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.