The second triangle: the Descending Triangle

Read MoreMastering the Trailing Stop Strategy: A Powerful Tool in Stock Market Trading

In the fast-paced and dynamic world of stock market trading, having a well-defined strategy is crucial for success. Among the various strategies available, the trailing stop strategy stands out as a powerful tool that can help traders maximize profits while minimizing potential losses. This strategy enables traders to take advantage of bullish market trends and make substantial gains using their investments while protecting them against sudden market reversals.

Understanding the Trailing Stop Strategy

The trailing stop strategy is a dynamic risk management tool that adjusts the stop-loss order as the market price of a stock moves in the trader’s favor. Unlike a traditional stop-loss order, which is set at a fixed price point to limit losses, the trailing stop order is set at a certain percentage or dollar amount below the current market price.

The key feature of the trailing stop strategy is its ability to trail or follow the stock price movements in a favorable direction. This means that as the stock rises, the stop loss order will also rise with it, thus providing traders with additional protection against losses. It also allows traders to take advantage of movements in the market that may be too small for traditional stop-loss orders to capture. However, if the stock price declines, the trailing stop order remains fixed, allowing for a potential exit at a predefined loss level.

Why should you use the Trailing Stop Strategy?

1. Profit Maximization.

The trailing stop strategy enables traders to capitalize on strong upward trends. This allows them to stay in winning trades longer and potentially achieve higher profits. For instance, a trader can set their trailing stop just below resistance levels and, as the market moves in their favor, the trailing stop will move up with it, locking in more profits.

2. Risk Management

As the strategy’s stop level is dynamically adjusted, it offers a balanced range of risks and rewards. In this manner, the trader locks in gains and limits the potential losses that may occur if the trade goes against them. For example, if you set a stop level of 10%, you will be able to keep 90% of your gains if the price of the asset moves in the expected direction while limiting your losses to 10% if the price moves against their expectations.

3. Emotion Control

This trailing stop strategy can help traders avoid emotional reactions as well as impulsive decisions due to market fluctuations by eliminating the need for constant monitoring and decision-making.

4. Adaptability

The strategy is adaptable to various trading styles and timeframes, making it suitable for both short-term and long-term traders.

Implementing the Trailing Stop Strategy

To implement the strategy, traders need to determine the trailing amount, which is usually expressed as a percentage or a fixed dollar amount. This value dictates how closely the trailing stop order follows the rising stock price.

Next, when entering a trade, traders place a stop-loss order at a certain distance below the entry price. This provides a safety net in the event that the trade immediately moves against them. As the stock price appreciates and surpasses the initial stop level, the trailing stop order is activated. From this point onward, the trailing stop order follows the stock price at the predetermined trailing amount.

If the stock price continues to rise, the trailing stop order keeps adjusting upwards, locking in gains as long as the price remains above the trailing stop level. This allows traders to capture more profits during strong bullish trends.

On the other hand, if the stock price declines, the trailing stop order remains stationary, maintaining a certain distance from the highest point. If the price retraces to the trailing stop level, the order is triggered, allowing the trader to exit the trade and limit potential losses.

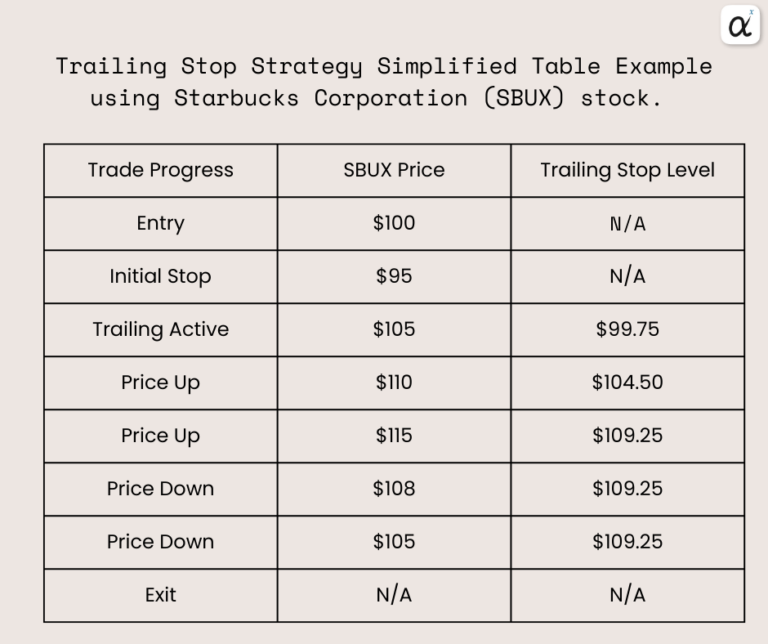

Let's look at Starbucks Corporation's (SBUX) stock as an example of implementing a trailing stop strategy.

Step 1: Initial Analysis

Starbucks Corporation (SBUX) is poised for an upward move according to your analysis. For instance, taking the current price of SBUX at $100, we see that the stock is poised for an upward move.

Step 2: Setting Trailing Amount

You decide to implement a trailing stop strategy with a trailing amount of 5%. This means that if the stock price rises by 5%, your trailing stop order will adjust accordingly.

Step 3: Placing the Trade

- Entry: You enter a trade by purchasing SBUX shares at $100 per share.

- Initial Stop Level: To protect your investment, you set an initial stop-loss order at $95 (5% below the entry price of $100).

- Trailing Activation: As the SBUX stock price rises, it reaches $105 per share. At this point, your trailing stop order becomes active.

Step 4: Trail the Stop

From this point on, your trailing stop order follows SBUX stock price movements, maintaining a 5% difference below the highest price reached. Let’s see how this plays out:

- Price Reached $110: Your trailing stop order would adjust to $104.50 (5% below $110).

- Price Reached $115: Your trailing stop order would adjust to $109.25 (5% below $115).

Step 5: Protecting Gains and Managing Risk

Now, let’s say the price start to decline.

- Price Drops to $108: Your trailing stop order remains at $109.25.

- Price Drops to $105: Your trailing stop order remains at $109.25.

Step 6: Exit or Continue

If the stock price continues to decline and reaches or drops below $109.25, your trailing stop order would be triggered.

In this case, you exit the trade, minimizing your losses to approximately $0.75 per share (excluding trading fees).

On the other hand, if the stock price keeps rising, your trailing stop order will adjust upwards, allowing you to capture potential gains. This flexibility allows you to stay in the trade as long as the trend is favorable. In addition, it ensures profits and limits losses in case of a reversal.

Bottom Line

By setting a trailing amount and allowing the stop level to adjust to price movements, traders can maximize profits during bullish trends and protect their investments against sudden market reversals. It’s worthwhile to note that while the trailing stop strategy offers significant benefits, there’s no one-size-fits-all approach in trading.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More