The second triangle: the Descending Triangle

Read MoreStarbucks mixed quarterly earnings (Insight)

Starbucks Corporation (NASDAQ: SBUX) delivered a mixed quarterly earnings report on Tuesday after the market close, in contrast to other food and drink companies such as McDonald’s Corporation (NYSE: MCD), Coca-Cola (NYSE: KO), and Pepsi (NYSE: PEP) that surpassed Wall Street estimates across the board last week.

Among the highlights of Starbucks’ report is the coffee giant’s rapid growth in China, which it attributes to a whole lot of factors.

The company’s CEO Laxman Narasimhan believes the coffee chain is well positioned to grow its business in China, where robust sales and outlet growth significantly contributed to the company’s $9.2 billion revenue.

According to Belinda Wong, CEO of Starbucks China, Starbucks achieved 10% outlet growth in China during its Q2 of 2023 to reach 6,243 stores nationwide. Starbucks will ‘accelerate even faster on new store growth in the second half of the year’.

Starbucks operates 37,222 stores across 86 markets in the United States and China, representing 61% of Starbucks’ global store portfolio. Over the course of the third quarter, the coffee chain opened a total of 588 net new stores. There are currently 51% of Starbucks stores in the world are company-owned, and 49% of Starbucks stores are licensed stores.

Peer Earning Performance

It is no surprise that McDonalds reported a profit of $3.17, beating expectations by 13.66%, in addition to its reported revenue of $6.5B, which also beat expectations by 3.22%. Furthermore, Coca-Cola and Pepsi both followed suit as Coca-Cola reported earnings of 8.14 % above expectations, while Pepsi also reported earnings of 4.76% above expectations. Coca-Cola reported revenue of $11.97 billion, while Pepsi reported revenue of $22.32 billion, both beating expectations by 1.83% and 1.76% respectively.

Starbucks Exceeds Analysts’ Q3 Earnings Projection

First and foremost, Starbucks generated the highest weekly sales in its history this past quarter.

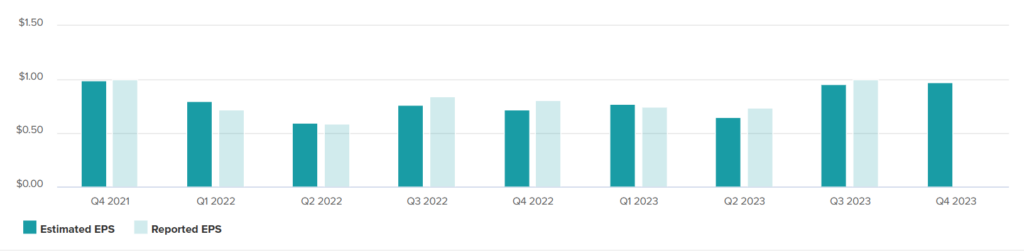

Starbucks has delivered better-than-expected earnings for the third quarter of the year. Its adjusted EPS of $1 increased 19% year-over-year and beat the average analyst estimate projection of $0.95 a share. However, the company’s revenue for the fiscal third quarter was a record US$9.2B, but that still fell just short of expectations.

The company mentioned on its earning call last Tuesday that it expects earnings per share to rise by 15% to 17% in its fiscal 2023 year, as opposed to previously forecasting earnings growth on the low end of its long-term target of 15% to 20%.

The company also highlighted that with their improved productivity and higher prices helped to boost operating margins to 17.3%, above market estimates.

Starbucks sales, growth, and rewards.

As part of Starbucks’ loyalty program, Starbucks also noted that its Chinese market, which is Starbucks’ biggest market outside of the United States, already has a record membership of more than 20M customers, whereas the US currently has 31.4 M members.

With 16,144 stores nationwide, Starbucks is the third biggest chain of restaurants in the United States. As of now, the brand is on its way to surpassing Subway (20,000 restaurants in the U.S.) as the nation’s most prolific restaurant chain. As far as sales are concerned, McDonald’s remains in the top spot.

The Refinitiv IBES data showed Starbucks’ comparable sales increase only 10% globally, falling short of analysts’ expectations of an 11.8% increase. Internationally, same-store sales rose 24%, missing estimates of 25.7%.

The trend toward attaching food to coffee orders is increasing at Starbucks, especially with breakfast sandwiches. It led to higher sales and volume growth. With this, Narasimhan has hinted that Starbucks will “explore new, elevated, and convenient food offerings.”.

Notable Competitor's Performance.

In its latest quarterly report, Luckin Coffee reported an 88% increase in total net revenue.

Net revenue reached US$855.2M in Q2 2023, compared to US$462.2M in Q2 2022. In total, Luckin Coffee operates 10,836 stores around the world. along with 1,485 new stores were opened by the company, including five new ones in Singapore.

“We are incredibly proud to report another record-breaking quarter with strong sales growth and increased profitability,” says Luckin Coffee Chairman and CEO Dr. Jinyi Guo.

SBUX

Currently, Starbucks is traded at $102.13, an increase of $0.87; +0.86%. The average price target is $116.47 with a high forecast of $150.00 and a low forecast of $102.00. The average price target represents a 14.04% change from the last price of $102.13.

Bottom Line

Starbucks will benefit from beverage innovation, expansion of new stores, customization, and food attachments. Furthermore, productivity gains, digital sales investments, and momentum in the delivery business should bode well for growth in sales and earnings in the future.

However, macro challenges, uncertainties in China, and overlapping pricing initiatives could hurt the company’s revenue growth rate.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More