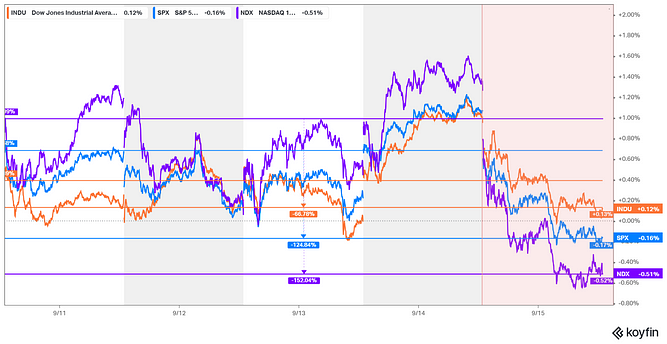

The move on Friday can most probably indicate the sentiment looming within the market ahead of the interest rate decision. Market players are trying their best to optimize their portfolios ahead of the announcement by the US Federal Reserve (the Fed).

The reason why such preparation results in gloomy market sentiment rests in the data released over the past few weeks. As a start, the US Consumer Price Index (CPI) YoY saw an increase of 3.7% in the September announcement, 0.5% higher than August’s 3.2%. This is also 0.1% higher than the forecast of 3.6%.

High inflation would most likely point to another rate hike by the Fed, given how careful Jerome Powell is when it comes to trying to get inflation down to 2%, as he (again) reiterated during his speech in Jackson Hole last month. Core inflation, however, took a better turn whereby it decelerated from 4.65% to 4.35% for August.

Apart from that, US Retail Sales are also going up to $606.7 billion from $603.14 billion, which is a 0.61% increase MoM and a 1.63% increase YoY. To many, this is a good sign of a strengthening market. However, this could also lead to a different path, whereby the Fed can interpret a strong market as one that could cause an ‘overheat’ in demand, thus leading inflation back up.

In August, nonfarm payroll employment went up by 187,000. This is another call for concern as a tightening labor market could mean that inflation might stay high for a while, or at least that is what the Fed goes by up until now.

If there’s any consolation, the unemployment rate also increased by 0.3% to 3.8%, according to the U.S. Bureau of Labor Statistics. More people got jobs in healthcare, leisure, helping professions, and construction. However, there were fewer jobs in transportation and warehousing. However, the number of people without jobs increased by 514,000, totaling 6.4 million.

If one is to take a guess, the writer personally is of the opinion that the Fed is not yet done with rate hikes. Instead, the recent data are a cause for concern and will most likely lead to another hike — that is if the Fed thinks the current rate is not yet too high.