Apple Stock; Is it still a buy? (Insight)

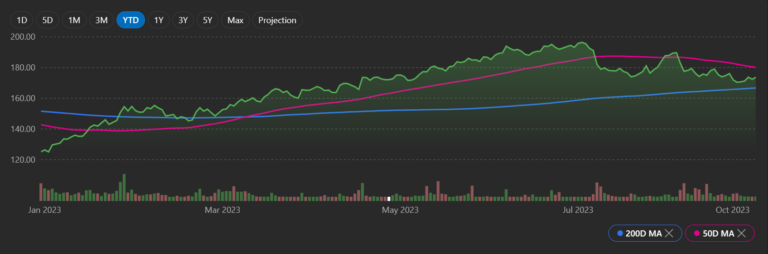

AAPL is currently trading at $173.66. The stock has seen a +3.04% increase in the past week, with a -3.04% drop in the past month, a -9.77% decrease in the past quarter, and a +33.66% increase in YTD.

Technically, Apple’s (AAPL) 50-day exponential moving average is 178.58, while Apple’s (AAPL) share price is $173.66, making it a Sell. Apple’s (AAPL) 200-day exponential moving average is 178.58, while Apple’s (AAPL) share price is $166.1, making it a Buy.

Analysts’ Opinion of AAPL

Street support for Apple remains strong, but not all are convinced. Based on 29 Wall Street analysts offering 12-month price targets for Apple in the last 3 months. The stock claims a Moderate Buy consensus rating, based on 20 Buys vs. 9 Holds. Among them, analysts from Keybanc, UBS, and Bank of America changed their opinion in the last 2 days to ‘HOLD’.

Forecasts show an average price target of $207.69, representing an upside of 19.6%. High and low forecasts range from $240.00 to $167.00.

Is It Worth Investing in Apple Inc (NASDAQ: AAPL) Right Now?

Apple Inc (NASDAQ: AAPL) has a 29.0x price-to-earnings ratio and a beta value of 1.24. The stock’s average monthly trading value is 58,254,569 and its current EPS is 5.95. These metrics indicate that Apple Inc’s stock is currently overvalued and may be due for a correction. The high price-to-earnings ratio and beta value suggest that investors may be overpaying for the stock, and the current EPS is relatively low compared to its trading value, which suggests that investors may be expecting higher earnings in the future.

Nevertheless, focusing on its long-term? Apple is still a BUY stock; with a +212.75% increase in 5 years.

Noteworthy Apple News of the Week

1.Massive Insider Sell- Trading of Apple’s Stock.

Tim Cook himself, Apple’s current CEO, was spotted selling shares as part of a scheduled plan. It still turned out to be a big sale despite its previously announced nature. Over $41 million worth of shares were sold by Tim Cook. Although he still has 3.28 million Apple shares left, a $41 million sale is no joke.

And to make things worse for investors, several other Apple executives made sales too. Katherine Adams, Apple’s general counsel and senior vice president, sold $11.3 million worth of shares and Deirdre O’Brien did too.

2. Considered, Rejected Switch to DuckDuckGo From Google

In talks with DuckDuckGo, Apple Inc. discussed replacing Alphabet Inc.’s Google as the default search engine in Safari’s private mode. However, it later rejected the idea.

Gabriel Weinberg, DuckDuckGo’s Chief Executive Officer testified that DuckDuckGo had about 20 meetings and phone calls with Apple executives, including Safari’s head, in 2018 and 2019 about becoming the default search engine for private browsing mode. While Safari does not track websites that a user visits or keep track of what a user has accessed in private mode, DuckDuckGo relies on Bing for its search information. It is also likely that DuckDuckGo might provide Microsoft with some user information, which is incongruent with DuckDuckGo’s marketing about privacy.

3. Overheating iPhone Solution

Currently, Apple’s brand-new iPhone is one of the hottest properties on the market. New iPhone 15 users have complained about overheating devices, claiming they are even too hot to handle. According to Apple, a software update will fix the overheating problem, which is caused by several factors, including bugs in iOS 17 and third-party apps. In spite of this, Apple’s flagship product continues to be in high demand.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 2)

The second triangle: the Descending Triangle

Read MoreTrading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More