The second triangle: the Descending Triangle

Read MoreBoomers Regret Not Saving for Retirement Earlier — Survey

Spend today because tomorrow may never come… but what if it does?

Retirement is supposed to be the time when you can finally sit down after decades of running in a rat race, enjoy a cup of coffee after watering your garden, and occasionally shower your grandchildren with unwarranted toys the size of the Empire States building. That dream, however, may come far off for many as their retirement savings fall short of what they’d hope to see.

No regrets — not.

According to a survey done by Bankrate, baby boomers (born around 1946–1964) are the most likely to now regret not saving for retirement early enough. The survey found that 74% of Americans have some form of financial regret. Well, a life with no regrets isn’t a very colorful one after all. It’s normal for many of us to have some form of financial regrets.

However, the most striking finding from the survey is that the regret that haunts most of them is not saving early enough for retirement. It’s not that surprising to see that boomers hauled most of the percentage (34% of boomers), given how most are around the age of retirement. The average age for retirement in the US is 64, and boomers are now at around 59–77 (at least per the survey’s definition).

The percentage also seems to decrease perpetual to the age of the participants. Gen X-ers (aged 43–58) come in second with more than 26%, millennials (aged 27–42), and Gen Z-ers (aged 18–26) with 5%. What does this tell us?

Regrets are only felt when it’s too late.

Sheesh, that was kinda edgy, wasn’t it? Anyhow, it seems like the closer you get to the age of retirement, the more you start to realize that you might have screwed up. No wonder some boomers tend to have harsher things to say to their younger acquaintances, they’re probably venting out their repressed sorrow, and it probably irks them to see these ‘kids’ walking around flaunting the only thing that they can’t have — youth.

Anyhow, we’re not here to talk down on boomers. We’re talking finance here, not psychology — well, maybe a bit of both. Reading between the lines of how boomers tend to criticize the financial decisions of their younger counterparts, and I mean, like — really reading between those lines — we can come to a conclusion: be those critics a sign of concern, resentment, or even jealousy, it comes from the regrets that they have deep within. If we are to delve deeper into the source of that regret, we’ll find their lack of retirement savings there, a stack in the bunch.

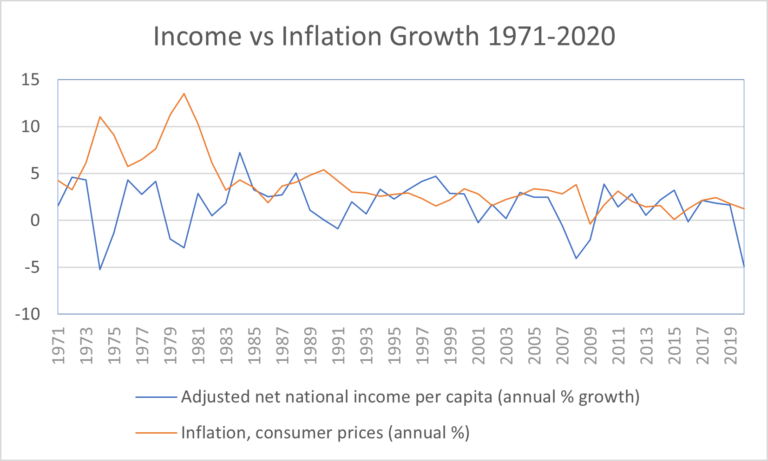

To be fair to the boomers — and boomers, if you’re reading this, we hear you — inflation has been quite tough against wages over the decades. Below is a chart that compares the growth of inflation and income per capita in the US.

Arguably, one can say that it’s not that the boomers aren’t saving as much as their predecessors did, but by the time they reach their retirement age, those savings don’t value as much.

Before we go any further…

Just to slip in some additional info, per the same survey, the next biggest financial regrets among Americans are that they took too much credit card debt (15%) and that they don’t save enough for emergency expenses (14%). All in all it’s still the same thing — you start to have regrets when it’s too late.

Back to where we were… so what?

Retirement savings plan

Back to how boomers are regretting not saving enough, there are things that we young ‘uns can learn from them, and as far as we are concerned, there are two key lessons to be learned: we should start saving early, and we need to make sure inflation won’t screw us up later.

The sheer horror of growing old and being grumpy and groggy to younger generations should have scared most of us by now. Honestly, saving for retirement isn’t so easy to do, discipline-wise.

If you have issues with savings discipline, we’d recommend you go for plans such as the 401(k) in the US, which is a retirement plan that will deduct a certain percentage of your income gradually, and that amount will grow on interest compounded to you. The typical annual growth would usually be around 5–8% for this kind of retirement savings.

Invest your money

Well, since we’re thinking of launching our own trading app sometime later, I guess I’ll have to say it — you can also invest your money in the stock market (invest, not trade) — you can use our app, or not if you don’t want to, it’s okay. Regardless, of the platform you choose, we’d still suggest you invest.

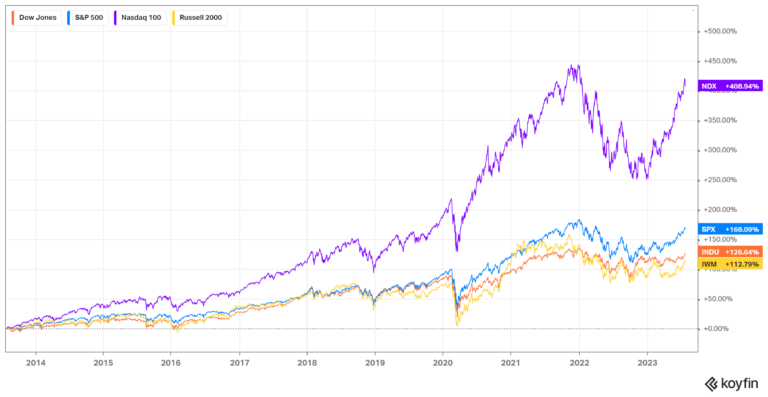

Of course, if we’re being honest, investing is riskier than going for 401(k). However, the growth is generally bigger. Over the past 30 years, the S&P 500 index grew at a compound average rate of 10.7% annually.

Looking at short-term price movements can scare you, but if you really iron out those creases, growth has been going on steadily, and we’re talking retirement here, which is a really long term (depending on your age now). Here’s the graph of US major indices over the past 10 years:

From the chart above, you can see how the chart just gradually moves up. There are times of crisis such as that in 2020 when the market really dips, but again, we’re not talking one or two years — we’re talking retirement, your investment will have time to grow again.

Logically speaking, unless there’d be nuclear showers wiping off everyone, the market will keep on growing — because the population will grow and there will always be new companies offering new things to the market.

So… yeah. Consider investing.

Bottom Line

Many younger generations might feel irritated by how baby boomers perceive them, and some might even reply to the pinch by accusing these boomers of screwing up the economic accessibility for the younger generations — be it true or not.

However, if there’s anything that we can and should agree on, we don’t want to spend the remainder of our age being bitter about what the next generations chose to do.

I don’t know about you, but I’d rather be unbothered at that point in life, perhaps die choking on some gourmet food I can finally afford to have (but not chew), rather than spend my time ridiculing everything people do because I can’t afford to do more than that.

That is if I’m not going to get married. On the account that I do, I’d want to shower my grandkids with gifts and be that cool grandparent they’ll be excited to get back to.

And for all that, I’ll surely be needing money.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More