The second triangle: the Descending Triangle

Read More

Market Update - 8/5 Unbox Berkshire’s annual meeting.

Table of Contents

Berkshire Hathaway’s annual shareholder meeting on May 6, 2023, Saturday in a full stadium of investors included dozens of topics and questions on strategy, artificial intelligence, and politics from the two pillars of the conglomerate: Chairman Warren Buffett and Vice Chairman Charlie Munger. The meeting wasn’t all business, during the over seven-hour meeting they also cracked jokes and shared wisdom.

Berkshire Hathaway’s compounded annual gain from 1965 through the end of last year was 19.8%, compared with 9.9% for the S&P 500. As a result, the overall total return is 3,787,464%, which is higher than the benchmark return of 24,708%.

Buffett claims Apple's business is better than Berkshire Hathaway's subsidiaries.

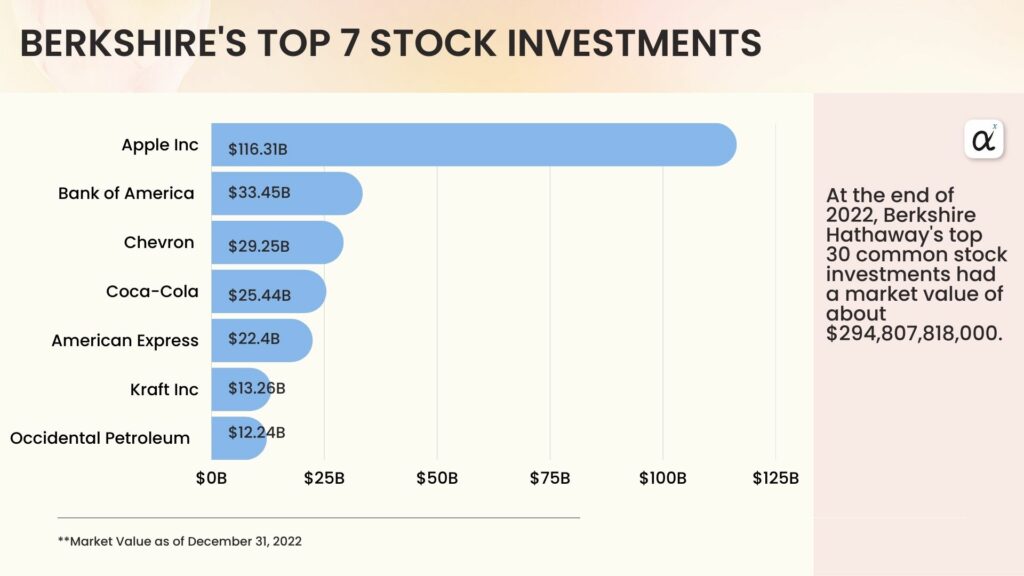

As Berkshire did the first purchase of Apple in 2016, the company now holds one of the largest equity positions in its portfolio, as well as one of the most valuable. There has been a 500% increase in the value of Apple stock since Berkshire first purchased it despite the fact that Berkshire has increased its stake in Apple through buybacks. It is estimated that Berkshire owns about 5.8% of the company as of today.

As a questioner suggested, Buffett clarified that Apple does not makeup 35% of Berkshire’s portfolio. This is because the portfolio also includes of non-publicly traded companies.

“Our criteria for Apple was different than the other businesses we own —It just happens to be better business than any we own,” Buffett said.

iPhone has indeed embarked on a loyalty quo that makes it an extraordinary product. “Apple has a position with consumers where they’re paying 1,500 bucks or whatever it may be for a phone. And the same people pay $35,000 for having a second car, and [if] they had to give up a second car or their iPhone, they would give up their second car.”

Apple has established a remarkable reputation among its users. “We don’t have anything like that that we owned 100% of, but we’re very, very happy to have 5.6 or whatever-it-may-be percent, and we’re delighted every 10th of a percent that goes up.”

“I don’t understand the phone at all,” Buffett said. “But I do understand consumer behavior.”

Occidental Petroleum - Buffett knocks down speculation

The chairman of Berkshire Hathaway, Warren Buffett, has assured investors that Berkshire Hathaway will not take full control of Occidental Petroleum, the stock in which Berkshire Hathaway owns a stake of more than 20%.

“There’s speculation about us buying control, we’re not going to buy control. … We wouldn’t know what to do with it,” he said.

Berkshire owns $10B of Occidental preferred stock and warrants to buy another 83.9 M common shares for $5B, or $59.62 each. The warrants were obtained as part of the company’s 2019 deal that helped finance Occidental’s Anadarko purchase.

“We will not be making any offer for control of Occidental, but we love the shares we have,” Buffett said.

“Cash Is Not Trash”- Warren Buffett

Despite concerns regarding the debt ceiling, Buffett believes that it is unlikely that the U.S. dollar will be dethroned as the world’s reserve currency anytime soon. The currency is viewed differently when people distrust it, according to Buffett.

“Nobody knows how far you can go with a paper currency before it gets out of control, and particularly if you’re the world’s reserve currency,” Buffett said. “You don’t want to try and pick out the point where it does become a problem because then it’s all over.”

“I don’t spend much time looking at the Federal Reserve Balance sheet. The one figure I do like to pay attention to is cash in circulation” – Warren Buffet

Bank of America will remain the bank of choice

Despite his decision to hold on to his Bank of America holdings, Buffett warns that he does not know what will happen in the future. During the recent economic downturn, he said that the recent banking crisis in the US has reaffirmed his conviction that the American public and lawmakers have a profound lack of understanding of the banking industry.

“We remain with one bank holding … but we originated that deal, with Bank of America. I like Bank of America, I liked the management and I proposed the deal for them. So I stick with it,” said Buffett. “But do I know how to project out what’s going to happen from here? The answer is I don’t”

Geico

Berkshire Hathaway has reported a 12.6% jump in operating earnings for the first quarter of the year, driven in part by a rebound in the company’s insurance business.

There was a big turnaround at Geico in the quarter, with the auto insurer returning to a big underwriting profit of $703 million after last year it suffered a $1.9 billion pretax underwriting loss as it lost market share to its competitor Progressive.

According to the latest figures, insurance underwriting net profit was $911 M, a sharp increase from $167 M a year earlier. Additionally, the insurance investment income increased by 68% from $1.170 B to $1.969 B from the previous year.

“Geico is in discussions with auto manufacturers to help them with insurance. Tesla and GM try to insure their electric vehicles themselves” – Warren Buffet

Warren Buffett says “We’re not done with Japan”

Buffet indicated that he is looking forward to continuing to explore opportunities in Japan, adding that he is “pleasantly surprised” with each of the five major Japanese trading firms in which he raised his stakes last month. In August 2020, on the occasion of his 90th birthday, the Oracle of Omaha acquired stakes in these firms. The companies, which behave similarly to conglomerates, are Mitsubishi Corp., Mitsui, Itochu Corp., Marubeni, and Sumitomo.

In April, revealed he had increased his stakes in each company to 7.4%. “We’ll just keep looking for more opportunities,” Buffett said to his shareholders.

Greg Abel: Warren Buffett's Successors

Warren Buffett reiterated that Greg Abel will succeed him as Berkshire Hathaway CEO, and that key executives of the company will be decided upon by Abel and Ajit Jain when it’s time to make the decision.

Abel became part of Berkshire Hathaway after the conglomerate acquired a 75% stake in MidAmerican Energy in 1999. At that time, Abel was president of a multibillion-dollar energy company. The firm eventually changed its name to Berkshire Hathaway Energy (BHE). Abel served as its Chief Executive Officer from 2008–2018. He currently serves as its chair. BHE had about 24,000 employees and reported more than $25B in revenue in 2022.

During his time at MidAmerican and Berkshire, Abel was mentored by David Sokol, who appeared to be Warren Buffett’s successor until he resigned from Berkshire in 2011.

Bottom Line

Knowing how good businesses can become bad ones or whether something needs to be attracted to attract interest is crucial. We can’t predict the future, but we can determine things like what a price should be and threats to business models.

“We don’t get smarter over time, we … get a little wiser, though, following it over time,”

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More