The second triangle: the Descending Triangle

Read MoreMarket Update – Of ‘Hawkish’ Market & AI Correction

Actively managed vs Passively managed — which one is better?

Before this, we’ve touched on actively and passively managed funds when we discuss the comparisons between funds and exchange-traded funds. We’ve also mentioned different types of funds in our introductory article to funds.

Actively managed funds are overseen by professional fund managers who actively make investment decisions with the goal of outperforming a specific benchmark or index. These managers research and select individual securities, such as stocks and bonds, based on their analysis of market trends, economic conditions, and company performance.

Passively managed funds, often called index funds, aim to replicate the performance of a specific benchmark or index, such as the S&P 500. Rather than relying on active decision-making, these funds invest in a representative selection of securities that mirror the composition of the chosen benchmark.

Which one is better?

The usual answer is that it would depend on your preference, much like what was explained in our previous article that talks about the things you’ll have to consider before deciding which fund is best for you. However, when speaking of money, it’s almost given that what we’re looking at is money — how much money can these funds make?

This, however, brings us to a fierce debate, an ancient clash between those who are for or against either side.

The Active vs Passive Debate

We’ll cut it short — so in 1973, Burton Malkiel, a professor at Princeton decided that a blindfolded monkey throwing darts at a list of stock names could perform as well as any fund managers out there. He decided that actively managed funds perform badly as a group, despite some of them doing splendidly well. So, he came up with passive funds which don’t aim to beat market performance but rather imitate it. Why take the trouble of beating it when the market performance is going up anyway, right?

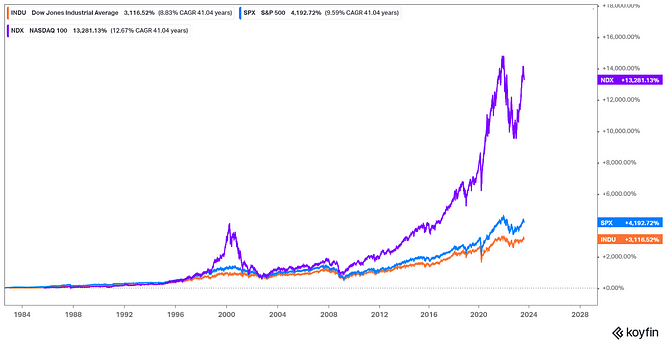

Ever since then, more and more people subscribe to the idea that passive funds are a much safer bet. You don’t pay as many fees, and the performance is… well, thanks to capitalism, is always up over the long course. Look below how the market has been doing over the past few decades:

All of the major indices are moving upward, right?

Over the years, active investing has always been the thing. However, passive investing has started to dominate more and more of the market. Why?

Active funds underperforming the benchmark?

There have been many studies done that found out actively managed funds as a group tend to underperform the benchmark. Consider this, you’re paying more, but you’re earning less than those who just chill and cling to the index, not too cool, isn’t it?

Then why do many people still invest in active funds?

When we say actively managed funds underperform benchmarks as a group, the key phrase is “as a group”. There are many actively managed funds out there that perform superior even to the passive counterpart. Here’s the thing, not many managers are good at their job. This is why many invest in active funds — to look for the very best that no manager ever had.

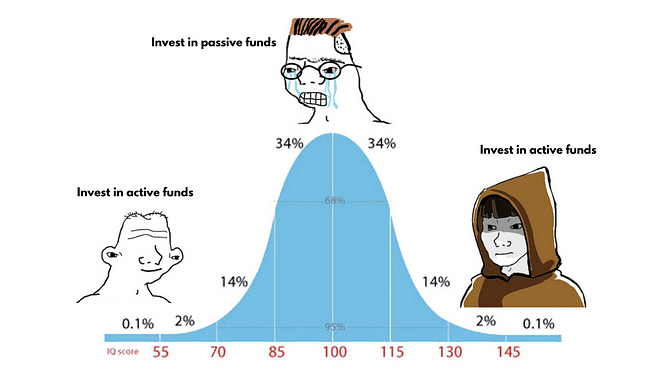

Ironically, you can say that at one end of the spectrum, many of those who have little to zero knowledge about finance would go for actively managed funds because they blindly believe in the promise of superior returns. On another end, there are the pros who know how to look for good funds and also invest in active funds. In the middle, there are those with a basic understanding of trying to avoid the risk and going for passive funds.

Of course, doing anything with knowledge is much better than without. A good swimmer can survive in the ocean while a bad one can drown even in a pool.

Why active funds can still work?

Here’s why active funds usually underperform the market — it’s because the market is doing relatively well. Put it like this, the market is the benchmark, you want to beat it, and the benchmark is doing good. Would it be easy? Most likely no. You’re trying to outpace a speeding train. This is why only exceptional fund managers manage to beat the market in this situation.

However, when the market is bad, everyone who invests in index funds will follow the market — which means that they’ll perform badly as well. Those who invest in active funds are more likely to avoid the crash and perform better than the market. Research by Nomura Securities found that when interest rates spiked from 1962 to 1968, these active funds manage to massively outperform the market.

When you invest in a passive fund, a good market landscape would be good for you. However, in a time of crisis, especially when the interest rate is high, active funds tend to perform better.

Another reason why active funds shouldn’t be thrown out completely is that when everyone else invests in passive funds, a huge bulk of the money will be allocated in a similar pattern, thus ‘streamlining’ how the money moves in the market. This is almost like the passive investors are ironing out the creases for active investors.

With fewer ‘haywires’ in the money movements, active investors will find it easier to look for hidden gems. Imagine if, out of 100 people, 60 of them pick the same set when buying groceries. You can tell which item might be more expensive at the superstore, right? Along the line, you can look for other groceries items that are actually very good, but not as expensive just because the herd hasn’t had an eye on it yet.

Bottom line

Both passive and active investing strategies will be profitable if you know what you’re doing. If you’re playing safe, passive investing is the way to go. Even then, passive investing is not the best way to go when the market is not doing well, since you’re tied to the market. If the market sinks, you sink.

Active investing, on the other hand, is riskier given that you have to pay more, and you also have to look for fund managers who are exceptionally good. In a time of market crisis, however, exceptionally good may not be a must, since the benchmark will weaken, and beating it would be an easier task.

Why do active funds seem to underperform more? Because the market is often in a good position. You’d often find years of prosperous growth followed by one or two years of crisis, and then everything goes up and well again.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More