The second triangle: the Descending Triangle

Read MoreMarket Update – Of ‘Hawkish’ Market & AI Correction

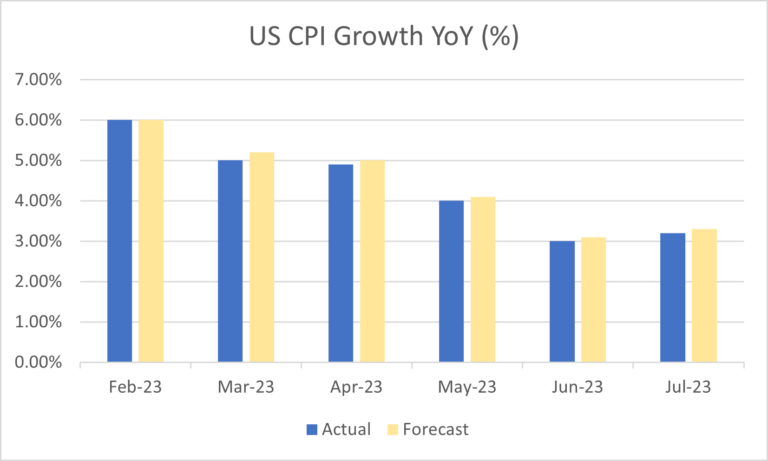

On August 10th, 2023, the Bureau of Labor Statistics (BLS) released much-anticipated data, July’s Consumer Price Index (CPI). The CPI YoY growth showed a slight hike in inflation whereby it grew by 3.2%, 0.2% higher than the previous month’s 3.0%. This is still, however, slightly below the expectation that it might grow to 3.3%.

The growth in itself is not necessarily a good thing, as the Federal Reserve aims for 2.0%, but the fact that inflation has been declining steadily over the past few months, coupled with its persistent results in flying below the expected growth is something that the market is somewhat hoping for.

What happened then?

The market rejoiced well at the news, given how the CPI data will greatly affect the Feds’ decision on whether to raise interest rates further. As it stands, the Feds have already hiked interest rates four times in 2023, starting from a hike to 4.75% in February to now 5.5% in July. There was only one time that rates were not raised, which is in June.

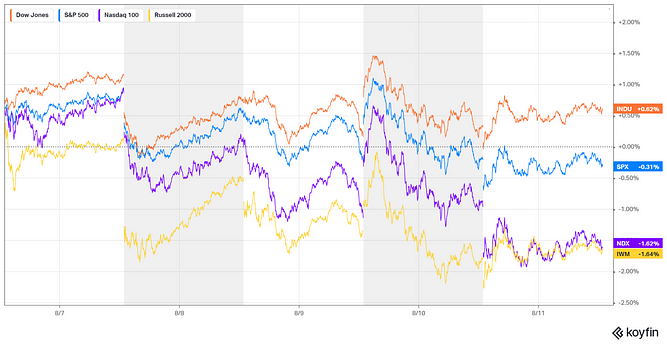

The market’s gleeful response can be seen when the S&P 500 index rose by 0.79% in the span of just half an hour after the market opened. Alas, the joy was short-lived, and the S&P 500 fell by almost 1.18% from its peak to the day’s close.

The question is why? Why did the market respond in such a way despite relatively well data being released?

Feds' Hawkish Eyes on Inflation

It’s very much apparent on how the Feds perceive inflation, that they would be willing to do whatever it takes to keep it down. First, despite being lower than expected, the 3.2% recorded in July is still a hike from the previous month’s YoY growth. As the market has already known, Feds’ Chair, Jerome Powell is closely monitoring the data and will not hesitate to hike rates again if the data is too close for comfort.

Second, the unemployment rate shrunk to 3.5% in July compared to 3.6% in June. Sounds like good news, doesn’t it? More people are employed, and it is good news for the labor market, but not for the Feds. When the labor market strengthens, the Fed would fear that demands may lead the market to overheat again, and inflation would go back to where it was, rendering the Feds’ previous effort futile.

Third, nonfarm payroll has also been showing an increment in August whereby it went up to around 187,000 from around 185,000 in July. Despite being short of expectations, a rise is still a rise, and as the market is now cautious of the ‘hawk’ that flies above, that is not a good sign.

These two data are then factored into the short-lived rally, and if there is anything that the trend tells us, the market isn’t feeling too optimistic about an end to rate hikes.

Gloomy Friday

Later on in the week, which is on Friday, if we are to be exact — the market saw two major data releases that brought them to really rethink their optimism. First, the YoY Producer Price Index (PPI) which measures the change in the price of goods sold by manufacturers rose more than anticipated in July, mainly due to a rebound in service costs, suggesting a mild moderation in inflationary pressures.

US PPI YoY in July rose to 0.8%, higher than the expected 0.7%, and a massive increase from the previous month’s 0.2%. Despite that, goods prices excluding food and energy remained stable, indicating a continuing trend of reduced inflation in goods.

At the same time, US Consumer Sentiment data by the University of Michigan was also released. Confirming the anxiety of the market, consumer sentiment declined in mid-August but remained significantly higher than a year ago. The initial consumer sentiment index reading dropped to 71.2 in early August from 71.6 in July, below the predicted 71.7.

Global stocks then dipped while the U.S. Treasury yields rose, leading the market to brace for prolonged higher interest rates by the Feds. The bond market’s reaction to inflation caused a ripple effect on stocks. The Dow rose 0.62%, the S&P 500 fell 0.31%, and the Nasdaq Composite dropped 1.62%.

Gloomy Friday

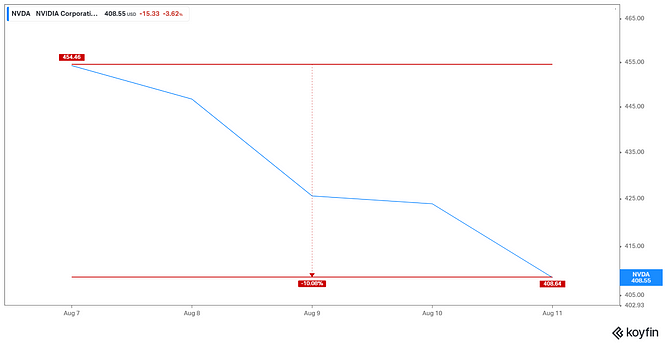

These past few months have seen AI rallying at a pace that can only be beaten by Chuck Norris’ sheer will. Jokes aside, we might be finally seeing the market comes to its sense as to the real prospect of AI. Not that AI was a mistake, on the contrary, AI will be big as it seems. The key phrase here, however, is “will be”.

The massive rally, especially one that Nvidia saw, was arguably a bit too much. It’s like that time when anyone could talk about was of either Barbie or Oppenheimer. Sometimes the hype precedes the real growth, and such can be said of AI.

Throughout the week, Nvidia saw its share fell by more than 10%, a move that one could argue as a correction.

However, this doesn’t mean that AI is dead, nope. This is the moment where the real momentum can be seen. Much like in a swimming race, the first few meters are just ‘hypes’ created by a swimmer’s jump, the real show of strength is after the hype ends, and this is where AI must swim or sink.

Spoiler alert: They will swim, by the way. It’s just a matter of who will swim forward and who will sink.

What to watch for this week?

The upcoming week features significant data releases from the US, and if you’re looking a bit beyond the horizon, major data releases will also be available for China, Europe, and the UK, ones that may affect the central bank outlooks in the upcoming period.

The US will look into its July retail sales data on Tuesday. The Eurozone will see this week indicators like German’s ZEW which measures the sentiment in the market, and its Q2 GDP. The UK will have its employment, CPI, and retail sales data released during the week. Moving further east, Japan will have its Q2 GDP and CPI data released, while Australia will see to its employment data.

Bottom line

- In the US, many of the previous data releases have been leading the market into a mixed-emotions frenzy, which is reflected by an anxious dip in many major indices.

- Despite promising CPI growth, the PPI and market sentiment aren’t good enough to cheer the bulls forward.

- The Feds’ hawkish approach to overcoming inflation is deeply rooted in the market, and it doesn’t seem that rate hikes are meeting their end anytime soon.

- AI may be going through a correction, particularly reflected by Nvidia’s dipping price, showing the real value of the AI hardware powerhouse.

- This week will see to a few interesting data releases in the US and in many other major economies.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More