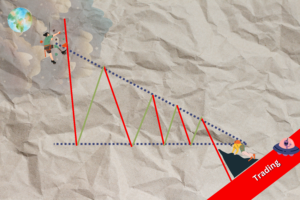

The second triangle: the Descending Triangle

Read MoreThe Psychology of Trading and Investing: How They Differ

How the brains of traders and investors differ despite their likenesses

In the world of finance, trading and investing are two distinct approaches to building wealth in the stock market. While both trading and investing involve buying and selling financial instruments, the psychological aspects that underlie these activities can be significantly different. Understanding these differences is crucial for individuals looking to navigate the financial markets effectively and make informed decisions. In this article, we will explore the trading and investing psychology, highlighting the key differences between the two.

The Trader’s Mindset

Trading, often associated with short-term strategies and frequent buying and selling, requires a unique mindset that differs from that of an investor. Traders are typically focused on capitalizing on short-term price movements, and their psychological profile reflects this emphasis on quick gains and losses. Here are some key psychological traits of traders:

1. Risk Tolerance

Traders tend to have a higher risk tolerance compared to investors. They are willing to accept a higher level of risk in pursuit of short-term profits. The ability to handle rapid fluctuations and the potential for significant losses is a characteristic of a trader’s mindset.

2. Emotional Discipline

Successful trading requires a high degree of emotional discipline. Traders must remain cool under pressure, as the speed of market movements can trigger emotional responses such as fear and greed. Emotional discipline is crucial for executing trading strategies effectively.

3. Quick Decision-Making

Traders often need to make split-second decisions. This demands the ability to analyze information rapidly and execute orders promptly. The fear of missing out (FOMO) is a common emotional challenge for traders, and it can lead to impulsive decision-making.

4. Adapting to Changing Market Conditions

Traders must be adaptable and ready to change their strategies quickly. Market conditions can shift rapidly, and traders need to adjust to new information and trends. This adaptability requires a flexible mindset.

5. Goal-Oriented

Traders are typically focused on specific daily or weekly profit targets. Their goals are often quantifiable and short-term in nature, which can create a strong sense of achievement when met.

The Investor’s Mindset

Investing, on the other hand, is a long-term endeavor. Investors purchase assets with the expectation that they will appreciate over time, and they are less concerned with the daily fluctuations in market prices. The psychology of investing is characterized by different traits:

1. Patience

Investors are patient individuals who are willing to wait for their investments to grow over an extended period. They are less concerned with short-term market volatility and more focused on the long-term potential of their holdings.

2. Risk Aversion

Investors typically have a lower risk tolerance than traders. They prioritize the preservation of capital and are less inclined to take risks that could lead to substantial losses. They are willing to endure short-term market fluctuations in exchange for potential long-term gains.

3. Emotional Resilience

Investors need emotional resilience to withstand the inevitable market ups and downs. While they may experience periods of uncertainty or anxiety, they are less prone to impulsive reactions and are more likely to stick to their long-term investment plan.

4. Research and Fundamental Analysis

Investors often engage in in-depth research and fundamental analysis to evaluate the assets they plan to hold for the long term. They base their decisions on the financial health and growth prospects of the companies or assets they invest in.

5. Set-and-Forget Mentality

Investors commonly adopt a “set-and-forget” mentality, meaning they buy their investments and hold them for an extended period without frequent buying or selling. This approach reduces the need for constant monitoring and decision-making.

The Impact of Psychology on Decision-Making

The differences in psychological profiles between traders and investors have a significant impact on their decision-making processes. Here’s how psychology influences the choices made by individuals in these two financial activities:

1. Time Horizon

One of the most apparent distinctions is the time horizon. Traders are focused on the short term and aim to profit from price movements that occur in hours, days, or weeks. In contrast, investors are committed to the long term, with their time horizon extending to years, decades, or even a lifetime. This difference in perspective fundamentally shapes their investment strategies.

2. Risk Management

Risk management strategies are influenced by the risk tolerance of traders and investors. Traders are prepared to accept higher levels of risk and often employ tactics like stop-loss orders to limit potential losses. Investors, on the other hand, prioritize the preservation of capital and are more likely to diversify their portfolios to reduce risk.

3. Emotional Biases

Both traders and investors are susceptible to emotional biases that can cloud their judgment. Traders may experience FOMO or become overly optimistic when they experience quick gains. Investors, on the other hand, may panic during market downturns, leading to hasty selling decisions. Recognizing and mitigating these biases is crucial for sound decision-making.

4. Market Monitoring

Traders need to monitor the markets closely throughout the day, which can lead to stress and burnout if not managed properly. Investors, with their long-term perspective, can afford to check their portfolios less frequently. Monitoring the markets can be time-consuming and emotionally taxing for traders.

5. Performance Evaluation

The way traders and investors evaluate their performance also differs. Traders assess their success based on their ability to generate short-term profits and meet specific trading goals. Investors, on the other hand, focus on their portfolio’s long-term growth and overall returns over the years.

The Impact of Psychology on Decision-Making

It’s worth noting that some individuals adopt a hybrid approach, incorporating elements of both trading and investing into their financial strategy. They might maintain a core portfolio of long-term investments while engaging in trading activities to capitalize on short-term opportunities.

This combination requires a unique psychological skill set, as individuals need to switch between short-term and long-term mindsets. It can provide diversification and potentially boost returns, but it also demands a high level of discipline and the ability to manage the psychological challenges of both trading and investing.

Bottom Line

In conclusion, the psychology of trading and investing differs significantly, driven by factors such as time horizon, risk tolerance, emotional resilience, and goal orientation. Understanding these psychological differences is essential for anyone participating in the financial markets, as it can help individuals align their strategies with their personal financial goals and risk tolerance.

Whether you choose to be a trader, an investor, or a hybrid of both, self-awareness of your psychological tendencies and biases is key to making informed decisions. It’s important to recognize that there is no one-size-fits-all approach, and the best strategy for you will depend on your financial objectives, risk tolerance, and the time you can commit to managing your investments. Ultimately, the psychology of trading and investing plays a central role in shaping your financial success and well-being in the markets.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

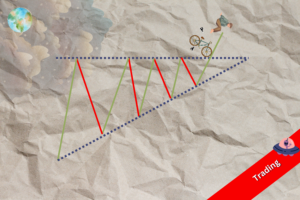

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More