The second triangle: the Descending Triangle

Read MoreMarket Update 26/6: Crude Oil Prices Rise, Bitcoin Tops $30K.

Oil Price Climbs Due to Russia's Mutiny.

There have been some concerns over potential political instability in Russia, as well as the potential impact on oil supplies from one of the world’s largest oil producers, following the failed mutiny by Russian mercenaries over the weekend. In a deal that halted their rapid advance on Moscow, heavily armed mercenaries Wagner withdrew from the southern Russian city of Rostov on Saturday.

Following the event, oil prices continued to rise over the weekend. This has raised concerns about political instability in the country as well as possible effects on oil supply.

Why does Russia's situation make such a big turmoil?

Russia provides roughly 10% of global petroleum production and is also a major exporter to world markets, exporting about 5 million barrels a day (mb/d) of crude oil and close to 3 mb/d of petroleum products. There has been a surge in oil prices in the past when Russia experienced disruptions to its oil exports; plus, the European Union is entirely dependent on Russia for a substantial portion of its coal supplies as well as for a significant portion of its natural and enriched uranium supplies.

“The fear that any disruption in Russia could lead to further disruptions in the global energy market.”

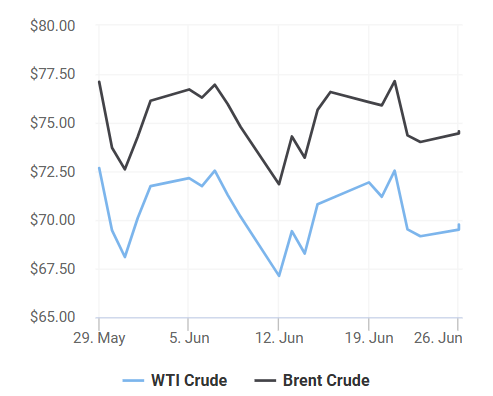

Brent Crude Futures price rose $0.95, or 1.3%, to $74.80 a barrel by 2300 GMT on Sunday whereas U.S. West Texas Intermediate (WTI) crude was at $70.04 a barrel, up $0.88, or 1.3%. Early Asian trade on Monday, June 26, 2023, around 0632 GMT Monday, Brent Crude Futures settled around $74.49, an increase of $0.63 or 0.85% while U.S. West Texas Intermediate (WTI) crude traded at $69.63, an increase of $0.47 or 0.68%.

In the past week, U.S. crude oil exports grew to 4.5 million barrels per day, while imports fell about 50% to 1.6 million barrels per day.

The impact may be limited since spot fundamentals have not changed, and issues such as financial risk or oil demand may be offset by increased uncertainty.

In addition to Saudi Arabia’s announcement of the reduction of 1 million barrels per day in production in July, the OPEC+ deal to limit supplies into 2024 is also set to tighten the market.

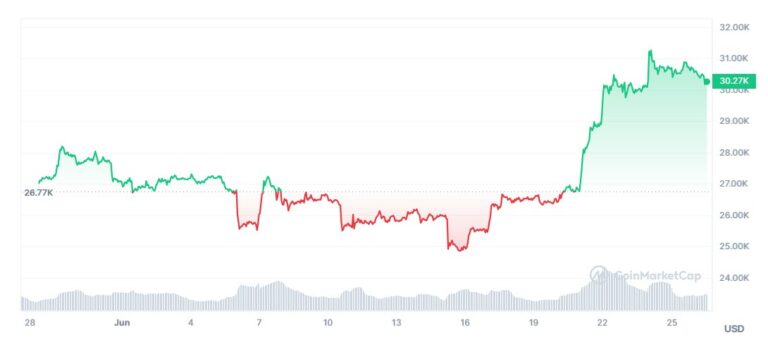

Bitcoin Opens Above $30,000

The main cryptocurrency starts rising on Wednesday, June 21, 2023. It topped its last peak on April 14, 2023. According to the data by CoinGecko, the daily trading volume in the cryptocurrency currently sits at around $24B. It was a significant reduction from the last peak of the crypto rally in 2021 during which there were more than $100B worth of trading volume when bitcoin reached an all-time high of nearly $69,500.

Today, trading volume is nowhere near where it was at the height of the 2021 crypto boom.

A significant factor behind the lack of liquidity in the crypto market is the regulatory scrutiny that U.S. authorities have applied to the crypto industry. The Securities and Exchange Commission has sued major exchanges such as Coinbase and Binance.

The Sudden Surge

Increasing interest from major financial institutions has contributed to the current surge in Bitcoin’s value. In particular, the world’s largest investment management company, BlackRock (NYSE: BLK), recently made an application to register a Bitcoin spot exchange-traded fund (ETF) in the US Securities and Exchange Commission. As a result of traditional financial institutions showing interest in financial instruments for the first time in a week, Bitcoin retained its position above US$30,000.

The price of Bitcoin might rise another notch if it can stay above $30,000.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More