Unveiling the Potential of Q4 2023

The S&P 500 is up 12.137% so far in 2023, even with the stock market in a correction.

Here are the top ten mega-cap companies that are driving the benchmark index this year, including Nvidia (NVDA), Meta Platforms (META), Royal Caribbean (RCL), Tesla (TSLA), General Electric (GE), Palo Alto Networks (PANW), Carnival Corp. (CCL), Airbnb (ABNB) and West Pharmaceutical Services (WST). These stocks have been highly sought after by investors due to their strong performance and potential for long-term growth. They are also seen as safe havens in times of market volatility, making them a popular choice for investors.

** as per October 2023.

Of course, not even the hottest stocks can do well all the time, so it can be useful to keep an eye on some of the promising stocks. Investing in individual stocks is difficult. You have to research and analyze the business and industry, as well as understand the dynamics that drive it all.

Riot Platforms Inc (RIOT)

Riot Platforms, Inc. (RIOT) is a software company listed on the Nasdaq Capital Market with a market capitalization of $1.73B. Looking at its financial metrics, Riot Platforms reported total revenues of $256.41M, with a growth rate of -16.87% for the twelve-month period ending on June 30, 2023. In terms of profitability, Riot Platforms has a gross profit margin of 11.55% and negative margins for EBITDA, operating margin, net profit margin, and pre-tax profit margin.

The company believes that its focus will positively affect each of Riot’s three business segments by providing more capacity for its Bitcoin Mining and Data Center Hosting operations, and by capitalizing on supply chain efficiencies garnered through its Engineering segment.

As Riot Platform Inc’s grows, the company position its business in deploying its efficient Bitcoin mining fleet at scale, while realizing the benefits of owning and operating its own Bitcoin Mining and Data Center Hosting facilities.

Riot Platforms believes it is well-positioned to benefit from industry consolidation in the Bitcoin mining sector.

Currently, the company trades at $9.88, up 6.22 % in the past 5 trading days. A YTD increase of +191.45% has been recorded for the RIOT stock despite the stock slump across the stock market in the last 3 months. There is an average price target of $19.94, an upside of 113.72%, with a high forecast of $24.00 and a low forecast of $16.00.

Prosus (PROSF)

Prosus is a company engaged in the e-commerce and internet businesses. It operates various internet platforms, including classifieds, payments and fintech, food delivery, travel, education technology, retail, health, ventures, social, and other internet platforms. The company also has investments in African e-commerce and payments, as well as digital payments and fintech businesses in India. Its diversified portfolio helps it to explore new opportunities and grow its revenue.

The company has operations in multiple regions across the globe. Its portfolio also includes Naspers, the largest global consumer internet company outside of China. Its operations span over 20 countries in Africa, Asia, Europe, Latin America, the Middle East, and the United States.

Taking a look at the financial metrics, Prosus’ market capitalization is $77.05 billion, and its total enterprise value is $72.58 billion. The company reported total revenues of $5,765 million. Profitability-wise, Prosus N.V. demonstrates a gross profit margin of 28.74%.

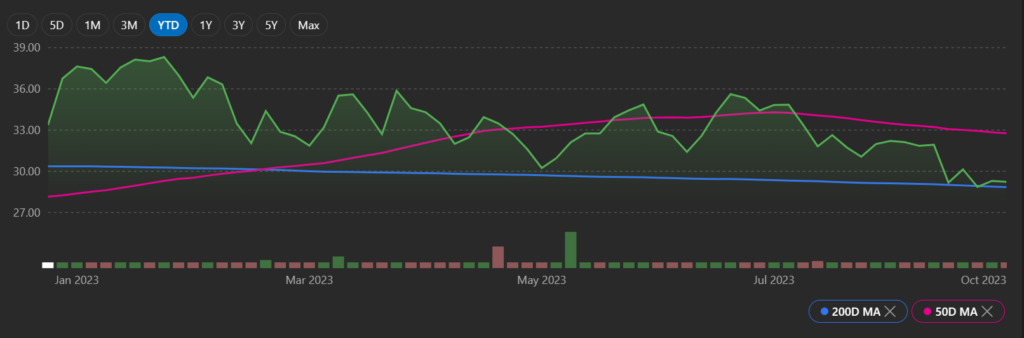

The stock is currently trading at $29.24, with a +1.55% gain in the last 5 trading days. Although the stock had been in a slump lately, it had gained 21.84% in a year. There is an average price target of $54.18, an upside of 84.9% with a high forecast of $100.57 and a low forecast of $40.23.

Argenx Se (ARGX)

Argenx SE (ARGX) is a is the Netherlands-based biopharmaceutical company. It is listed on NASDAQ under the ticker of ARGX.

The company creates and develops a pipeline of antibody therapeutics focused on cancer and autoimmune indications. A pipeline of differentiated antibody therapeutics is also being developed using the Company’s discovery platform, Simple Antibody, which is based on characteristics of the immune system in llamas.

Among Argenx pipeline of antibody therapeutics includes ARGX-110, an antibody for heme malignancies and solid tumors, which modulates functions of tumor such as cell proliferation and survival; ARGX-111, an antagonist of c-Met, a receptor tyrosine kinase involved in cell proliferation, angiogenesis, and metastasis in multiple solid tumors; ARGX-112, an antigen which targets atopic dermatitis by neutralization of IL-20 and IL-22 (interleukin) mediated signaling through blockade of their common receptor, among others.

As far as financials go, Argenx SE reported $835.26 million in revenue. There’s a gross profit margin of 2.87% and negative margins for EBITDA, operating margin, net profit margin, and pre-tax profit margin. Looking at valuation metrics, Argenx SE has an EV/Sales ratio of 31.94, indicating that the company’s enterprise value is 31.94 times its annual sales.

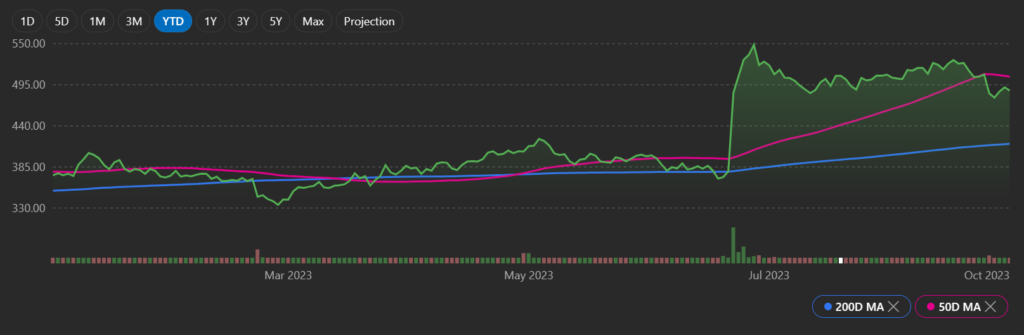

The stock is currently trading at $487.32, with 1.12% upside in the last 5 trading days. AGRX remains consistent with a 27.71% increase in 3 months, +28.64% YTD, +38.86% in the last 1 year, and an increase of 85.79% in 3 years time. Based on Wall Street analysis, the average price target is $566.68, with an upside of 15.27% with a high forecast of $616.00 and a low forecast of $361.63.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 2)

The second triangle: the Descending Triangle

Read MoreTrading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More