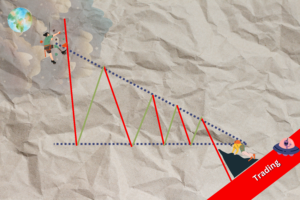

The second triangle: the Descending Triangle

Read MoreIncome vs. Growth Investments: Which Is Right for You?

Looking into the existential question of investors — for what purpose?

In a world where personal finances have become increasingly complex, achieving financial independence is a dream for many. But this dream can often seem distant and unattainable without a solid foundation of financial literacy. Financial literacy is not just about understanding numbers; it’s about acquiring the knowledge and skills to make informed financial decisions that can lead to a more secure and prosperous future. In this article, we will explore the importance of financial literacy and provide practical guidance on how to empower yourself on the path to financial independence.

Understanding Financial Literacy

Financial literacy refers to the ability to understand and manage various aspects of your finances effectively. It encompasses a wide range of topics, including budgeting, saving, investing, debt management, retirement planning, and understanding financial products and services. Having a strong grasp of financial literacy is essential for several reasons:

1. Making Informed Decisions

Financial decisions impact every aspect of our lives, from daily budgeting to major life events like buying a home or planning for retirement. Without financial literacy, individuals may make poor choices, leading to financial stress and missed opportunities.

2. Avoiding Financial Pitfalls

The lack of financial literacy can lead to costly mistakes, such as taking on excessive debt, falling for scams, or investing in unsuitable products. Being financially literate helps you recognize and avoid these pitfalls. Sometimes your heart is in the right place, but making financial decisions that aren’t suitable for you may lead to more losses than gains.

3. Building Wealth

Financial literacy is the foundation of building wealth over time. It allows you to make smart investment choices, take advantage of tax benefits, and plan for a comfortable retirement. After all, the lesser you lose from making questionable decisions, the more money you will have for later days.

4. Achieving Financial Independence

Financial independence is the point at which you have enough savings and investments to support your desired lifestyle without the need to rely on a regular paycheck. Achieving financial independence is a significant goal, and it’s only attainable with a strong financial literacy foundation.

The Components of Financial Literacy

To become financially literate, you need to develop a comprehensive understanding of various financial concepts. Here are some key components of financial literacy:

1. Budgeting

Budgeting is the process of creating a plan for your income and expenses. It helps you track where your money goes, prioritize spending, and ensure that you’re living within your means. A well-structured budget is the first step toward financial control and success.

2. Saving

Saving involves setting aside a portion of your income for future needs or emergencies. It’s crucial to establish an emergency fund, as unexpected expenses can otherwise derail your financial progress. Additionally, saving for specific goals, like a down payment on a house or a dream vacation, helps you stay motivated and disciplined.

3. Debt Management

Understanding how debt works and managing it effectively is a vital part of financial literacy. This includes knowing the difference between good and bad debt, minimizing high-interest debt, and having a plan to pay off outstanding loans.

4. Investing

Investing is a means of growing your wealth over time. Financial literacy in investing includes knowledge of various asset classes (e.g., stocks, bonds, real estate), risk tolerance, and the importance of diversification. Investing wisely can significantly accelerate your journey to financial independence.

5. Retirement Planning

Retirement planning involves determining how much money you’ll need to retire comfortably and creating a strategy to achieve that goal. Understanding retirement accounts like 401(k)s and IRAs, as well as investment strategies for retirement, is essential.

6. Taxes

Taxes are a significant part of personal finance, and being tax-efficient can save you a substantial amount of money over your lifetime. Knowledge of tax deductions, credits, and strategies for minimizing tax liabilities is essential.

7. Financial Products and Services

Understanding financial products like savings accounts, credit cards, mortgages, and insurance policies is crucial for making informed choices. This includes knowing how to compare products, read the fine print, and avoid hidden fees.

8. Financial Planning

Financial planning involves creating a roadmap for your financial future. It includes setting specific financial goals, creating a plan to achieve them, and regularly reviewing and adjusting your plan as your circumstances change.

Steps to Enhance Your Financial Literacy

Now that we’ve discussed the importance of financial literacy and its components, let’s explore practical steps to enhance your financial literacy and empower your journey to financial independence.

1. Start with Self-Assessment

Begin by assessing your current level of financial literacy. Identify areas where you feel confident and areas where you need improvement. Self-awareness is the first step to improvement. No one knows what you want and where you stand. That’s why you can’t take any financial strategy you find online at face value.

2. Educate Yourself

Take advantage of the many resources available to educate yourself about personal finance. Consider reading books, attending seminars or workshops, and following reputable financial websites and blogs. There are also online courses and certifications specifically designed to enhance financial literacy.

3. Create a Personal Finance Plan

Develop a comprehensive financial plan that outlines your financial goals and the steps you need to take to achieve them. A financial plan acts as a roadmap, helping you stay focused and motivated. Again, you can look for samples online but don’t take it as is.

4. Budget and Track Expenses

Start budgeting by tracking your income and expenses. There are various tools and apps available to help you create and maintain a budget. Regularly review your budget to ensure you’re staying on track.

5. Build an Emergency Fund

Establish an emergency fund with enough savings to cover at least three to six months’ worth of living expenses. This fund will provide a financial safety net in case of unexpected events, such as medical emergencies or job loss.

6. Pay Off High-Interest Debt

If you have high-interest debt, prioritize paying it off as quickly as possible. High-interest debt, such as credit card debt, can be a significant obstacle to achieving financial independence.

7. Start Investing

Begin investing as early as possible to take advantage of compound interest. Consider opening a retirement account, such as a 401(k) or an IRA, and explore different investment options that align with your goals and risk tolerance.

8. Seek Professional Advice

If you’re unsure about certain financial matters, consider seeking advice from a certified financial planner or advisor. They can provide personalized guidance and help you make informed decisions.

9. Stay Informed

Financial markets and regulations are constantly evolving. Stay informed about current financial trends, tax laws, and investment opportunities. Regularly reading financial news and publications can help you make timely decisions.

10. Practice Patience and Discipline

Financial independence is a long-term goal that requires patience and discipline. Avoid making impulsive financial decisions and stay committed to your financial plan.

11. Teach Others

As you enhance your financial literacy, consider sharing your knowledge with friends and family. Teaching others about personal finance can reinforce your own understanding and help them on their journeys to financial independence.

Bottom line

Financial literacy is not a destination but a journey that empowers individuals to take control of their financial lives. It’s the key to achieving financial independence, allowing you to live life on your terms and pursue your dreams with confidence.

Remember that improving financial literacy takes time and effort, but the rewards are well worth it. By following the steps outlined in this article and continually educating yourself about personal finance, you can chart a course towards a more financially secure and independent future. Your journey to financial independence starts with a commitment to financial literacy, and it’s a journey well worth taking.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

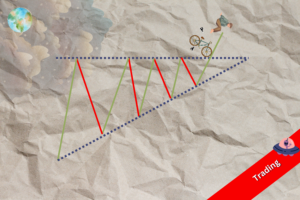

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More