The second triangle: the Descending Triangle

Read More

Market Update 1/5 — First SVB, Now First Republic?

A look into what did, what is, and what will happen with the bank.

The market in 2023 has surely seen a lot — perhaps too much that the benchmark into what amounts to breaking news might as well be sky-high by now. Nonetheless, the week has seen quite a few twists and turns along the way, making an already interesting year more interesting.

First Republic Bank jabbing on fresh wounds

We’ll start our story of the week with something that is perhaps still fresh in the minds of the market — and the key phrases are bank failures, massive withdrawals, and depositors’ panics. Ring a bell?

The situation which faces First Republic Bank (NYSE: FRC) is not something too foreign. In its First Quarter report, the bank made known that it was facing troubles with massive withdrawals — one that amounts to around $100 billion, apart from its profit that fell by 33%, and its revenue by 13%.

“With the closure of several banks in March, we experienced unprecedented deposit outflows,” — Neal Holland, First Republic Bank Finance Chief.

That didn’t come as a surprise. The banking sector was facing a tumultuous month in March, when Silicon Valley Bank (OTCMKTS: SIVBQ), a Goliath of $209 billion, fell — rattling the whole sector while sending panic waves across the horizon. Since then, the banking sector has struggled to regain its business model’s crux — confidence. People are afraid that if they didn’t take their money out now, they won’t be able to do it later. “Just look at the businesses with money in SVB,” some might say.

What’s more troubling for the First Republic is not that people are just scared, but the bank is in the shoes that look almost as similar to SVB’s when the latter dropped. SVB faced around $142 billion in withdrawals as it was falling — around 81% of SVB’s total deposit. Now what’s happening to First Republic looks awfully similar to what had happened to SVB, a flash into the not-so-distant trauma for the market.

However, here’s the thing — First Republic’s plight is not at all new. It has started way earlier in March, even before its quarterly report was released. From March 8th up until around a week since, the share price of First Republic Bank took a nosedive of 72.86% from $115 per share to just $31.21 per share.

The crash was the first financial crisis of global proportions, demonstrating how interconnected financial markets became through electronic trading. In total, there were declines in all 23 stock exchanges that day, with 19 falling more than 20%. The losses amounted to an astonishing $1.7T.

What happened to First Republic?

SVB’s failure was nothing short of a punch in the face for the banks. If there’s any sector that would define the economic health of an era, the banking sector is it — the bastion of economic wellness, or one could even call it an indicator to economic wellness.

As SVB fell, people can’t help but ask — what happened? As questions were raised, answers were given. SVB failed because withdrawals were too much above their expectations, in a situation where it depends heavily on their wealthy clients’ deposits. On top of that, the bank had a worrying difference between its fair market value and its actual (balance sheet) value. As for SVB, most of its deposits were invested into long-term assets, such as Treasury Bills and the likes.

Well, another question that you might be asking now is how much longer we will be rambling about SVB and get the hell down to First Republic already — the answer is, First Republic was in the same shoes as SVB. They are relying on deposits, and they have a large difference between fair market value and actual value, while the only thing that separates the two was that SVB is more into debt securities while the First Republic is more into loans.

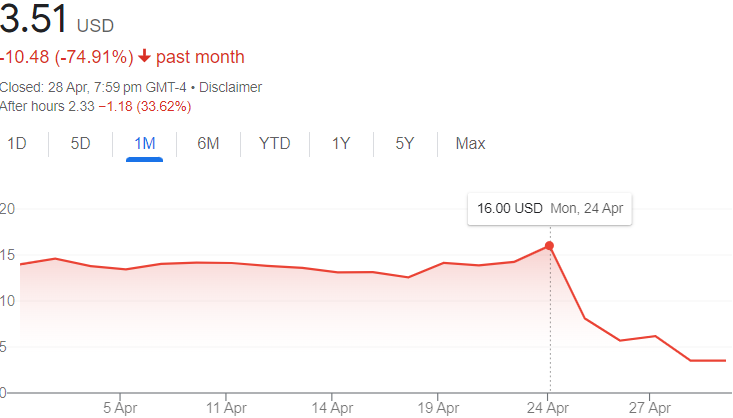

The response was hauntingly well-articulated in the price graph as per above. In just one week, the shares of First Republic dove into Hades’ lair, waiting for the judgment which is yet to come — in April.

Did they die out? The troubled bank preserved as it received $30 billion injections from a few other major banks, which of course, came after Treasury Secretary, Janet Yellen, intervened and pleaded for these whales to provide a buoy for First Republic, and with it, hopefully, the public wouldn’t go into panic if a major player like First Republic is to sink. First Republic didn’t die — not yet, at least.

A further fifty basis points were slashed by the Fed, and billions of dollars were injected back into the financial system through the purchase of long-term Treasury bonds. Eventually, this practice became known as quantitative easing. Moreover, the Fed encouraged banks to continue making loans on their usual terms, which contributed to the maintenance of financial liquidity.

What is happening to First Republic now?

The situation with the First Republic was more of a ticking time bomb. All it took was an inevitable quarterly report to unleash the pandora box upon First Republic. Here’s the thing. People are already scared of the bank’s prospects. The price movement above says it all. All they need is a confirmation of their fear that the bank is going down, which they did get.

When the executives of the banks looked up to God, fist-clenched, asking if things could have gotten any worse, the answer was a nonchalant yes. On April 24th, 2023, First Republic Bank published its Q1’23 report where here are a few things that caught investors’ eyes:

- Deposits were $104.5 billion, down 35.5%.

- Revenues were $1.2 billion, down 13.4%, YoY.

- Net interest income was $923 million, down 19.4%, YoY (attributed to “unprecedented loss of deposits”).

- Net income was $269 million, down 32.9%, YoY.

- Diluted earnings per share of $1.23, down 38.5%, YoY.

- Net interest margin was 1.77%, compared to 2.45% for the prior quarter.

With that, investors scrambled, and a stock that looks as if it is on the brink of death finally met a new low. Four days from the day that the quarterly report was released, the price fell by 78.06%.

The bank, however, didn’t take it too easily. As the drop seems inevitable, the executives tried as hard as they could to convince the people that they can waddle through this whirlpool, but their words grew faint from the wails of fear that gushes in. In the end, the bank had to see the same view as SVB at the latter’s final moments — the sky opens as light pours in — the Federal Deposit Insurance Corporation (FDIC).

As this piece was written, the auction for the First Republic was underway, and a few of the big names were asked by the FDIC to bid, among others, JPMorgan Chase & Co (NYSE: JPM), Citizens Financial Group (NYSE: CFG), and US Bancorp (NYSE: USB). The finalized deal is expected to come on Sunday.

The aftermarket price of the First Republic (around the time this piece was written) is hovering at around $2.2, which is around a 37% decline from its Friday closing price.

What will happen to First Republic?

here are two possibilities for a fallen bank, in which the most likely one is that it will find a buyer. What’s going to happen then is that the FDIC will take on these banks’ troubled assets, and whichever bank won the bid will get the healthy ones, and in this situation, account holders can transact normally — with new management in town. All is well.

This may seem to be the situation for First Republic which will most likely be bought by JPMorgan Chase, in which JPMorgan is to acquire all deposits and all assets of First Republic, including uninsured deposits. JPMorgan is also said to have been exempted from a regulation preventing any bank to hold more than 10% of U.S. deposits, which JP Morgan is already holding more than that.

The second option is that no one buys the bank. If that happens, the bank will have to be liquidated, and this will make their clients unhappy. Throughout the liquidation process, the banks’ assets will be liquidated, the cash will then be used to reimburse its account holders. However, as with many other bankruptcy processes, not everyone will get back their money — or at least, not that easily.

It will be a hassle, there are many processes you’ll have to go through to get your money wired back to you, and that’s okay if you’re just another guy living on a 9 to 5 job, having only a few bucks in First Republic. The businesses and people within it are the ones to take a hit. If they had their money stuck in the account for a few days, it might disturb their operations, causing a bit of a dent in their revenues.

Bottom Line

In comparison to the 1929 Stock Market Crash, which sparked the Great Depression, the 1987 Stock Market Crash recovered relatively quickly, regaining its pre-crash height within two years of the crash.

No single factor contributed to the Dow’s largest daily decline in history, but a number of precedents established by the crisis, including greater transparency from the Federal Reserve and circuit breakers on electronic trading systems, have prevented similar catastrophes from occurring in the future.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More