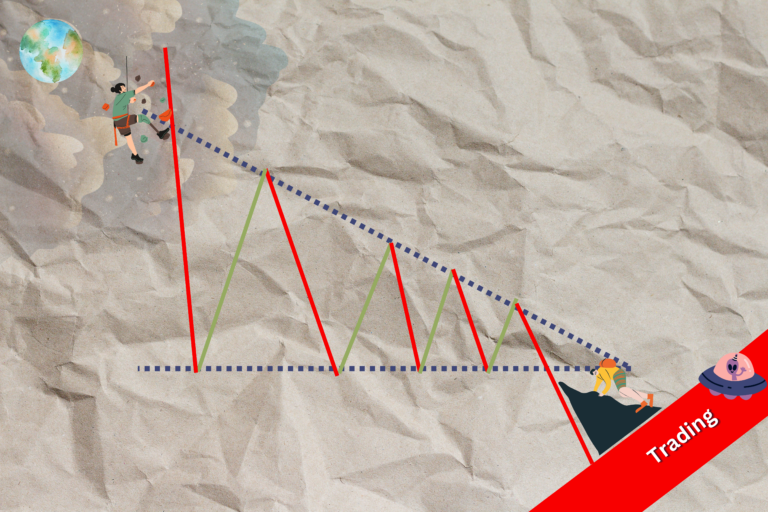

The second triangle: the Descending Triangle

Read More

Market Update 21/3 — The Banking Melodrama Blockbuster Continues.

The latest banking scene updates include UBS, Credit Suisse, New York Community Bank, Signature Bank, First Republic Bank, The Fed, and Global Central Banks.

It is just a matter of weeks ago that they were one of the biggest players in the giant American banking system, but now they are at the center of a crisis that has shaken the whole nation.

Contents

UBS to Acquire Credit Suisse for $3.3B to End Crisis

In a groundbreaking, government-brokered deal, UBS Group AG has agreed to buy Credit Suisse Group AG in order to contain a global crisis that had begun to spread across global financial markets, and in turn, to contain this crisis of confidence.

In an all-share deal that includes extensive government guarantees and liquidity provisions, UBS is paying 3B francs ($3.2B) for its rival in order to acquire it entirely. Currently, Credit Suisse’s shares have fallen 99% since its 2007 high. The Swiss National Bank is offering 100 billion-franc liquidity assistance to UBS while the government is granting a 9 billion franc guarantee for potential losses from assets UBS is taking over.

As a result of the buy-over, Colm Kelleher, the UBS Chairman, mentioned that he would shrink the investment bank at Credit Suisse, a unit that has been losing money for the past few years

“It was indispensable that we acted quickly and found a solution as quickly as possible“ – Thomas Jordan, Swiss National Bank President said at a press conference late Sunday.

In addition, according to Karin Keller-Sutter, Credit Suisse was no longer able to survive on itself.

As a result, the buy over of SVB, in my opinion, is a fast and necessary action that has to be taken in order to contain the fall with the fear of another SVB contagion.

UBS shares fell sharp after the Credit Suisse deal

According to UBS, the combined bank will have $5T in invested assets following the emergency rescue.

Analysts call UBS’ Credit Suisse deal ‘attractive’ and ‘compelling’ but according to UBS Chairman Colm Kelleher, “as far as Credit Suisse is concerned, this is an emergency rescue.”

UBS shares sank 8.8% as the market opened on Monday while Credit Suisse shares plunged 60% in morning trade.

In response to Credit Suisse eradicating such debt, Markets in Europe opened lower on Monday after clocking their worst week since September 2022 following a volatile week in the banking sector. The pan-European Stoxx 600 index was down 0.6% at 9:00 a.m. London time, with financial services falling 3.3%. Banks pared earlier losses to trade 2.6% lower.

As part of its rescue merger with UBS, Credit Suisse announced on Sunday that 16B Swiss francs of AT1 debt would be written down to zero under Swiss regulatory orders, surprising bondholders and raising questions about the safety of investing in such debt.

AT1s issued by other European banks were down by roughly 10 points in early trade (According to data gathered from Tradeweb). UBS bonds traded at $.084 and Deutsche Bank AT1s were at roughly $0.72, BNP Paribas AT1s were down 0.08 at $.070. (All prices as per cents on the dollar).

A $2.7B deal, New York Community Bank to Buy failed Signature Bank

In a $2.7B deal, most of Signature Bank’s deposits and certain loans were acquired by Flagstar Bank, a subsidiary of New York Community Bankcorp (NYCB) according to The Federal Deposit Insurance Corporation (FDIC) last Sunday. As of now, the FDIC estimates that the cost of Signature Bank’s failure will be $2.5B. However, a final figure will not be available until the receivership is completed.

Starting Monday, Flagstar Bank will be taking over the 40 branches of Signature Bank. During the course of the deal, Signature Bank’s assets will be purchased for $38.4B. This is about slightly more than a third of the bank’s total assets when it fell under a week ago.

However, a total of $4B in deposits and $60B of loans related to Signature’s digital banking services were excluded from the deal. The FDIC also reported that $60B in Signature Bank’s loans will remain in receivership and will be sold off.

First Republic Bank’s Rating Being Downgraded Again

On Sunday, Standard & Poor’s (S&P), the rating agency had just downgraded the bank’s long-term issuer credit rating for the second time in a week from BB+ to B+, despite a US$30B rescue package from 11 large US banks.

Seen from the fact that First Republic Bank, which owns a portfolio of municipal bonds, presents a similar profile to that of SVB. This is expected to be the next in the line of events following the fall of the Banking Scene. The stock market valuation of First Republic Bank, the 14th largest bank by assets in the US, has been slashed by 80%.

First Republic Bank is set to receive a $30B lifeline from a group of America’s largest banks including JPMorgan Chase & Co, Citigroup Inc, Bank of America Corp, Wells Fargo & Co, Goldman Sachs, and Morgan Stanley. The $30B infusion of capital will provide the bank with much-needed cash to meet customer withdrawals and buttress confidence in the US banking system during this uncertain period.

As of Sunday, First Republic had been able to access US$70 billion in funds as part of a round of financing raised through JPMorgan. Even so, investors did not seem to be calm as fears of a contagion escalated as the demise of Signature Bank followed that of SVB and depositors began to move their cash to larger lenders as a result.

Despite its stock closing up 10% on news of the rescue, First Republic Bank’s shares fell 18% in after-market trading after the bank announced that its dividend would be suspended.

“The recent declines in bank asset values very significantly increased the fragility of the U.S. banking system to uninsured depositor runs,” economists wrote in a recent paper published on the Social Science Research Network.

Fed and Global Central Banks Move to Boost Dollar Funding.

Central banks will boost the frequency of swap-line operations.

Central banks involved in the dollar swaps will “increase the frequency of 7-day maturity operations from weekly to daily,” the Fed announced in coordinated action Sunday. This marks the latest effort by policymakers to ease growing strains on the global financial system. Among the five central banks coordinated with the US Fed are the Bank of Canada, Bank of England, Bank of Japan, European Central Bank, and Swiss National Bank.

US equity futures rose early Monday as investors weighed the agreement and central bank moves to boost dollar liquidity. Traders’ fears about the stability of the financial system were initially calmed by the news, but their attention quickly turned to the Fed’s interest rate decision.

Traders have been trying to work out how much mind Jerome Powell and his colleagues will pay to global banking stress when they decide on rate hikes, as Powell says he is determined to tame inflation.

Financial conditions in the US have reached restrictive levels last seen during the Fed’s 75-basis-point hikes. That would help the argument for the US central bank to pause, or at least slow rate increases. The tightening of conditions might not, however, be enough to bring inflation under control, so policymakers should be wary.

Will financial stress be more transient than inflation?

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Become a AXEHEDGE investor today.

5 Common Mistakes Beginner Traders Make

Things to avoid when you’re just starting to trade

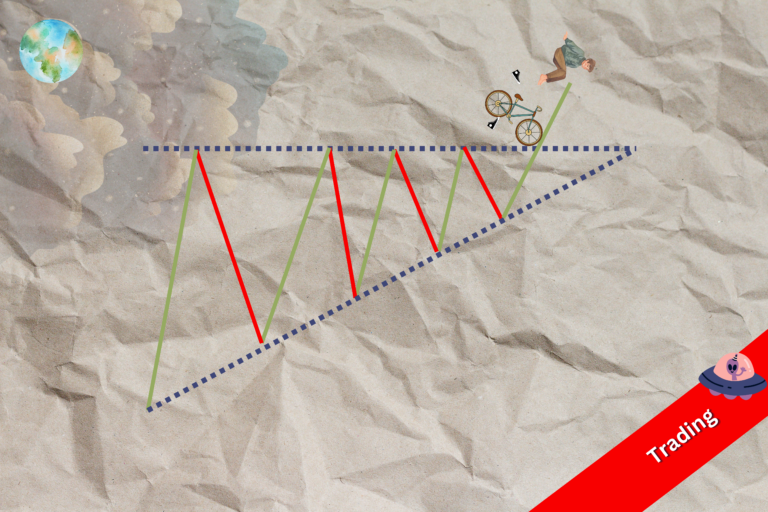

Read MoreTrading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More