The second triangle: the Descending Triangle

Read MoreHow Big is Gaming to Microsoft?

Gaming has become an incredibly lucrative industry, attracting millions of players worldwide and generating significant revenue for companies involved in the sector. Recently, Microsoft’s (MSFT) move to acquire Activision Blizzard (ATVI) has caught much attention — from the Federal Trade Commission (FTC) deeming it anti-competitive, to gaming pundits arguing whether this move will lead to more wonders or will the industrial power be concentrated in the hands of Microsoft.

How big is the gaming industry?

The gaming industry itself is huge. It is predicted that revenue from the gaming industry in 2023 is set to be around $348.81 billion, with the largest bulk of the revenue coming from mobile games ($286.5 billion). If we’re looking at scales, the global movies and entertainment market size and shares by revenue in 2022 are valued at $94.45 billion, per Zion Market Research.

The revenue is set to grow by around 49.52% to $521.54 billion in 2027. If we are to look into the average revenue per user, mobile games significantly rake up the most profit per user and are set to still do so over the same course above. The most remarkable shift, however, lies in cloud gaming where its projection stands at only $21.4/user in 2023 but is set to move up to $40.73/user in 2027, beating every other market (apart from mobile games).

Despite being one with the lowest revenue among other markets, cloud gaming is set to be one with the most growth over the years, with an average growth of 48.22% annually from 2023 to 2027. To put this into perspective, other markets such as mobile games, gaming networks, and online games are all fairing at around 10% growth annually (or lower) over the same course.

Long story short, the gaming industry is huge — and cloud gaming, which Microsoft is heavily betting on, is set to grow rapidly. In fact, Microsoft attributed their sales of Series S and Series X Xbox consoles to their bets on (among others) cloud gaming.

How big is Microsoft's gaming business?

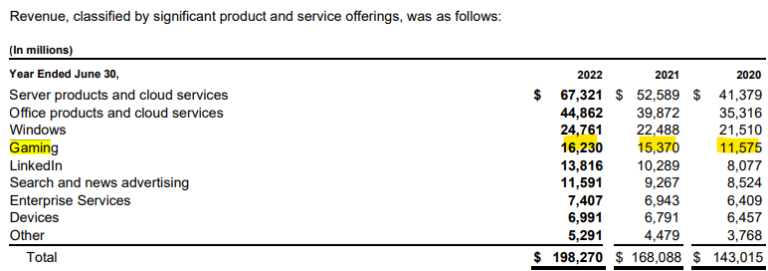

If we are to look into global rank in 2022, Microsoft ranks second with $16.2 billion in gaming revenue, right after Sony with $28.2 billion in gaming revenue. Despite that, if all other sources of revenues are taken into account, Microsoft stands taller at $198.27 billion compared to Sony’s $88.3 billion.

If we look into the games that made the most for the two, it’s an unlikely duo. On Sony’s side, they hailed God of War: Ragnarök as their champion. The God of War franchise has been a cult favorite since its initial release in 2005 for PlayStation 2 platform. On Microsoft’s side, they have Minecraft on their top ladder, a sandbox gaming platform that Microsoft acquired in 2014 for $2.5 billion. Make no mistakes, these two are equally fun to play (in their own respective niches)!

If we look into the numbers, gaming stands as the fourth biggest revenue generator for Microsoft at $16.23 billion for FY2022 (ended on June 30th). Out of its total revenue in FY2022, gaming contributed around 8.18% of the whopping $198.27 billion. The top three are still dominated by Microsoft’s core businesses such as server products & cloud services (33.95%), office products & cloud services (22.58%), and Windows (12.46%). From FY2020 to FY2022, gaming’s revenue proportion to Microsoft’s total revenue fares at around 8% to 9%.

In its most recent quarterly report (Q3’23), Windows reported that its Xbox content and services revenue increased by 3% year-over-year (Y/Y) from January to March 31st, 2023.

Speaking of Xbox, it’d be great to have a look into the gaming studios which sail under Microsoft’s Xbox Game Studio flag:

- 343 Industries (Notable for the Halo franchise)

- Alpha Dog Games (Notable for Wraithborne)

- Arkane Studios (Notable for Dishonored & Redfall)

- Bethesda Game Studios (Notable for Fallout & Skyrim franchises)

- Bethesda Softworks (publishes games, not developing)

- Compulsion Games (Notable for We Happy Few)

- Double Fine Productions (Notable for Psychonauts)

- ID Software (Notable for the Doom franchise)

- Inxile Entertainment (Notable for Wasteland)

- MachineGames (Notable for Wolfenstein franchises)

- Mojang Studios (Notable for the Minecraft franchise)

- Ninja Theory (Notable for Devil May Cry & Hellblade franchise)

- Obsidian Entertainment (Notable for The Outer Worlds franchise)

- Playground Games (Notable for Forza Horizon & Fable franchises)

- Rare (Notable for Sea of Thieves)

- Roundhouse Studios (a smaller team from Bethesda)

- Tango Gameworks (Notable for The Evil Within)

- The Coalition (Notable for Gears of War)

- The Initiative (Currently rebooting Perfect Dark series)

- Turn 10 Studios (Notable for Forza Motorsport)

- Undead Labs (Notable for State of Decay)

- World’s Edge (Notable for Age of Empire)

- Xbox Games Studios Publishing (they support other developers)

- ZeniMax Online (Notable for Elder Scrolls Online & Fallout 76)

Now, if that’s not enough, Microsoft is currently going for Activision Blizzard, the fifth-largest gaming company globally in 2022, with $7.4 billion in gaming revenue for said year. The acquisition is set to be at a nice price of $68.7 billion.

Microsoft’s keen eyes on gaming can also be seen as it puts gaming as one of the top priorities together with cloud engineering and Linkedin. In 2022, R&D investments for the three businesses were $24.5 billion, $3.8 billion higher than in 2021, although similar to 2021 if looked at in relation to its revenue (12% from revenue).

How big is Activision Blizzard?

Activision Blizzard is massive in the gaming scene, with releases such as the Call of Duty Franchise, Overwatch, Sekiro: Shadows Die Twice, Diablo IV, and of course, a globally acclaimed masterpiece — Candy Crush Saga!

The market capitalization (market cap) for Activision Blizzard as of April 2023 stands at $67.06 billion, even higher than Electronic Arts ($35.12 billion) and Roblox ($24.55 billion). Just to put things into perspective, Electronic Arts is known for the household staple FIFA franchise (until they decided to stop the venture recently), and Roblox is most probably the top reason banks receive calls from distressed parents.

In 2022, Activision Blizzard generated net revenue of around $7.53 billion, with around 88% of it coming from digital online channels — in line with Microsoft’s goal of expanding their cloud gaming business.

Its acclaimed Call of Duty series has been seeing a constant increase in units sold, whereby it moved up from 175 million units in 2014 to 425 million in 2022 — a 58.8% increase in the course of 8 years. Mind you, the market for Call of Duty is very competitive as it has to deal with contenders such as Battlefield, Counter-Strike, and Player Unknown’s Battleground.

30 days prior to the publication of this article, Call of Duty: Modern Warfare 2 (CODMW2) had around 7.02 million active players globally, with 11.69 million hours of Twitch streams being watched over the same period.

That is only one franchise that Activision Blizzard came up with. Like it or not, the company is one of the global superpowers when it comes to the development of video games.

Microsoft bullish on video games

Sentiments on video games going more mainstream, with streaming services generating billions from video game streamers, growth of shows adapted from video games, and many governments worldwide officially incorporating e-sports into their portfolio. The industry is growing bigger than ever.

Microsoft’s acquisition of Activision Blizzard is as good a signal as their $10 billion investment in OpenAI, they’re betting big on the industry. Despite concerns over the acquisition’s possible path to anti-competitive moves, Microsoft’s solid will to move forward with it shows that they’re planning for something big.

From its Q3’23 release, Microsoft is planning to expand its gaming experience and development, as well as moving beyond it to capitalize on game-related merchandise. For gaming experience, Microsoft and Sony agreed to add Microsoft’s top-selling franchise’s Minecraft Dungeons to Sony’s PlayStation Plus service.

They have also announced ID@Xbox Developer Acceleration Program and the Developer Sustainability Toolkit to help creators in developing their products, and to bring their products into Xbox — a win-win situation on both ends.

On the merchandising side, Microsoft leveraged on the fame of their Minecraft franchise as they partner with Mattel (MAT) and Crocs (CROX) to produce Minecraft-related merchandise such as the Camp Enderwood toy collection and downloadable content (DLC), as well as Minecraft-themed Crocs footwears.

Over the course of the past few months, the price movements for Microsoft and Activision Blizzard are pretty much in tandem with each other. As the news on acquisition moves from good to bad, bad to good — and repeat, the market is pretty much of the sentiment that if Microsoft manages to acquire Activision Blizzard, both will be at an advantage.

Based on analysts’ expectations over Microsoft’s 12-month price target, it currently stands at a strong buy with the high expectations set at $420, average at $354.26, and low at $232. Microsoft’s share price as of the time this article was written is $354.26. However, this is, of course, to be taken with a grain of salt. The number of shares held by hedge funds has been decreasing rapidly from March 2023 to July 2023, from around 180 million shares in March to only 116,674 shares in July.

It all rests on one thing

The subheader sounds a bit too overdramatic — well, Microsoft’s gaming business won’t just suddenly die out if it fails to acquire Activision Blizzard. However, the concerns about monopoly in the video games industry are real. There are many companies that introduce console-exclusive video games to encourage the purchase of their consoles.

Some might argue that video games are an open field whereby even indie developers can thrive, but that doesn’t seem to be very accurate. According to VG Insights which looked into how well video games are selling on the Steam web store, only 15% of indie games can earn more than $100,000 in revenue. The usual revenue that these games can generate is only around $13,000. If you consider how much cost, time, and labor is poured into crafting a single video game, a total of $13,000 won’t really foot the bills.

However, the issue is now set to sit in the realms of uncertainty, with Microsoft getting an initial sigh of relief as a US judge OK-ed the acquisition before the FTC appealed against it; and the Competition and Markets Authority (CMA) in the UK agreed to reconsider a new deal brought forth by Microsoft and a tribunal appeal by Microsoft is put on hold.

How each of these will play out, however, is still unknown. Nonetheless, against the backdrop of a massive industry that is still growing, Microsoft stands tall — and they want to keep it that way, if not taller.

Bottom Line

Microsoft’s enthusiasm to expand its business in the gaming industry is already out in the open. If its acquisition of Activision Blizzard is set to move forward, it’ll be holding one of the biggest market shares when it comes to gaming, supported by authorities to boost its consoles and services revenue through its newly acquired (if it is approved) gaming franchises. Microsoft will hold the key to many Triple-A games to hit the market. However, whether the acquisition will fall through or not is another case. Even if Microsoft gets hold of Activision Blizzard, the gaming industry is an open field for many to thrive.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More