The second triangle: the Descending Triangle

Read More6 Top Education Stocks to Invest In H2 2023

The education sector is a solid, staple, and in-demand sector yet it never really gets the hype, especially on the stock market. Imagine everyone spent almost 14 years in formal education, then some advanced to tertiary education while many others explored the beauty of learning in many other ways.

Do not confine the education sector to just schooling, as it covers a wide spectrum. For instance, my personal favorite edu-tech platform to use. They were proclaimed the most powerful bird online after Twitter changed its name to ‘X’ – ‘Duolingo’. They provide language learning through websites and daily exercises through their apps. It changes the way traditional means of language learning are conducted, making it fun yet practical.

Education Sector of the US Stock Exchange.

Certainly! The education sector on the US stock exchanges, such as Nasdaq and NYSE, can be broadly divided into several sub-sectors based on the type of educational services provided. Here are the main divisions within the education sector:

For-profit Education Companies: These companies operate private educational institutions and often offer specialized training programs or career-focused education.

Online Education Companies: These companies primarily provide online educational services, including virtual classrooms, online courses, and tutoring platforms.

Publishing and Educational Technology Companies: This sub-sector includes companies that develop and distribute educational materials, textbooks, and online learning platforms.

Education Services Providers: These companies offer a range of educational services, such as consulting, testing, assessment, and professional development for educators.

Higher Education Institutions: Some publicly traded universities and colleges are listed on stock exchanges, providing higher education programs and degrees.

It’s important to note that some education companies may fall into multiple categories, as they may offer a combination of services. Additionally, the boundaries between sub-sectors can sometimes be blurred, especially with the increasing integration of technology in education.

6 Top Education Stocks to Invest In

Duolingo Inc (NYSE: DUOL)

Duolingo is a mobile app that enables people around the world to learn languages fun and engagingly. With over 575M users, the language-learning app provides 95 languages for users to learn through quizzes, questions, and stories. In addition to its IPO in 2021, the company aims to make learning available and fulfilling.

Empowering over 100 million people to learn a second language online.

The total language market is estimated to be $60B per year and is still mostly taught offline. However, management expects a shift to online learning in the future. Online language learning offers several advantages, such as convenience, cost savings, and greater access to teachers and materials. This shift is likely to result in a boom in the language learning market, with online platforms becoming the preferred method of instruction.

The company has recently re-entered the Chinese market, the largest market for English language learning in the world. Although the Chinese market presents difficulty in monetization and the possibility of change in the current political climate, if Duolingo is able to penetrate deep into the Chinese market, it opens up the opportunity for a large increase in paying subscribers.

With more than 4.8M paying subscribers worldwide at the end of Q1 of 2023, up 14.3% when compared to the previous quarter. The Duolingo revenue for the twelve months ended June 30, 2023, was $0.442B, a 44.47% increase year-over-year. Duolingo annual revenue for 2022 was $0.369B

The language app will dominate the company’s focus in the next three to five years, but it is currently testing its Math app as another opportunity. The app is available on iPhone and iPad and it’s only in English for now. The company hasn’t revealed when it will be available on Android.

Duolingo uses a gamified approach to support learning based on in-app purchases and has rolled out a standardized English test that is formally acknowledged by an increasing number of universities.

Given the company’s increasing presence in core markets and opportunities for further revenue generation through monetizing its upcoming Math app, the company should continue to enjoy comfortable growth over the coming years, solidifying its place as an educational institution.

DUOL is currently traded at $126.61. Based on analyst consensus, the average price target is $164.75, an 26.16% upside, with a high forecast of $180.00 and a low forecast of $149.00.

Stride (K12 Education) (NYSE:LRN)

Stride, Inc. is a technology-based education service, it offers individualized learning opportunities for students primarily in kindergarten through 12th grade (K-12) across the United States and internationally through proprietary and third-party online curriculum, software systems, and educational services.

Stride offers a wide range of online and homeschooling learning solutions, ranging from K-12 & career prep to early career & training with Galvanize, ATech Elevator, MedCerts; and job placement & recruitment with Tallo.

The online programs give Stride some cost advantage compared to traditional education methods as 75% of employees work remotely, transportation costs are eliminated, and the schools have a recycling/refurbishment program for class resources.

There were 180.3 thousand enrollees at the end of December 20, 2022, and 187.6 thousand at the end of December 2021, respectively. Compared to last year, revenue of $1,837.4M was up compared to $1,686.7M, driven by in-year enrollment strength and higher revenue per enrollee. It is also important to note that parents have become more aware of the conveniences associated with online classes, so growth tailwinds may continue in the future.

The company is projected to generate around $2.05B in revenue by 2025, and earn around $300M in adjusted operating income. Career learning and not general education are the biggest contributors for future growth. With Stride, quality education is available to students in areas that are unable or insufficient to receive it from traditional brick-and-mortar institutions.

The current LRN price is traded at $40.90. It is valued as ‘Strong Buy’ by wall street analysts. The average price target is $65.00 with an upside of 2.64%, with a high forecast of $65.00 and a low forecast of $65.00.

Udemy (NASDAQ: UDMY)

Udemy provides online courses that are free or paid with low barriers to entry. Through this approach, learners benefit from a benevolent feedback cycle that encourages competition among course creators. As a result of incentivizing the course authors to promote their courses at the platform, this platform has a high amount of traffic.

It is clear that Udemy focuses on improving marketable skills that are able to help people earn money or get employed, which in turn allows them to justify the price they pay for their service. The value proposition of the program is that it offers pre-requirement courses in order to obtain certifications that are more mainstream in nature.

Unlike traditional educators, Udemy excels at being agile. For instance, computer science and web development evolve rapidly as programming languages are updated and traditional educators struggle to alter their curriculums to keep up with the changes. Using Udemy’s app, you will be able to quickly find the most relevant courses because the app uses a ‘marketplace’ approach. Therefore, users can always access current and high-quality courses, unlike other educators, who might only have access to curriculum updates every six months. Udemy’s platform also offers up-to-date and relevant content that is tailored to the user’s needs. Moreover, the app’s user-friendly interface makes it easy to access and navigate the courses.

Currently, Udemy has almost 773M course enrollments in 2022 and the number is expected to increase due to technology advancement and online learning. In the twelve months ending June 30, 2023, Udemy generated $678.43M in revenue, an increase of 18.95% from the previous year. In the quarter ending June 30, 2023, revenue was $178.24M, an increase of 16.41% over the same period last year. In 2022, Udemy had annual revenue of $629.10M with 22.00% growth. The company total revenue is projected to reach US$1 billion by 2025, with an annual revenue growth rate of 18.9%.

UDMY currently traded at $10.27. Wall Street analyst forecast the average price target is $14.00, a 36.32% upside with a high forecast of $22.00 and a low forecast of $10.00.

2U (NASDAQ:TWOU)

2U provides online degree programs through partnerships with colleges and universities around the country. The company offers a variety of degree programs, including bachelor’s, master’s, and doctoral degrees in a wide range of disciplines with an exceptional partnership with several top universities. Further, they also provide students with the chance to obtain certificates and certifications in a variety of technical subjects such as coding and cybersecurity. The company has seen tremendous growth and success since its launch in 2008.

2U main platform centered around their EDX brand. The company centers around offering courses and degrees from highly recognised institutions including the University of Southern California, Harvard University, and the University of California, Berkeley.

Revenue for Y2022 compared to Y2021 increased 2% to $963.1M. the division segmentation revenue as degree program revenue decreased 3% to $571.6M while alternative credential revenue increased 11% to $391.5M.

The company currently has 78+ million registered worldwide learners across more than 4300 courses with 250 partners.

As part of their future progression as per reported on Q2 2023 earnings, The 2U plan outlined new platform innovations, including: edX Xpert, a generative AI-powered learning assistant, and edX Career Resource Center, an online hub designed to help registered edX learners navigate the fast-changing employment landscape. A brand-new subscription-based service for professional certificates.

Along with riding the wave of AI, 2U plan to debut the edX ChatGPT plugin; that enables ChatGPT Plus users to seamlessly discover higher education programs across edX’s library of courses. Plus, with the increasing demand of AI, they announced a new Artificial Intelligence Boot Camp and a Machine Learning and Artificial Intelligence MicroBootCamp™ program in partnership with leading universities.

TWOU is currently traded at $3.06. As per analyst estimation, the average price target is $6.97 an upside of 127.78% with a high forecast of $15.00 and a low forecast of $4.00.

Chegg (NYSE:CHGG)

The Chegg platform provides learners with products and services to help them better understand their academic course materials, as well as personal and professional development skills training. With the demand of nowadays leaning requirement, Chegg has become the go-to destination for high school and college students looking for online education support. In addition to providing 24/7 homework help, the direct-to-student learning platform offers a textbook marketplace where students can buy, sell, and rent textbooks, as well as a plagiarism and grammar checker for papers.

“If we’re successful, we can change the outcomes of millions of people.” – Nathan Schultz, Chief Operating Officer of Chegg.

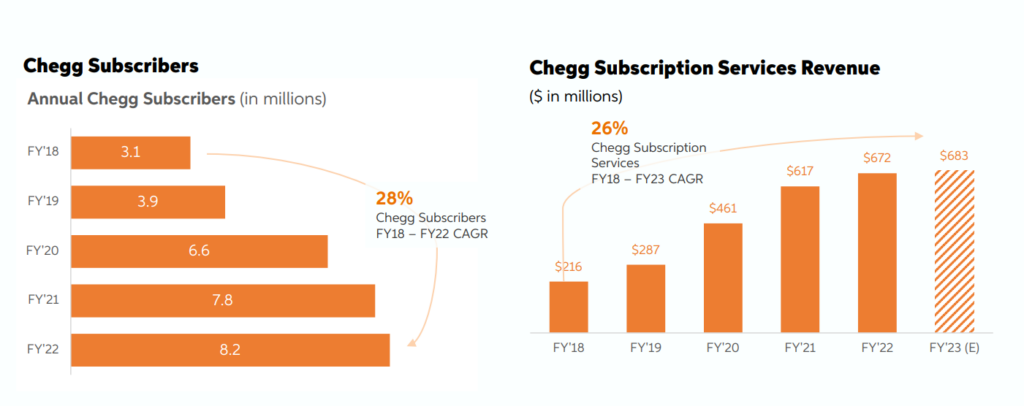

As reported, in 2022, CHEGG’s service subscribers reached 8.2 million, up 5% over 2021. As part of its global expansion plans, the company has reached 2.1M subscribers internationally. This represented 15% of total revenue. Due to its low monthly price of less than $20 and high customer satisfaction ratings, Chegg is also good at retaining subscribers.

According to Chegg’s projections for 2023, the company plans to invest in localized content, pricing, packaging, commerce, user experience, and marketing efforts in order to optimize the product-market fit and increase conversion rates internationally by 2023. Next, Chegg projected to develop its own large language models and owning them is a way for the company to enhance competitiveness, lower costs, and allow the models to be trained specifically for the education industry. In addition, the company collaboration with Scale AI allows them to accelerate their ability to deliver the new Chegg experience starting in the fall and rolling out over the next two semesters. The beta version of Chegg’s initial generative experience was released in May; results with very positive feedback.

The COVID-19 pandemic led to massive growth for Chegg. Chegg subscription services revenue keep on increasing since 2018 till 2022.

CHGG is currently traded at $10.61. The average price target is $13.36, a 25.92% upside with a high forecast of $15.00 and a low forecast of $12.00.

Coursera (NYSE: COUR)

Coursera is now one of the largest online learning platforms in the world, with 129M registered learners. With the mission of providing universal access to world-class learning. Coursera focuses on offering professional certificates by large enterprise partners and established educational institutions.

Many people who want to attain top quality education are willing to quit their jobs and move to another city in order to do so. As an alternative to this, Coursera aims to counteract this issue and provide a much higher quality education within the context of a flexible, remote learning environment. As of today, Coursera is partnered with more than 275 top universities and companies to provide flexible, affordable, and job-relevant online education to individuals and organizations around the globe. This includes courses, Specializations, Professional Certificates, Guided Projects, and bachelor’s and master’s degrees. Institutions around the world use Coursera to upskill and reskill their employees, citizens, and students in fields such as data science, technology, and business.

The company has a segment targeting business clients, where the main selling points are reduced training costs and the ability to increase productivity for businesses as a result.

“As the year came to a close, we were reminded of the transformative power of technology to change the way we teach, learn, and work. Every person, in every job, needs to keep learning to stay relevant,” said Jeff Maggioncalda, Coursera CEO.

In terms of pricing, Coursera strives to be a differentiator in the market compared to its competitors. The online learning environment it provides is cost effective and allows Coursera to offer the same level of tuition at a price point well below most on-campus degree programs.

Total revenue was $523.8 M, up 26% from $415.3 M in the prior year. “In 2022, we grew revenue 26% year-over-year, reflecting our ability to deliver the skills and branded credentials desired by both individuals and institutions in today’s digital economy,” said Ken Hahn, Coursera’s CFO.

Additionally, Coursera intends to expand its AI advancement, both in developing its platform and learning materials.

“AI advancements are accelerating digital transformation, and people need access to affordable, flexible, and personalized learning pathways designed to keep pace with emerging job opportunities,” said Coursera CEO Jeff Maggioncalda.

The current price of COUR is traded at $15.53. According to consensus by Wall Street Analyst, the stock remains ‘Strong Buy’. The average price target is $18.33, an upside of 18.03% with a high forecast of $20.00 and a low forecast of $15.00.

Bottom Line

Educational stocks are a niche and rarely discussed segment in stock investing. Nevertheless, that didn’t get in the way of their prospects of making a profit since there is always a demand for people to study and explore for more, so they did not give up on making profits. Educational stocks can also serve as an excellent avenue for investors to increase their return on investment.

The key takeaways/market update is a series by AxeHedge, which serves as an initiative to bring compact and informative In/Visible Talks recaps/takeaways on leading brands and investment events happening around the globe.

Do keep an eye out for our posts by subscribing to our channel and social media.

None of the material above or on our website is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Investors should carefully consider if the security and/or product is suitable for them in view of their entire investment portfolio. All investing involves risks, including the possible loss of money invested, and past performance does not guarantee future performance.

Trading Dow Pattern the Triangle Pattern (Part 1)

The first triangle: the Ascending Triangle

Read MoreFunds: Equity Funds (Part 3)

How to choose between equity funds based on companies’ earnings...

Read More