The second triangle: the Descending Triangle

Read MoreCan Barbie's Explosive Weekend Be Mattel's Saving Grace?

With the weekend box office set in pink, is Mattel set for greens?

Greta Gerwig’s Barbie blew this year’s box office with a weekend opening of $155 million, the highest opening in 2023 so far. From the internet memes and marketing feats that built into its hype, up to its weekend launch which reignited the long-forgotten joy of summer blockbuster, one might be intrigued to know how well Barbie’s brand owner, Mattel (NASDAQ: MAT), will fare from the hot-pink wave of “Barbie Girl Summer”.

The buildup

As far as this social-media-laden brain could work it out, the marketing campaign for Barbie didn’t roll out that early, but the buildup was already there — and you might’ve guessed it — from memes. It is one of those glorious moments where the internet does the job before the corporates even had the chance to even know what would be bestowed upon them.

It started off when the public gets to know that these two movies may be launched around the same time. The internet was particularly flooded with the initial meme, the typical “men go for Oppenheimer, girls go for Barbie” joke. However, the absurdist state of millennials and Gen-Z have turned the jokes around. This time, the premise revolves around the actual audience for both movies being not the ones targeted, much like these memes that we stole online (forgive us for the ifunny watermark).

Before we know it, the memes again evolved into what we now recognize as Barbenheimer, where the fans started to think “Hey, screw that. Why not watch both?” and that’s when we start to see the marketing team ride on the memes. We saw Margot Robbie (who stars as Barbie) signing a fan-made Barbenheimer t-shirt, and at some point, Greta Gerwig and Margot Robbie posted a picture of them with their tickets for the Oppenheimer movie, it’s an interesting buildup.

“I signed on that side. I hope you find Cillian Murphy and he signs the other one.” — Margot Robbie signing a fan's #Barbenheimer shirt!#Barbie #Oppenheimer pic.twitter.com/67FGap65Uh

— Streaming Digitally (@streamdigital_) July 4, 2023

The next thing we know, these two brought millions into the weekend opening.

Back to the Barbie World

Well, we’re here to talk about Barbie, right? Barbie is a very important asset to Mattel, whereby the doll brand has been standing as the top contributor to Mattel’s sales for many years. That was also the case in 2022 when Barbie’s sales were declining by 11%, it still stands on top with around $1.49 billion in sales. In the same year, the Hot Wheels brand saw a surge of 17% in sales, yet it still lags behind Barbie with only $1.25 billion for the toy car brand.

Over these past few months, the hype for Barbie has been skyrocketing. Per Google Trends data, the initial interest started as early as late June, before growing further around a week before the opening, and it finally took off when the film meets the audience.

Note: Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term.

One thing that obviously came out of the hype is brand partnerships. Zara, a retail clothing chain, launched their Barbie collection which features 17 children’s garments and accessories; and 85 items for women. The best part about this is that it’s not just for children and women, as men too get a chance to think that they look like Ryan Gosling’s Ken with the iconic fuchsia suit. Aside from Zara, H&M, Primark, Gap, Crocs, and Superga have also each launched their own Barbie collections.

“I don’t think we’ve ever seen this many brand partnerships coming out of one film,” — Jo Ashdown, Managing Partner, Mando-Connect

As the hype goes on a rampage, many retailers saw their Barbie collections emptied by enthusiastic buyers. Zara’s Barbie Eau de Parfum which is sold at $29.90 was sold out (at least at the point when this is written). Its dress which features the iconic pink-and-white strapless dress that is sold at $89.90 is also out of stock.

That is only for Zara alone. As for the other brands, we’ll leave the scouting to you. It doesn’t just stop at retailers, hotels such as Hilton and Hyatt Hotels are also offering their own Barbie-themed suites, with Barbie-themed décor, from pink Barbie-printed duvets to Barbie-themed tea set (an actual teatime snacks served Barbie-styled). Our point from all this is the hype from the Barbie film is really getting the cash pouring in, be it for Mattel or those that partner with it.

Let's talk finance

If there is anything that we have established before, it is that this recent Barbie film is really raking in the cash. How well has it been? It is well enough to the point that The Goldman Sachs Group have increased their price target for Mattel from $21 to $24, which is looking at an 11.27% upside. Over the past week, Stephen Laszczyk from Goldman Sachs and Linda Bolton Weiser from D.A. Davidson have both put Mattel in the “Buy” position.

The share price for Mattel (NASDAQ: MAT) has also increased since late June, where the price has increased by almost 20.78% from June 21st to July 24th, and if we look at the share price since the market close prior to the film’s opening up until the recent close, we can see that the price has moved up by around 1.54%.

However, there is one main concern among investors — how long can the hype last? To understand this, we look into Mattel’s previous hype, whose songs still sometimes wake us up in cold sweat and fear in the middle of the night — Frozen! Like it or not, there is one phase where the easiest way to please the toddlers in your house is by getting them any Frozen-related merchandise.

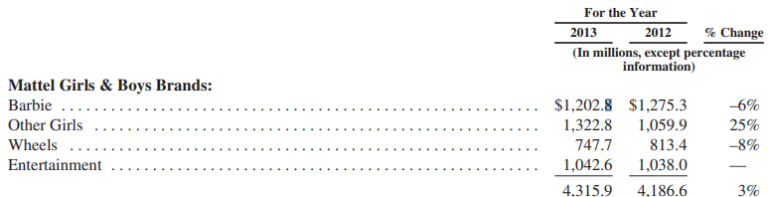

We look into Mattel’s financial reports from 2012 to 2015, where 2013 is the year in which Frozen was unleashed to the public and 2016 was the year that Mattel lost Disney to Hasbro (before they win it again in 2022). From 2012 to 2013, the sales for the toys that Mattel used to label as “Other Girls” which includes brands such as Frozen, jumped by 25%. Despite the lack of breakdowns in where the sources are from, we can infer that Frozen had its impact on Mattel’s sales, although the exact amount wasn’t mentioned.

Moving forward, however, Mattel’s sales for Other Girls dropped by 2% from 2013 to 2014, and it dropped massively from 2014 to 2015, which is at 26%. What we can tell from this is that Mattel can look to profit off Barbie films over the short term, but it will need more than that to stay as a good investment. Mind you, we are not saying that it’s bad, but Greta’s Barbie can only stay hyped up for so long.

Being fair to Frozen, however, unlike Frozen which is owned by Disney, Barbie is fully owned by Mattel. When it comes to Frozen, Mattel only owns the rights to produce the merchandise, but when it comes to Barbie, it’s Mattel’s own gold-laying goose.

According to Andrew Uerkwitz, a wall street analyst for Jefferies, Mattel can only profit from Barbie’s hype until 2024. Uerkwitz stressed the fact that Mattel’s margin from the movie itself will be relatively “little”, and the only way that they can profit from the current hype is through its merchandise, intellectual property (IP) licensing, and brand partnerships.

Bottom Line

There is no doubt about how successful the Barbie movie is, but while the movie itself is successful, Mattel stands on a different field. If you are thinking of investing in Mattel itself, you’ll have to note that Mattel doesn’t profit much from the movie itself, but rather on the heap of merchandise, IPs, and brand partnerships that it has over the Barbie brand. The revenue from Barbie will definitely soar over this particular period, but you will have to keep an eye on how Mattel plans to fare after the hype is all over. If there is anything that we can tell you about hype from films, it will end at some point, unless there is another proactive action that Mattel takes to either keep the hype alive or build another hype.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More