The second triangle: the Descending Triangle

Read MoreInvesting is not gambling - why do many believe so?

A look into how an intergenerational myth skewed our financial literacy.

It is a phrase often heard when we talk about investing — “investing is like gambling,” a phrase that perhaps was made just to romanticize investing — adding a sense of impending danger into what would have actually been a relatively timid thing to do. Don’t we all love a bit of grandiosity?

It is a sin propagated to many, this idea. Even in our writings we would have at least mentioned it once from a Freudian slip, not from the risk that investing brings, but rather from the need to feel that the thing we do is interesting when it’s most likely not.

Put it this way, investing (not trading) in the stock market is where you plant your money and watch it grow. It’s almost like watching paint dry. There’s nothing much that you can do other than wait for results.

But investing comes with risks as well, no?

Yes, and so are driving, working, and walking to the grocery store, all of this has its own risk, but let’s get down to it below.

How investing is not gambling - at all.

There are so many reasons, but we’ll just look at three:

Risk level.

When speaking of investing, many associate it with gambling because investing comes with risk. Is it true? Yes — on the risk part. However, with that logic, driving to work is a gamble, walking to the store is a gamble, and getting back with your ex would also be a (bad) gamble — almost everything will be a gamble then. At some point, you’ll have to draw the difference between balancing the probabilities and leaving it to pure chance.

Let’s look at the odds of you losing money when you invest. We’ll look at the odds in relation to your investment time frame.

1 month: 38%

1 year: 25%

5 years: 11%

10 years: 5%

15 years: 0.2%

At the worst time frame, you’ll have a 62% chance of making money. To put it into perspective, the only kind of gambling that would come close to it is blackjack, with a 49% chance of winning. That is if your investment time frame is only for a month. If you increase it, the likeliness of loss decreases.

The difference is apparent if you ask me.

Foresight.

I just put “foresight” as the subheading as it sounds cool. The actual point here is in investing, you can have access to company information, financial statements, data, performance, news, and more. All of the beforementioned would most likely affect how the price movement will be.

In a gamble, there are only a few things that you can know. If you’re going for poker, you can only tell the cards that you hold, and the cards flipped on the table. There’s not much to do after that apart from guessing.

As for investing, there are a lot of things being laid down for you to evaluate, you can look into the company’s overview, financial ratios, and a lot more indicators before you place a buy. Simply put, in investing, you have access to everything that you’ll need to know. It’s just a matter of how you utilize it, and only after the research part is done, luck comes in. As for gambling, the most you can do is to play the game of probability by guessing what hands your opponent might have based on what you have and what’s shown on deck — and that’s the best-case scenario, in the worst case, you’re playing a slot machine with a 1-to-34 million odds of winning.

Investing is not as thrilling.

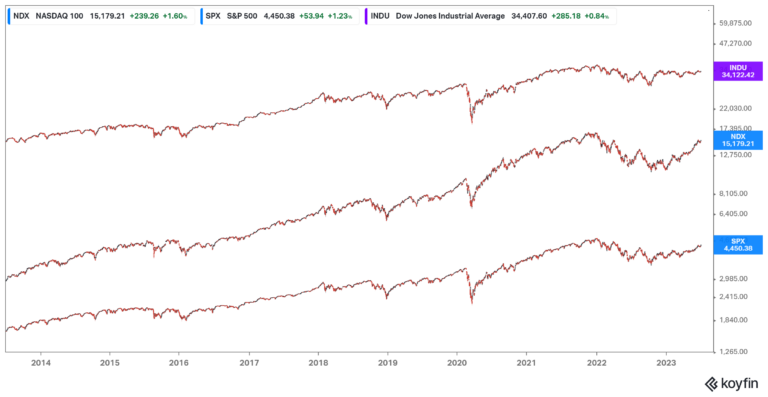

Like it or not, investing is not as thrilling as many made it to be. Take a look at the 10-year graph below.

The graph consists of three main US stock market indices that are the S&P 500 (SPX), Nasdaq 100 (NDX), and the Dow Jones Industrial Average (INDU). If you’d invested in a fund or ETF of any of these indices, the most thrilling story that you can tell would sound something like “Oh yeah, it dipped sharply in 2020,” and the rest is just a gradual upward movement.

Due to this lack of thrill, some might try to overrepresent what investing actually feels like in order to… I don’t know, overcompensate, maybe? As a result, the people who have no clue might fall into this well-known myth.

How does this myth affect soon-to-be investors?

People are scared of investing

The obvious risk from this widespread myth is that people would be scared to invest in the first place, and guess who’s suffering the most from this? The people at the bottom who can afford to invest, but decided not to because of this false belief that investing is akin to gambling. The rich ones won’t be too affected by this, as they have access to financial literacy so as to not gobble up this nonsense heads on.

Of course, not all of that money is being wasted. They put it in savings accounts and earn their gain on interest. Now, here’s the catch — let’s say they can make around 3–4% annually on their savings, inflation would definitely eat up a huge chunk of that gain and leave them with more or less 1%. Oh and don’t forget your taxes!

A gain is still a gain, but if they invested, they’d be looking at a growth of around 8% annually, and that is inflation adjusted. Take that and factor in compounding interest, we’re looking at a massive potential wasted. If you invested $10,000 in 2013 and did nothing to it (including reinvesting the dividends), you’ll fare with $34,888.63 now. That’s almost triple the amount.

That much would’ve meant a lot for one’s general livelihood, and it’s sad to see it getting washed away because of one misunderstanding.

Misused ‘risk’

Another downside of believing in this widespread myth is that the people who don’t know tend to use it as a justification for their loss.

“Ah, it didn’t work out for me. Risk is always present, am I right?”

No! It didn’t work out for a reason, find that reason and look for ways to improve your strategies.

Honestly, that is better compared to some of the scamming financial gurus who use “risk” to get away with siphoning their followers off their money.

“So sorry my strategy didn’t work out as planned, well like I’ve always said, it comes with risk! Ha-ha!”

No, these gurus just screwed unknowing beginners off their pump-and-dump scheme. Wait until one of them starts to find out and they’ll show these gurus the true meaning of risk.

Bottom line

We know that there are perhaps more things that we have left unsaid, but for now, it’d be enough to fair with these few points first. Let’s wrap it up for you, investing is not a gamble. The level of risk in both activities is way apart for you to put them side-by-side. Gambling relies on chances while investing relies on how well you make use of the information available to you. Investing is not as thrilling and cool as they’re usually pictured. Gambling on the other hand… Nothing is cooler than someone who’s alive on the thrill of losing it all! Our final words are if you want to grow your money — invest. if you don’t know how — learn (but don’t easily trust these gurus who guarantee you their system works — BS).

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More