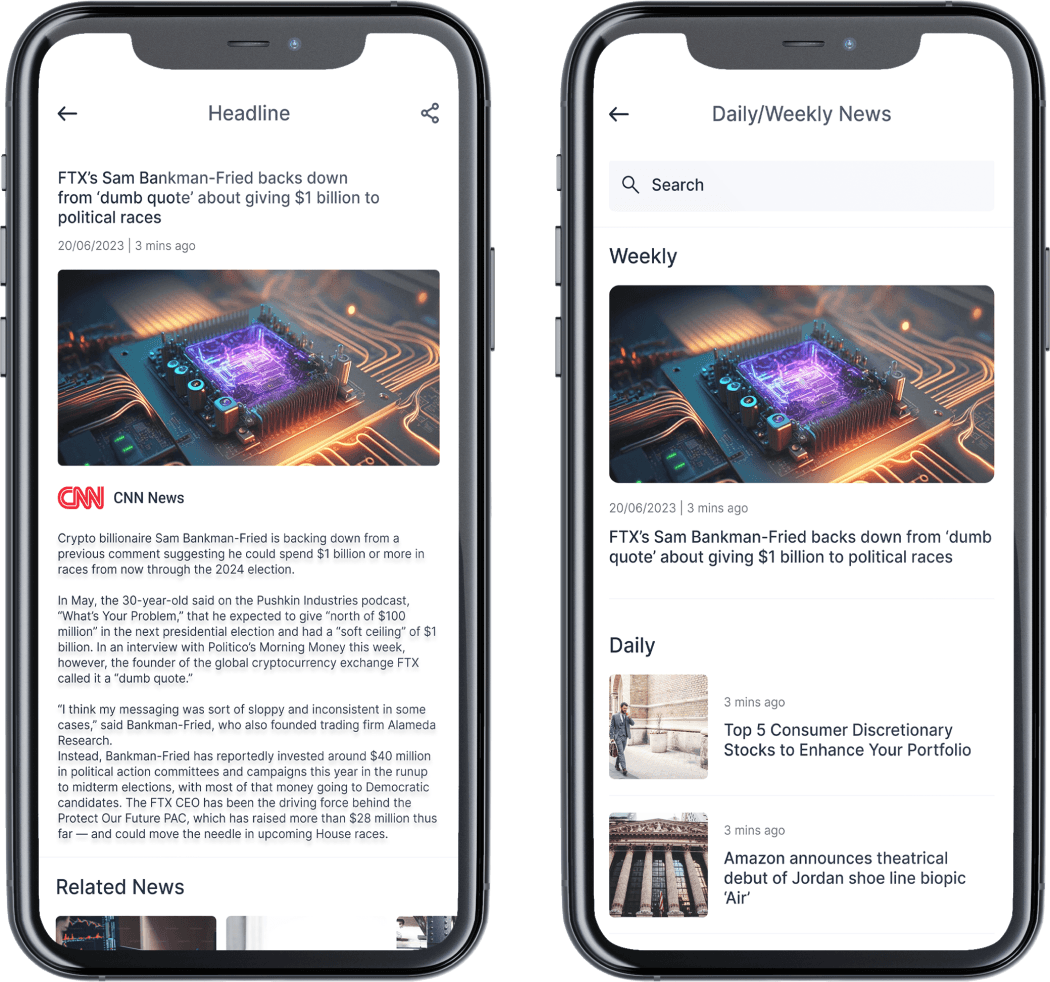

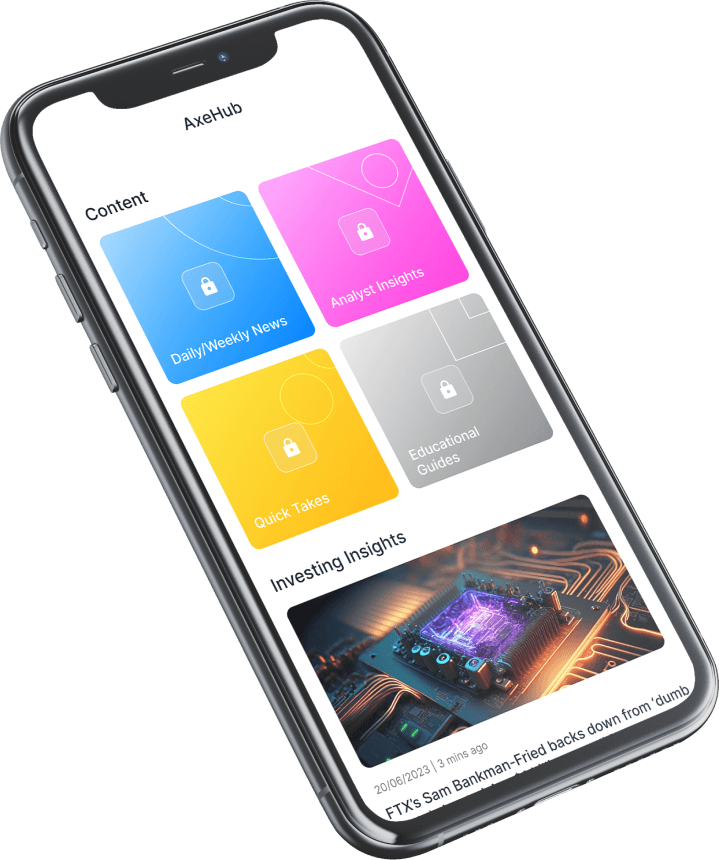

Empowering Millennials with Institutional-Grade Investments

Making investing as easy as buying a Coca-Cola or subscribing to Netflix.

The Big Picture

An Institutional Grade Investment Firm for Millennials in Southeast Asia. We believe in democratising access to global funds and products.

Why AxeHedge Exists

Unlocking Global Investment Opportunities for Seasoned and new Investors.

Challenges Faced by Most Investors

High Cost

Infrastructure Limitations

Low Financial Literacy

Transforming Investment for Retail Investors

We build the future of investment for retail millennials, offering a holistic and experiential investment journey.