The second triangle: the Descending Triangle

Read MoreRisk Management: An Introduction

In this series, we will touch on the topic that made the basics of many successful trades/investments (for the sake of being energy-efficient, we will just call it trade throughout this article instead of trades/investment — it’s too long to write). Many of the things we will explain hereon will come off as a no-brainer, things that you might think “Oh yeah, no sh*t Sherlock,” but are actually worthy to note before we move deeper into the realm of risk.

So, here’s the deal, to make this worthwhile, let’s play a drinking game: every time we mention something that is obvious, you drink a glass of water to keep yourself hydrated.

Let’s get to it!

Before this, we’ve written on the many kinds of risks involved when you get involved with the market, if you’d like to give it a read do check it out here:

Different Types of Risk in Investment for Beginners

Well, here goes — trading involves risk (that’s one drink). In the article we mentioned above, we did mention many kinds of risk involved, but as of now, we’ll look into the basics first, the two types of risks that will be with you when you trade/invest, and these two are somewhat correlated: unsystematic & systematic risk.

Unsystematic Risk

Unsystematic risk, also known as specific risk or diversifiable risk, refers to the risks that are unique to individual investments or securities and can be reduced through diversification. Unlike systematic risk, which affects the entire market or asset class, unsystematic risk is specific to a particular company, industry, or asset and is not related to broader market movements.

Put simply, it’s a risk that comes with the asset (e.g., stock) that you buy. If you buy the stock of Company ABC, for example, these risks will always be there, regardless of how small they are. Company ABC may face these risks (this is not everything, we’re just giving examples):

- Management misconduct: Remember the Wirecard scandal? How a whole financial company went insolvent when their fraudulent financial reporting was exposed — you can only have so much faith in rich execs.

- Business not doing well: Any company has the risk that their business is not doing well. It doesn’t have to relate to (or affect) their competitors. Say, McDonald’s introduces bubble tea burger, which is an abomination leading everyone to boycott a company that would dare go that length. It doesn’t always mean Burger King’s share price will be affected.

- Lower margin: Take a look at Tesla’s Q2’23 car deliveries — it increased by more than 80%, but their revenue didn’t increase by that much. Why? Because they slashed prices for their cars, among other factors. This decline in margin is a risk specific to Tesla, its competitors can perform well — or not, but it has nothing to do with the EV industry as a whole.

- Regulatory issues: Microsoft’s acquisition of Activision Blizzard would’ve made Microsoft into a MASSIVE force in the gaming industry — but regulators decided to say “nuh-uh” (at least as of the time this was written), and almost at every point in this drama, their share price moves correspondingly.

There are many more examples for us to give, but it would suffice for you to note that unsystematic risks are risks that don’t come with the financial system as a whole — which means that they can happen anytime to anyone without necessarily affecting the whole industry. When thinking of unsystematic risk, it’s easier to think like this: any stock can screw up, and the only thing that makes the difference is the probability of it happening.

Systematic Risk

Systematic risk, also known as market risk or undiversifiable risk, refers to the inherent risks that affect the overall market or an entire asset class, rather than risks specific to an individual investment or security. It is beyond the control of any single investor and cannot be eliminated through diversification. Systematic risk is driven by factors that impact the entire economy or financial markets, such as interest rates, inflation, geopolitical events, natural disasters, and economic downturns.

Simply put, systematic risks are risks that come with the system. Put it like this, when choosing a trolley/shopping cart at the supermarket, the unsystematic risk is that some trolleys might come with defective tires, and it’s based on the specific trolley you choose. The systematic risk in choosing shopping carts is that the law of physics somewhat decided to be an a-hole and the trolley will give you a little zap every now and then — it’s embedded in the system — regardless of which trolley you chose, they will zap you every now and then.

In a more realistic way of explaining it, systematic risks can come from things such as:

- Geopolitics: The US and China spat is a good example. Two guys in a suit fight one another, and the next thing we know the whole semiconductor industry is scrambling to find alternative resources and markets — regardless of what you invest in, geopolitics will give at least some effect on you — for better or worse.

- Declining economy: Take recession as an example, the whole stock market was in a bummer, and it’s part of the economic cycle, there are good days and there are bad days. When bad days hit, almost everyone felt the heat.

- Interest rate policy: Since the COVID-19 pandemic, many global economies are faced with sky-high inflation. In return, central banks raised interest rates to slow the economy down and bring inflation down. Read again: “…slow the economy down” which means the whole economy is affected, which means that your stocks are likely not exempted.

We would’ve been more generous with the examples if it weren’t for the deadlines but put it like this — systematic risks are risks that come with the whole financial system as a whole. When it bursts, the splash can be felt everywhere. Although one kind of risk might lead to another. Take FTX for example, the fallen crypto exchange. They fell because of an unsystematic risk as they decided to do shady things. However, their fall led to a systemic risk in the crypto market, which is the loss of confidence among traders, leading to the market as a whole seeing a downward spiral.

What to do with these risks?

Unsystematic

When it comes to unsystematic risk, what you can do is diversify your investment. If you have $1,000 to invest, you can either invest $1,000 in Company ABC or Company XYZ. Why not both? You can invest in both Company ABC and Company XYZ for $500 each.

These companies can be in the same sector, but diversifying across different sectors would be safer as sometimes the sector can fall as a whole, but other sectors are going to stay well. This would mean that if one of your stocks falls, your other stocks would shoulder the burden and lessen the loss — or even still make your portfolio in the greens despite one stock performing poorly.

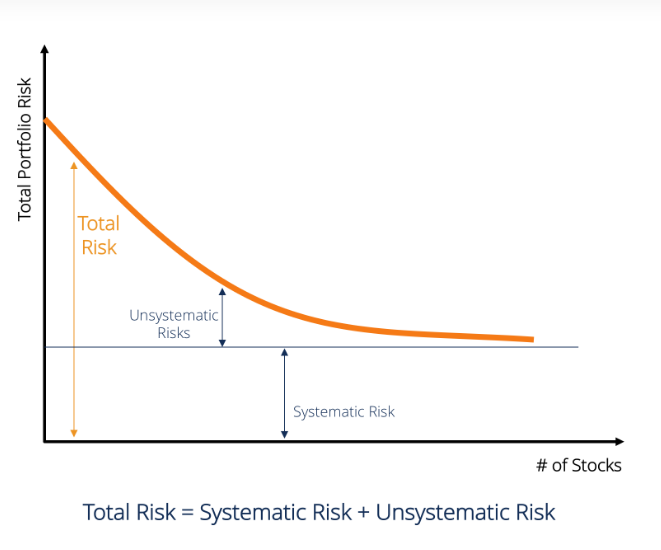

The more stocks you buy, the more diversified your portfolio will be, but you shouldn’t hoard stocks like how Asian aunties hoard Tupperwares, most would just recommend a portfolio having around 20–30 stocks. Why? Have a look at this graph we borrowed from Corporate Finance Institute (all credit goes to them for this graph):

On the bottom axis, we can see that as the number of stocks in your portfolio increases, the total portfolio risk decreases — but it would stop decreasing at some point. Here’s what happened, when you diversify, you reduce the unsystematic risk. So, you reduce it, and reduce it, and reduce it, but think with this common sense: is there any investment without risk at all? Impossible, right? Unless if you’re talking to a scammer.

The risk that is left afterward is the systematic risk. That’s why in the graph above (which is from CFI), they laid down the formula: Total Risk = Systematic + Unsystematic Risk.

You can diversify to reduce unsystematic risk, but what can you do to reduce systematic risk?

Systematic risk

When it comes to systematic risk, what you can do to reduce it is through hedging. Should you do it, though, is another issue. So, what is hedging? In a simple way, hedging is much like the hedge you see on your neighbor’s lawn, which stops their dog from pooping on your lawn — it stops risk from coming toward your portfolio.

Sounds good, doesn’t it? That depends, but we’ll get to that shortly. Let’s get to hedging first. Hedging is also like the car insurance you pay. You’ll have to allocate your money by paying the insurance premium over time, but if you get into an accident, the damage to your pocket won’t be so severe because your insurance company will pay for the repairs.

Do investments have insurance as well? In some ways, yes. Let’s take a look at a few things that investors/traders usually do to hedge their portfolios. Some would buy a ‘put’ contracts which is a contract that gives you the option to sell an asset at a specific price over a certain period. For example, you bought Stock ABC at $100, and you bought a put contract that allows you to sell it at $95 within the period of 1 year. If Stock ABC falls to even as low as $0, you can save your portfolio by exercising the put contract and sell it at $95.

Some would also go for assets that move in the opposite direction as their portfolio. For example, if the portfolio goes up, the hedged asset will move down, and vice-versa. This will offset the losses you make if your portfolio goes down. Can it be 0 risk? Theoretically, yes.

If you invest in Asset A and hedge with Asset B where if Asset A moves up by $1, Asset B will move down by $1, and vice-versa. Technically, if your Asset A falls, Asset B will offset the losses, but there will also be no gains in your portfolio, as the end result will always be $0.

Those are only a few examples, and there are many ways to hedge your portfolio. There are also hedging methods that cater to specific risks such as inflation, rate hikes, and even currency fluctuations. However, the question of whether you should do it or not is another issue.

Hedging takes a lot of skills, can be costly, and it requires you to be timely — there’s no one-hedge-for-all. Much like your car insurance, the basic insurance package will cost you, say, $300. If you want to insure your windshields, it will cost you more, and if you want protection against natural disasters as well, you’ll have to add it to the package and pay more.

At some point, you might see your wallet torn apart only by the cost of hedging alone if you are too afraid of risk. That is why hedge funds only cater to rich people — if you are wondering. Even then, they will not try to do a 100% hedge against risk. After all, higher risk = higher returns.

If you’re just starting out, it would be better for you to cater to unsystematic risk by diversifying and just generally be smart and do your research on the trades that you’re going to make. If you want to hedge, be sure that you know how, and that you can keep up with the game.

Bottom Line

- The two types of risk most commonly present in the market are unsystematic and systematic risk.

- Unsystematic risk only affects a specific company or a sector, while systematic risk affects the market as a whole.

- To reduce unsystematic risk, you can diversify your portfolio.

- To reduce systematic risk, you can go for hedging.

- Hedging, however, may come off as tricky, and you may actually lose more than what you’re expecting to save.

- Remember: higher risk = higher return; but don’t go in gambling.

- All in all, this is just an introductory piece into the realm of risks. This is not everything, and we will dive deeper in the future.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More