The second triangle: the Descending Triangle

Read More

Is It Too Late to Invest in AI?

Artificial Intelligence (AI) has become one of the most transformative technologies of our time, revolutionizing industries and driving significant economic growth. With its vast potential, the numbers are rallying up, and many companies involved in AI are seeing tremendous growth, which led many investors to consider whether it is too late to invest in AI. In this article, we will assess several key factors to help you determine the investment prospects of the AI sector.

Innovation and Technological Advancement

The level of innovation and technological advancement within the AI sector is crucial in assessing its investment potential. AI is rapidly evolving, with advancements in machine learning, deep learning, and natural language processing. This continuous innovation presents ample opportunities for investment in AI-driven solutions.

In a business sense, a sensible way to peek into the prospect of innovation in a sector is by looking into the money being poured into it. According to a report by the Stanford Institute for Human-Centered Artificial Intelligence (HAI), GPT-2, which is a large language model launched in 2019, took only around $50,000 to train. Fast forward to 2022, Google launched its first Pathways Language Model (PaLM) which chugged down $8 million in its training.

By the end of 2022, OpenAI launched ChatGPT, a chatbot based on the language model AI which garnered 100 million users in no time. Microsoft invested $10 billion in OpenAI, and the rest is history. Money keeps on gushing in, and companies start throwing the word “AI” around to ride on the hype.

What does that tell you? Simply, AI is at the beginning of its development phase, where the hype train is beginning to speed up. With that much money being poured in now, the results will only be known in a year or two — but it definitely won’t be small. The AI boom is lauded as bigger than the discovery of the internet itself, but could it just be the hypes talking?

Personally, the writer is of the opinion that even if you look beyond the hype, there are many scalable growth potentials with AI. It’s not just about some chatbots that can write emails for you, it is an industry in itself, which is utilized by businesses and consumers alike. Estimates have shown that the market size of AI can reach up to $1.8 trillion in 2030, that’s more than 10 times bigger than how it was in 2022.

What ChatGPT can do in all honesty is not even a fair insight into the potential of AI. Businesses need it for resource optimization, the motor industries need it for automated driving experience, and the military sector is looking forward to its application in mobile defense technologies. The possibilities are limitless.

Of course, it is a rat race, and along the way, some might fall behind. Don’t let FOMO gets to you. Do your maths and see if AI will scale.

Regulatory Environment

The regulatory landscape surrounding AI also plays a vital role in determining its investment viability. Favorable regulations that support industry growth and innovation create a conducive environment for investment. Governments around the world are recognizing the importance of AI and are implementing regulatory frameworks to facilitate its responsible development.

The European Commission, for example, has developed a regulatory framework surrounding AI, which is mainly centered around the degree of risks surrounding the AI application. This can be on whether the AI itself is risky in nature, or the environment in which it is applied is risky, such as being deployed in a critical service.

The regulation seeks to filter through which AI are suitable to be used, and which of them aren’t. It also seeks to provide guidelines on how it can be used, as well as regulatory enforcement as it is being used, such as parameter checks, compliance assessment, and enforcement upon breach.

The general concern on regulations is that they can slow down growth, but based on what is being outlined in the regulation proposals, the regulation seeks to only facilitate how AI can be applied, and in a rightful way of doing so. No one wants an AI that can decide on your health (or even life) going about unbridled.

On top of that, governments are less likely to approach AI in a way that can hinder its growth, given the interest that government bodies themselves have in AI. This can be reflected in the increased budget for AI in the US, whereby the FY23 budget laid down $97 million more compared to the enacted amount in FY22 which is at $1.7 billion (which is also the highest spending amongst other branches of R&D in IT and Artificial Intelligence).

Competitive Landscape

Analyzing the competitive landscape is crucial to understanding the market share and competitive advantages of different players within the AI sector. The presence of dominant players and barriers to entry can significantly impact profitability.

Numerous AI startups are emerging, competing to deliver innovative solutions. However, established players often possess greater resources and expertise, giving them a competitive edge — or at least that’s what many would think.

According to a finding by Harvard Business Review (HBR), despite bigger companies possessing more capabilities, smaller competitors can still nudge through the crowd, provided they have ample skills to utilize the data available to them.

But can they compete with the massive data that many tech giants possess? Based on the same findings, it was found that the accuracy of this AI wouldn’t simply improve just because more data was being churned in, but rather how these data are processed — regardless of size — is the key factor.

However, the market share at the moment is rather saturated, at least in the hardware department, whereby according to The Economist, NVIDIA currently controls 80% of the market when it comes to AI chips. As for the software side, the bigger guns are at an advantage, but there are also many other smaller firms and startups putting up a fight in the field.

With the vast potential of AI, the competitive sphere can be expected to nurture growth, especially in terms of innovations and discovery. This can help the market to expand as companies seek to provide better products/services than their competitors.

Investor Sentiment

Monitoring the sentiment of investors and analysts towards the AI sector provides valuable insights into its investment potential. Positive sentiment and increased investment activity can be indicative of market potential.

AI has attracted significant attention from investors globally, with venture capital funding pouring into AI startups. This heightened investor interest reflects confidence in the sector’s growth and profitability.

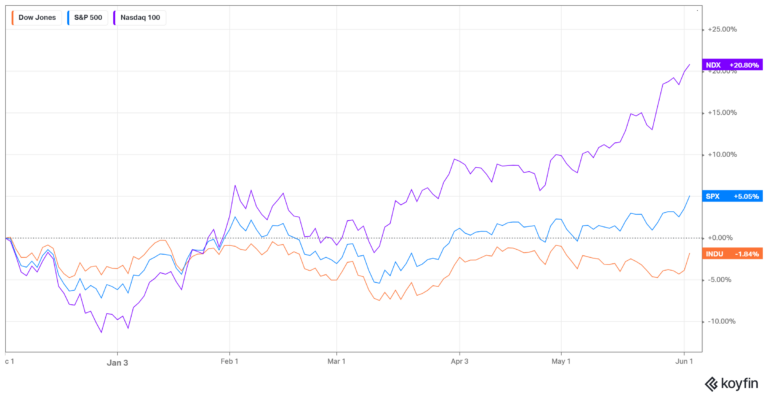

Generally, the performance of the tech-heavy NASDAQ (NDX) index has been showing an impressive rise over the last 6 months, compared to the S&P 500 (SPX) and the Dow Jones (INDU).

If we move closer into the scene, according to a report by Pitchbook, venture capital firms (VC) have increased their positions in the generative AI segment, which went from $408 million in 2018 to $4.8 billion in 2021, to $4.5 billion in 2022.

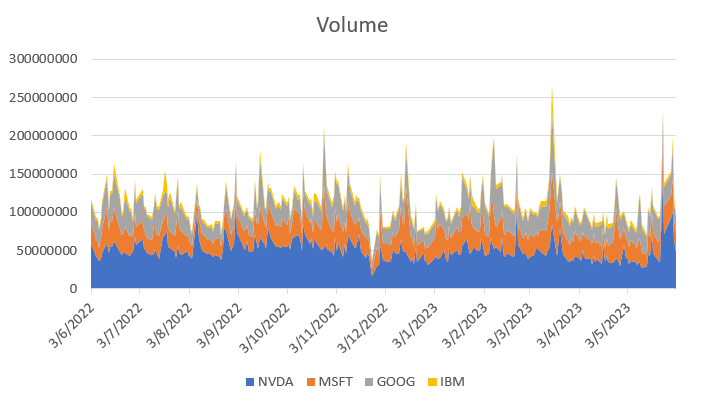

As for the volume of trades involved, we can see that the volume is gradually increasing, whereby companies with a good story to tell in the realm of AI will see that their share price and volume are making a move. The chart below represents the trading volume of four companies: NVIDIA (NVDA), Alphabet (GOOG), Microsoft (MSFT), and IBM (IBM).

Hence, we can conclude that there is an undoubted increase in the interest in AI. Brad Gertner, a billionaire investor, lauded AI as something that is “bigger than the internet itself”. However, one must proceed with caution and not get carried away by emotions, since as with any up-and-coming industry, the hype is sometimes worth more than the thing itself.

Bottom line

Considering the factors discussed above, it is evident that the AI sector still offers significant investment opportunities. The ongoing innovation and technological advancements, favorable regulatory environment, competitive landscape, positive economic factors, R&D investments, investor sentiment, and sustainability practices collectively contribute to the sector’s growth potential.

Investors should conduct thorough research, evaluate specific opportunities within the AI landscape, and consider their risk appetite and investment horizon. While the AI sector has seen substantial growth and attention in recent years, the dynamic nature of this field ensures ongoing opportunities for investment and innovation.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More