The second triangle: the Descending Triangle

Read MoreMarket Update - The IPO storm; ARM, Instacart, and Oddity.

Little of the week’s wagon bravado when the IPO was welcomed on New York’s Nasdaq exchange and later thrown by investors.

Arm climbs 25% in Nasdaq debut after pricing IPO at $51 a share and later being slammed!

Arm Holdings is a British company that designs and licenses microprocessors, graphics processing units, and other semiconductor technologies. One of the world’s largest suppliers of chip designs for smartphones, laptops, and other devices. Arm Holdings was acquired by SoftBank Group, a Japanese conglomerate, on 18 July 2016 for $32 billion (£23.4 billion). The transaction was completed on 5 September 2016.

Arm Holdings debuted on the Nasdaq stock market on September 14, 2023, under the ticker symbol ARM. It priced its initial public offering (IPO) at $51 per share, above the expected range, valuing the company at $54 billion. The IPO was the largest in the U.S. since Rivian in 2021. Arm Holdings sold 95.5 million shares, raising about $4.9 billion from the offering.

The stock of Arm Holdings rose 25% on its first day of trading to close at $85 per share, giving it a market cap of around $65 billion. The stock was in high demand as investors were attracted to Arm Holdings’ strong position in the semiconductor industry. Investors were also attracted by its potential growth opportunities in artificial intelligence, cloud computing, and the Internet of Things (IoT).

In a presentation to investors, Arm said it expects the total market for chip designs to be worth about $250 billion by 2025, including growth in chip designs for data centers and cars.

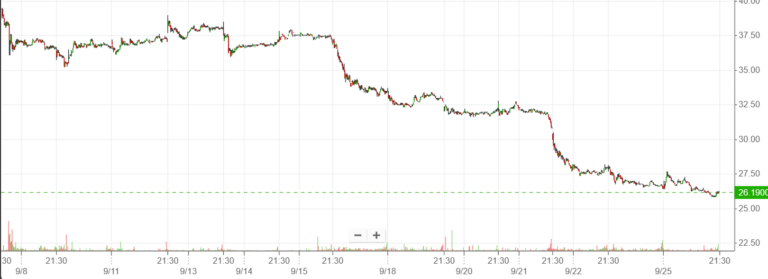

However, Arm Holdings’ stock faced some downward pressure after the initial surge as the broader stock market declined. This was amid concerns over inflation, interest rates, and the debt ceiling. This led to a sell-off in Arm Holdings’ stock as investors became more cautious. The company’s stock ended the month down about 7%, underperforming the broader market.

The stock also faced competition from other tech IPOs, such as Instacart (CART), an online grocery delivery service. Stock in Arm Holdings fell below its IPO price of $51, closing at $50.48 per share on September 25, 2023.

The stock later started to pick up its momentum on September 25, 2023. It increased 6.08% in a span of a day and settled closing at $54.44.

Instacart shares closed up 12% after its public market debut.

The company offers grocery delivery and pickup services, as well as in-store technology and online advertising solutions to customers, retailers, and brands in the United States and Canada.

Instacart was founded in 2012 by Apoorva Mehta, Max Mullen, and Brandon Leonardo, and has grown to partner with more than 1,400 retail banners and 80,000 stores across more than 14,000 cities. Instacart has a network of 600,000 freelance shoppers who pick up and deliver orders from local stores to customers’ homes.

Under the ticker symbol CART, Instacart debuted on the Nasdaq stock market on September 19, 2023. Instacart priced its initial public offering (IPO) at $30 per share, above the expected range, valuing the company at $9.9 billion on a fully diluted basis. A total of $660 million was raised for the company through its IPO. An IPO like Instacart was one of the first major tech IPOs in the US since December 2021, and was closely watched by both investors and startup companies alike.

Instacart’s IPO was a significant milestone for the company. However, it also reflected its challenges and uncertainties in a competitive and dynamic industry. On its first day of trading, Instacart’s stock soared 40% to open at $42 per share. This gave the company a market valuation of over $11 billion. Stocks of Instacart were in high demand due to the company’s strong position in the grocery delivery market and its potential to expand in new verticals and geographies. Instacart’s stock, however, declined following the initial surge as inflation, interest rates, and debt ceiling concerns weighed on the market. Instacart’s stock price had fallen below its IPO price of $30 per share by September 25, 2023, closing at $29.48.

Notable to take note as Instacart’s appointed new CEO of Instacart, Fidji Simo, who joined the company from Facebook in August 2021, will be taking the company through these challenges and opportunities as it enters a new phase of its journey.

Another IPO worth mentioning; Oddity Tech.

Oddity offers beauty and wellness products and services and uses artificial intelligence, molecular discovery, computer vision, and data science to develop these products and services. It operates two brands: Il Makiage, a prestige cosmetics brand, and SpoiledChild, a wellness brand that offers personalized supplements and skincare products.

Oddity debuted on the Nasdaq stock market on July 19, 2023, under the ticker symbol ODD. It priced its initial public offering (IPO) at $35 per share, above the expected range, valuing the company at $9.9 billion on a fully diluted basis. As a result of the IPO, the company raised $660 million.

Oddity’s stock soared 40% on its first day of trading, opening at $42. Consequently, the market valuation of the company reached over $11 billion. The stock was in high demand as investors were attracted to Oddity’s strong position in the beauty and wellness market as well as that company’s potential growth opportunities in new verticals and geographies.

Oddity’s IPO was a significant milestone for the company. As a competitive and dynamic industry, it also faces challenges and uncertainties.

As competition in the beauty and wellness sector intensifies, Oddity faces rivals such as Sephora, Ulta Beauty, Amazon, and Glossier. Oddity also has to balance profitability and growth, as it has sacrificed revenue growth for earnings in recent quarters. Oddity also has to maintain its relationships with its customers, retailers, brands, and advertisers, who have different needs and expectations from the platform.

The IPO was like a tightrope walk for the company, with the potential for great rewards but also great risks. Oddity’s new CFO Lindsay Drucker Mann, who joined the company in June 2021 from Goldman Sachs, will have to lead the company through the new challenges and opportunities.

However, after the initial surge, Oddity’s stock faced downward pressure. By September 25, 2023, Oddity’s stock had fallen below its IPO price of $35 per share, closing at $29.48 per share. The stock might have a successful debut, yet it had fallen -44.92% since listed.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More