The second triangle: the Descending Triangle

Read MoreHere's why many people lose money when they invest

A look into how biases shape your decision-making process.

We’ll cut to the chase. We want to see why many lose their money when they invest — and here’s a caveat: read everything. We mean, every part of this writeup. We won’t be held liable for anything that you do if you don’t read this article in its entirety. Let’s get down to business.

Picture this…

You have to invest, now you’ll have to choose between two stocks:

- Ford Motors (A well-known US vehicle manufacturing company)

- ATS Corporation (A Canadian-based industrial automation company)

Many would go for Ford Motors. The reason behind such a decision is that Ford is more well-known, and its trucks are almost a staple in the US. No way they’re going to fail right?

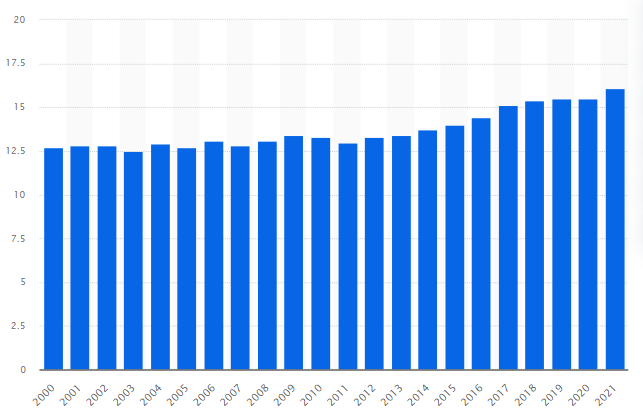

But what if we tell you ATS is a better company? Mind you, despite being smaller than Ford, ATS has actually been reporting profit from operations — and we meant consistently doing it since 2000. Impossible? Not for ATS, no. Take a look at the graph below.

“Wow, I’ll go for ATS then!”

Now, here’s the first mistake that many people make — instinctive decision. Nobel-winning Daniel Kahneman pointed out this phenomenon where we humans tend to think in two channels — the fast and slow thinking, or as my therapist would call it — the automatic thoughts vs non-automatic thoughts.

What happened if you decided to swing for ATS above, is that at first, you thought “Hey, Ford is more well known, right? That should be a safer bet.” However, when we create the ‘wait a minute’ sentiment, you’ll now think “Oh, so that was a trick — it happened a lot, where people put two things and the choice seems too obvious but it’s not as straightforward as it seems… haha alright I’ll pivot then”.

That is how your fast thinking or automatic thoughts work. You learn from experience, and it creates a sense of reflex in you. Someone raises their hand to throw something at you — dodge! Your ex says he misses you — dodge! Your long-lost classmate suddenly asks how you’ve been — Ponzi scheme!

Automatic thoughts are good for situations that require spontaneous reactions, but investing isn’t one. It requires thorough research and analysis.

Well… actually…

If you pivoted to ATS, that’s the second sin. We did tell you that ATS is good, but we never told you that Ford is bad. Why did you pivot? Because we said ATS could be the better company, right? You instinctively pivot to ATS thinking “Oh, it’s a trick question, ATS is better”.

We haven’t even shown you anything on Ford yet.

How can you decide one is better than another without even seeing what’s on the other side? This is how many retail investors/traders lose their money — when they see some brokers publishing: “OOOO STOCK ABC IS GOING UP BY 30% NOW, TIME TO BUY Y’ALLS!” They tend to think “Dang, that’s not bad. I’ll get to it then”.

It might not be bad, but is it good? The stock has already risen to 30%. Can it go up a bit more? Unlikely. It goes up by 30% from what price? If $100, then it’s tempting, something is brewing, but if we’re looking at $0.50, 30% is a sign that it is most likely a pump-and-dump scheme appearing in the wild.

Our point is, you tend to get too overhyped to look left and right before taking that leap — and get crashed into by a double-decker bus.

Back to Ford vs ATS. By now, you might be withholding the idea of pivoting to ATS, and you might want to consider Ford — but of course, smarter and better now — “show me the data”.

We will, and we'll show you both sides.

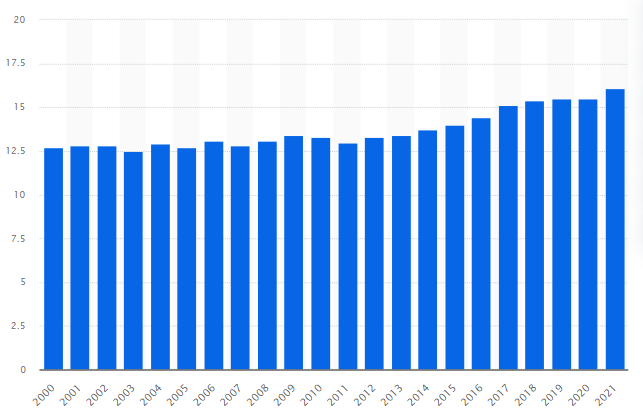

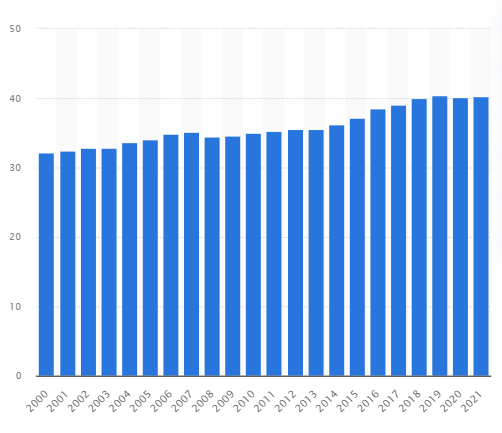

First, do you know who else is consistent in their profit from operations other than ATS? Yep, you got it right — Ford!

Here are the operating profits from the two:

ATS:

Ford:

Next, we’ll look into share price projection — which is the price that the stock will likely move to in the best, average, and worst situations.

Ford: High ($23), average ($15.18), low ($11)

ATS: High ($52.11), average ($50.62), low ($48.39)

From the price range above, we can see that Ford is a bit more volatile compared to ATS.

Now, assuming that you can only decide on these two data, it is obvious that Ford is the better choice since the price can go up more, right?

Wrong

First, we gave you an idea that both companies are making a profit from their operations, cool. However, Ford’s price range is a bit wider, in the sense that it can go up at a higher margin and it can also go down more severely.

“So… Ford is risky, and risky is bad, right?”

Wrong.

“Ah, so risky is good?”

Nope.

“It’s a trick question! Ford is good all along!”

Nope.

“Alright, so what?”

Beyond good and evil

Here’s the thing. If there’s anything that philosophy and finance have in common, it’s that you have to look beyond the dichotomy of ‘good and evil’. What’s good for you might be bad for others, and vice versa.

Here’s the thing. We go on the base grounds that both are making a profit, right? The only issue is its volatility. Now, what you are expecting from us is for us to decide which one is better. That is why many people lose money, they just follow what others are doing without taking into account their own goals and strategy.

If you’re in your mid-30s cash is gushing in and you can afford to take more risk, then riskier assets might be better for you. If you’re nearing retirement, losing money at that point might have you end up relying on social aid.

This is also why copy trading doesn’t work for many. You simply follow some dude’s portfolio without knowing what his priorities are and you expect it to be in line with yours? (Skill issues aside). If investing is that easy, I won’t be writing this thing for you, I’d be in my yacht feeding my 12 cats freshly caught giant tuna or something.

Alright, so we must know ourselves?

Yes, and you must also know others. Here’s the thing, money isn’t evil, nor are people (generally), but everyone wants to work in their own interest. That’s how the world is. You can’t just trust everything you read online. Find your own data.

Do you know why that is so important? Because all of the data that we mentioned above are (I’d like to apologize to my editor for using this word) — bullshit! Do you know what those graphs are? They are the graph of cheese consumption per capita in the US. Here’s the link to Graph 1 and Graph 2. Enjoy your cheese stats.

Of course, big firms wouldn’t just lie straight to your face, but what they would do is if they want you to buy the stocks that they’re trying to offload, they’ll present you with only part of the data — the part that you want to hear, people crave for good news — hoping is mankind’s favorite demise.

“Stock ABC is going superbly well! Already 15% up!”

What they don’t tell is:

“Stock ABC is currently losing momentum, buy it from us now so that we can secure a profit while we offload this crap unto you.”

So, you'll have to take into consideration every data?

No, at least not at this point. There’s this paper by some scientist that I have forgotten his name, who speaks of heuristic thinking, which is how people make decisions with limited information in a very limited time.

Now, here’s a minigame to reflect this:

You and 10 other imaginary people must pick one out of two baskets, the goal is to get a basket that will most likely have the most votes. Of course, you don’t know who votes for what.

The question is: which basket of people is more prone to have scandals / sexual affairs?

Basket A: Politicians, celebrities, and conglomerates.

Basket B: Teachers, gardeners, and lawyers.

Have your pick.

Many would have picked Basket A, because these are commonly people who enjoy the sensation of power, and they have enough money to just do it. I mean, look at the tabloids, it’s full of stories on how these people engage in scandalous affairs!

Or could you have been led by biases? Have you ever thought that maybe — just maybe — the reason why the stories of these people having scandals fill the papers is that their name sells? Many of you would’ve known that Bill Clinton was alleged of many scandals, but can you pull off from the top of your head the names of people he had it with?

Bill Clinton was the US President. Monica Lewinsky was an intern. Even in this case, we tend to overlook Lewinsky, what more are the tabloids? Do you think it would sell to publish the stories of some farmer who had a scandal with his neighbor’s house helper?

Don’t you think that there are more farmers than politicians, so there tend to be more scandals among farmers than there are with politicians?

Now, reconsider your pick.

If you pivot to Basket B, congratulations! You manage to think a step ahead of the biases. However, if you stay with Basket A, a bigger congratulations to you! You might have won the game!

Remember, the whole purpose of this game is to pick a basket that everyone else picks. You might be free from biases now, but do you think others are? Such is the nature of heuristics. Do you think everyone would have the data to pick something so accurately in such a short time?

In some cases, you tend to think a step too far, you forgot to account for people’s limited access to information. Although maybe in a few years we can see some AI tools that are so readily available it can help retail users with that, until then, heuristic is the way for many!

This is the case for finance, especially if you’re trading. Trading is about reading into market sentiments and riding the wave. You have to understand how the waves ‘think’ if you want to ride them, no?

If you, and you alone, have the information that Company ABC will crash in 10 years, do you think that you’ll make money if you bet against it 5 years too early? People don’t know about it; they might still rally the heck out of Company ABC’s stock.

Also, don’t take any ‘facts’ we present here too seriously, some of them are made up. Our whole point is to point out the flaws in the way we think — flaws that are somewhat reflected in the way our money flows.

Bottom Line

- Spontaneous thoughts and emotions can mislead you from the actual thing.

- Look into data from all angles. Sometimes what might seem good may not be too good!

- Don’t just listen to what others have to say about a pick. Look into your own strategies and capabilities.

- Sometimes people don’t present you with the whole truth — many times, actually.

- Consider how people make decisions in a limited time with limited access to information.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read MoreHere’s the thing. If there’s anything that philosophy and finance have in common, it’s that you have to look beyond the dichotomy of ‘good and evil’. What’s good for you might be bad for others, and vice versa.

Here’s the thing. We go on the base grounds that both are making a profit, right? The only issue is its volatility. Now, what you are expecting from us is for us to decide which one is better. That is why many people lose money, they just follow what others are doing without taking into account their own goals and strategy.

If you’re in your mid-30s cash is gushing in and you can afford to take more risk, then riskier assets might be better for you. If you’re nearing retirement, losing money at that point might have you end up relying on social aid.

This is also why copy trading doesn’t work for many. You simply follow some dude’s portfolio without knowing what his priorities are and you expect it to be in line with yours? (Skill issues aside). If investing is that easy, I won’t be writing this thing for you, I’d be in my yacht feeding my 12 cats freshly caught giant tuna or something.