The second triangle: the Descending Triangle

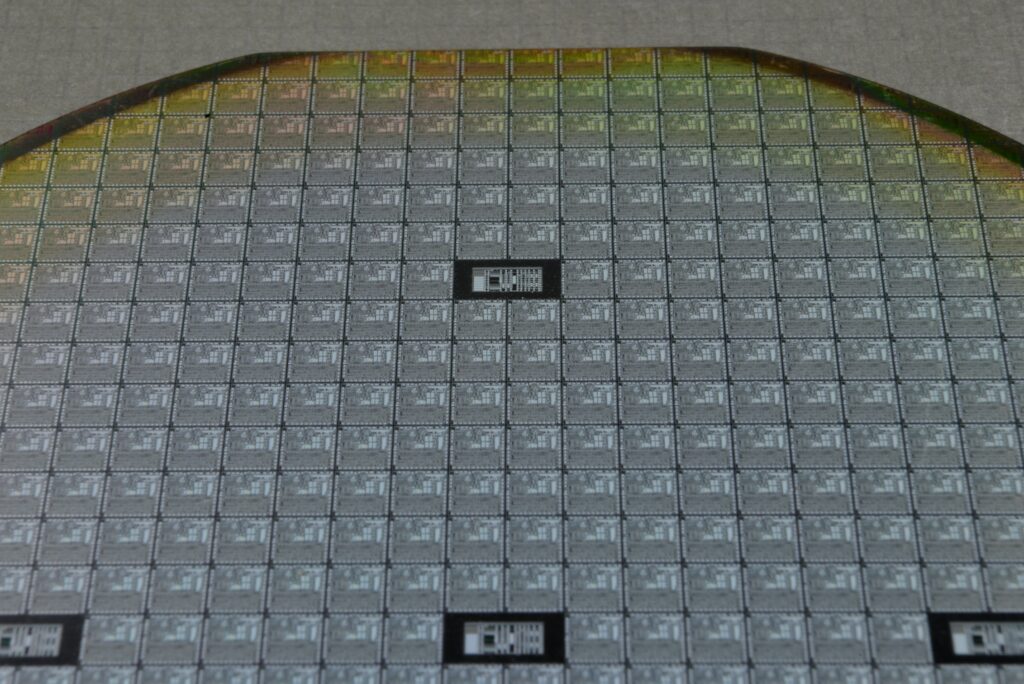

Read MoreInvest in EV's core component - silicon carbide!

With the recent development in electric vehicles (EVs), many are looking at the opportunity to invest in this new-and-emerging sector. After all, it’s hard not to. Tesla (TSLA) has been showing an impressive performance with the recent record-breaking car deliveries of 422,875 units delivered.

Despite that, we know it’s hard to take a pick when it comes to investing in EVs. Tesla is doing good, but is it too expensive for now? If you want to look into other EV manufacturers, can they survive the tight race?

Perhaps it would be good to take a breather and look deeper into those who will benefit regardless of who survives the EV arena — silicon carbide provider!

What is silicon carbide?

Silicon carbide (SiC) is a crystalline compound known for its remarkable physical and chemical properties. It is a combination of silicon (Si) and carbon (C) atoms, which is a highly durable and robust material with outstanding properties.

SiC has a higher breakdown voltage than traditional semiconductor materials like silicon, making it highly suitable for high-power and high-temperature applications.

Silicon carbide & EVs

There are many ways in which SiC is utilized in the EV sector. One of them is power electronics, specifically in the production of power modules and inverters. These components are responsible for controlling the flow of electricity between the battery, motor, and other parts of an electric vehicle. SiC’s high breakdown voltage and excellent thermal conductivity allow for the design of smaller, lighter, and more efficient power electronic systems.

SiC is also utilized in the development of motor drives, which are responsible for converting electrical energy from the battery into mechanical energy to propel the vehicle. SiC-based motor drives offer lower power losses, higher switching frequencies, and improved thermal management, resulting in enhanced motor efficiency and overall vehicle performance.

In battery management systems (BMS) used in electric vehicles, SiC is also widely utilized. These systems monitor and manage the performance, health, and safety of the vehicle’s battery pack. SiC-based BMS solutions offer higher accuracy, lower power losses, and improved thermal management, ensuring efficient and reliable battery operation.

Outside of the EVs themselves, SiC is used in the development of high-power charging stations, enabling faster charging times and reducing the overall charging infrastructure costs.

Growth Potential

There are various thoughts on the market growth for SiC alone. Some report the global market value of SiC in 2022 is at around $3.3 billion which will grow to around $7.16 billion by 2030. While some value it at only $1.8 billion in 2022 but is projected to grow to $11.1 billion by 2028 alone (that’s 2 years earlier). Mind you, the gap between these two projections is huge, with the former projecting a CAGR of 11.7% while the latter projects it to be at 36.4%.

Is the CAGR good? If we are talking in the context of companies, a large company is generally considered good when its CAGR is around 8–12%, while a riskier company’s CAGR is good when it’s at 15–25%. In the context of an industry, the current average CAGR in the electrical equipment industry is 14.37%.

That is on SiC’s part. EV on the other hand is expecting a 66.7% increase in unit sales from 2022 to 2028, with an estimate of 81.87 million units sold between 2023 to 2028. That is a massive growth in demand that SiC will have to account for.

Risk

Technical limitations

One of the main issues concerning SiC lies in its production. Over recent years, demand has been increasing rapidly, however, its production seems unable to keep up with the surge in demand. In April 2023, the share price of a few SiC manufacturers saw a decline as Wolfspeed (NYSE: WOLF) disclosed that their dampened earnings were due to hardships in scaling up their productions to match demands in the market.

It is vital for you to keep yourself updated with any technological developments in SiC manufacturing, especially ones that will affect production capacity. This will definitely turn the table around and put whichever company wins such innovation at a competitive advantage against its peers.

Not all companies will perform equally

One thing that you’ll have to keep in mind is that despite SiC being the hot item now, you can never tell which company will dominate the market more than the others. It’s a no-brainer but we’d like to remind you this is where your financial analysis skills will come into place. What we can say is that SiC may go through a massive surge in demand over the years, but we can’t surely say which company will take the bigger slice of the pie.

Better tech discovery

If there’s anything that we can marvel at, science is constantly evolving with more new discoveries found over time. The SiC may one day be irrelevant if any better materials are found.

As of current (pun intended), Gallium Nitride (GaN) stands as SiC’s alternative. However, GaN is mostly used for lower power/voltage applications with high frequency. SiC, on the other hand, is used in high-power and high-voltage switching power applications. So, it might not be so much of an apple-to-apple comparison.

It can be said that there’s not yet a challenger which seeks to dethrone SiC as of now but keep your eyes and ears open for any such developments.

Investing in silicon carbide

There are a few ways that you can invest in SiC, the two most common ways that we would usually go for are stocks and exchange-traded funds (ETFs). Do note that we are just listing out these financial instruments’ examples for you, it’s not an indication that these are good buys, and we only focus on US companies. Do your own research and evaluations before deciding to invest.

Note: All prices mentioned are as of at the time this article was written.

Stocks

ON Semiconductor Corp (NASDAQ: ON): ON semiconductor is currently traded at $98.63, with analysts forecasting the 12-month price target where the average is at $99.11, a high of $110, and a low of $83. Over the past four quarters Q1’22 — Q1’23, ON Semiconductor managed to beat estimates when it comes to its earnings per share (EPS).

Wolfspeed Inc (NYSE: WOLF): Wolfspeed is currently traded at $65.26, with analysts forecasting the 12-month price target where the average is at $64.67, a high of $90, and a low of $46 — a much more volatile stock, compared to the previous one. Wolfspeed has also beaten estimates over the past four quarters Q1’22 — Q1’2 when it comes to its EPS.

Allegro Microsystems (NASDAQ: ALGM): Allegro Microsystems is currently traded at $47.17, with analysts forecasting the 12-month price target where the average is at $51.20, a high of $54, and a low of $50 — a much more stable stock compared to the previous ones. Allegro Microsystems has also beaten estimates over the past four quarters Q1’22 — Q1’2 when it comes to its EPS, with its EPS growing over the period.

STMicroelectronics NV (NYSE: STM): STMicroelectronics is currently traded at $51.66, with analysts forecasting the 12-month price target where the average is at $58, a high of $62, and a low of $54 — a balanced stock compared to the previous ones. STMicroelectronics has also beaten estimates over the past four quarters Q1’22 — Q1’2 when it comes to its EPS, with its EPS growing over the period.

ETFs

Before we start, these ETFs are not exclusively for SiC, but they do have companies that produce/manufacture SiCs in their buckets of stocks, so the price movements might not necessarily depend on SiC’s performance in the market. We’ll just list a few of them for you nonetheless:

iShares Semiconductor ETF (SOXX): Currently traded at $519.

SPDR S&P Semiconductor ETF (XSD): Currently traded at $226.65.

VanEck Vectors Semiconductor ETF (SMH): Currently traded at $156.30.

Invesco PHLX Semiconductor ETF (SOXQ): Currently traded at $29.31.

Bottom Line

SiC can be a good alternative investment for EVs. The prospect of its growth is huge, given how demand for EVs is ramping up, and that it is a key component in EVs. However, there are a few challenges that you’ll have to take note of, especially technical limitations for production. These limitations can also be used to your advantage, that is by looking at which company prevails over these limitations, putting them at an advantage over their peers.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More