The second triangle: the Descending Triangle

Read More

Invest in a Payment Processing System

Table of Contents

How many times have you sighed upon seeing the word ‘Cash Only’ when reaching for the cashier counter? The payment system has evolved and changed the way we make purchases. The new way of payment penetrated the public, especially after Covid-19.

In many countries, the new normal involves a cashless method in which we can opt to pay using QR, e-wallet, debit, credit card, and mobile payment such as Apple Pay. The growth of e-commerce has increased the demand for digital payments. Digital payment which used to be only for online transactions has now moved further across offline transactions.

The freedom of not bringing cash and coins wherever we go with only a piece card or with just a mobile phone has made the demand better.

Here are the top 5 Payment System Companies Available on Stock Exchange.

Credit cards are one of the most common payment methods in the world. In recent years, the convenience of ‘Tap and Go’ has increased the demand for credit cards. A mobile wallet or even an e-wallet can also be loaded with most credit cards to be used on the go with a simple tap of a smartphone. Nowadays, we live in such an easy, convenient world.

Visa, MasterCard, and American Express top the list of the top 3 card payment processing services.

According to the report, of ‘The Business Research Company’ published by The Business Research Company; The global credit card market is expected to grow from $101.98B in 2022 with a CAGR of 2.9% from its record of $99.08B in 2021. It is projected that the credit card market will grow to $106.67 billion by the year 2026.

Mastercard Incorporated (MA)

Mastercard Inc. is the second-largest payment-processing corporation worldwide. The company works as a bridge to facilitate payments from merchant to bank. In other words, processing payments between the card-issuing banks or credit unions of purchasers and the banks of merchants who use the “Mastercard” brand of credit, debit, or prepaid cards during the payment process.

In accordance with MasterCard statistics, there are approximately 1.05B MasterCard credit and debit cards in circulation worldwide at the moment. As of May 2023, Mastercard Inc has a market cap of $365.407B, an increase of 8.43% compared to 2022. Its market capital has had a constant double-digit percentage increase yearly since 2015 except for 2021 and 2022. Mastercard Inc reported revenue for 2022 of $22.237B; a 2.61% increase.

As of May 11, 2023, the MA is trading at $382.54. The stock has increased 10.31% YTD and maintained a growth rate of 97.85% over the past 5 years. The stock’s consensus is ‘Strong Buy’ with an average price target of $$433.82, an upside trend of 13.41%, along with a high forecast of $476.00 and a low forecast of $400.00

Visa Inc. (V)

The company offers distinct offerings, as neither company extends credit or issues cards. Therefore, all Visa payment cards that can be used to make payments are issued by financial institutions that provide card payment services through some type of co-branded relationship with Visa.

According to Visa Factsheet, A total of 4.1B Visa payment cards circulate online. As of December 2022, a total of 259.3B transactions with $14.1T volume transactions are being conducted worldwide.

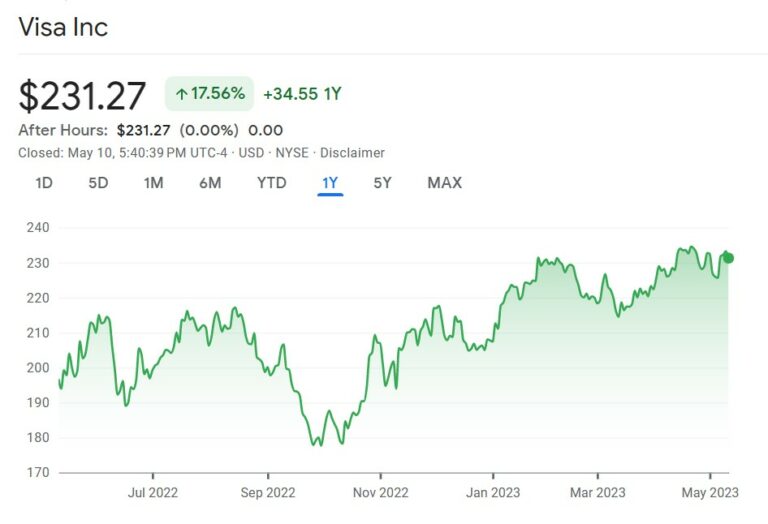

As of May 2023, Visa Inc has a market cap of $435.04B, an increase of 10.1% compared to 2022. Its market capital has had a constant increase yearly since 2011 except for 2021 and 2022. Visa Inc reported revenue for 2022 of $29.31B; a 2.64% increase. The company had constant positive revenue growth since 2008, except for 2020 due to the Covid-19 outbreak.

As of May 11, 2023 V is trading at $231.27. The stock has risen 11.51% YTD and maintained an increase of 75.44% in a span of 5-year periods. The stock’s consensus is ‘Strong Buy’ with an average price target of $272.83, and an upside trend of 17.97%. Along with a high forecast of $300.00 and a low forecast of $240.00.

American Express Company (AXP)

In addition to offering charge and credit payment card products, American Express Company also provides travel-related services worldwide through its subsidiaries and affiliates. American Express and its main subsidiary, American Express Travel Related Services Company, Inc., are bank holding companies.

The company provides business travel-related services through its non-consolidated joint venture, American Express Global Business Travel, through which it offers business travel-related services. As one of the largest companies in the country, the company offers a variety of payment, financing, and acquisition services to merchants, including merchant acquisition, processing, servicing, and settlement, as well as point-of-sale marketing and information services for merchants. Network services, other fee services, such as fraud prevention services and the design and operation of customer loyalty programs, expense management products and services, and travel-related services are all included in the company’s product range.

American Express statistics show 121.7M card users worldwide. While AmEx was offered on many United States websites, its market share was relatively higher in Brazil than in other countries up until 2022.

As of May 2023, American Express Company has a market cap of $113.746B, an increase of 0.09% compared to 2022. It is still short of a $11B difference from 2021. Mastercard Inc reported revenue for 2022 is $55.4B; a 4.82% increase. With the exception of 2021, the company has had positive growth since 2017. This is the highest revenue reported to date for the year 2022.

As of May 10, 2023, AXP is trading at $148.68. The stock had risen 1.06% YTD and maintained an increase of 46.60% in a span of 5-year periods. The stock’s consensus is ‘Moderate Buy’ with an average price target of $178.33, an upside trend of 19.94%. Along with a high forecast of $205.00 and a low forecast of $146.00.

PayPal Holdings, Inc. (PYPL)

PayPal Inc. is a digital payments company founded in December 1998. The company is known for its online payment system that allows users to send and receive money electronically, without paper checks or physical cash. PayPal is also a popular payment option for online shopping, and it can be used by a large number of e-commerce sites all around the world in order to make a payment. Additionally, the company provides services to small and medium-sized businesses, allowing them to accept payments from their clients via the Internet. PayPal also provides tools for online invoicing, shipping, and fraud protection as well as tools for online invoicing and shipping.

Besides its core payment services, PayPal has also expanded into other areas, such as peer-to-peer payments, mobile payments, and online money transfers, in addition to its core payment services. The company has developed a number of mobile apps, including the PayPal app. As a result, users will be able to manage their accounts, send and receive money, and even make purchases right from their mobile devices.

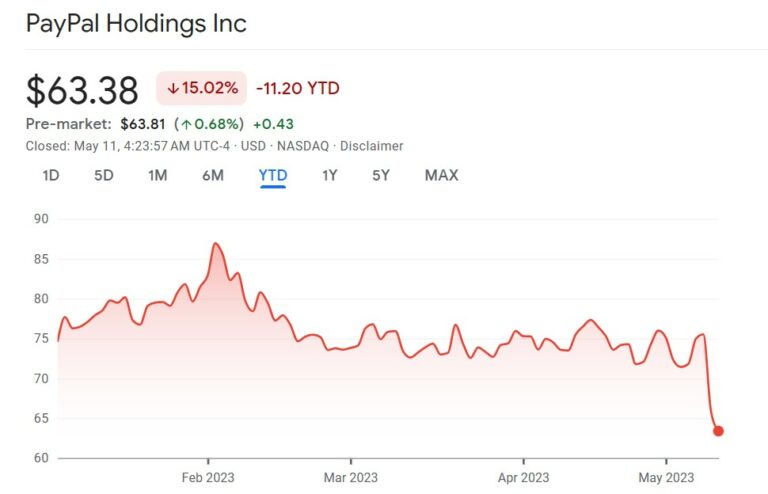

As of May 2023, PayPal has a market cap of $84.79 B, an increase of 4.44% compared to 2022. However, the number fell significantly compared to 2011 which fell by 61.81%. PayPal has acquired several other companies over the years, including Braintree, Venmo, and Honey Science Corp., among others. The company’s 2022 annual revenue was $27.518B, an 8.46% increase from 2021.

As of May 11, 2023, PYPL is trading at $63.38. The stock’s consensus is ‘Strong Buy’ with an average price target of $121.53, an upside trend of 60.92%, along with a high forecast of $357.40 and a low forecast of $85.00.

Block Inc. (SQ)

Block Inc., formerly known as Square Inc. is a financial technology company founded in 2009 by Jack Dorsey and Jim McKelvey. It is best known for its mobile payments and point-of-sale (POS) hardware and software solutions.

Block is a mobile payment fintech that operates under two different ecosystems; Seller and Cash. It is mainly to aid startups to grow their business and provide financial products to individuals. The company’s flagship product is its Square Reader, which is a small device that attaches to a smartphone or tablet and is designed to enable businesses to accept credit and debit card payments. The company also offers a range of other hardware and software products, including the Square Stand, a tablet-based POS system, and the Square Cash app, a peer-to-peer payment service.

The company also acquired Eloquent Lab, Third Party Trade LLC, Weebly, Stitch Lab, and Verse. The latest remarkable acquisition is After Pay – a buy now pay later app.

These acquisitions help Square elevate its services. For instance, Verse enchanted the company capability that was limited as Cash App was only available in the U.S and UK; with the acquisition, they branch to European markets such as Spain, Italy, Germany, and France.

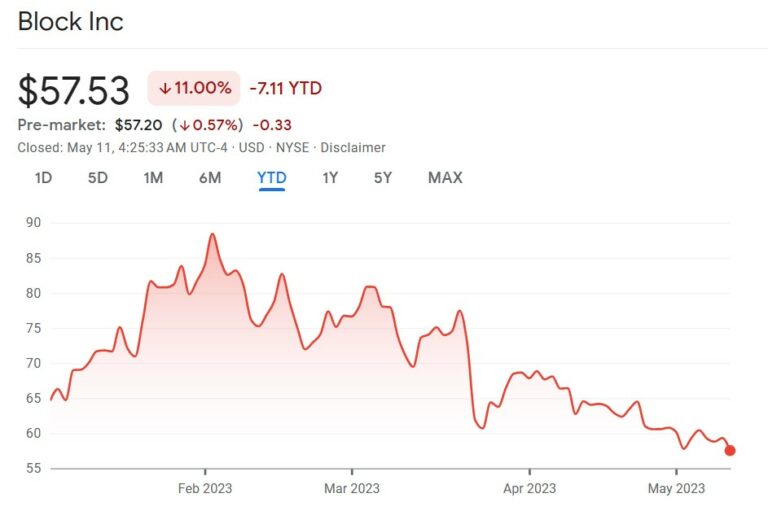

As of May 2023, Block Inc has a market cap of $35.88B, which decreased by 3.52% compared to 2022. Nevertheless, the company had a positive revenue growth yearly from 2015 to 2021 with a slight decrease in 2022 of 0.73%. As per report from SEC filings from Block, Inc, for 2022, 4 Million users use CashApp.

As of May 10, 2023, SQ is trading at $57.53. The stock dropped 11% YTD and maintained an 5.12% increase in a span of 5-year periods. The stock’s consensus is ‘Strong Buy’ with an average price target of $91.19, an upside trend of 53.73%. Along with a high forecast of $130.00 and a low forecast of $70.00.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More